Jeff Dillon

Jeff Dillon

Solidarity

IG:@jeffdillonfineart

We built Inukshuk Capital Management to serve the needs of clients looking for a unique approach – void of conflicts of interest, commission sales and pushed products. We began by putting our own money where our mouth is. With low fees and active risk management, we help families achieve financial longevity, that’s the bottom line.

Stay up-to-date on the latest developments by following us on LinkedIn here.

April 2022: Realize

In this issue:

- Global Equity Markets

- Stocks, Bonds and Gold

- More Prices

- Yield Curves

- Realize Cash

- If Nothing Changes, Nothing Changes

GLOBAL EQUITY MARKETS

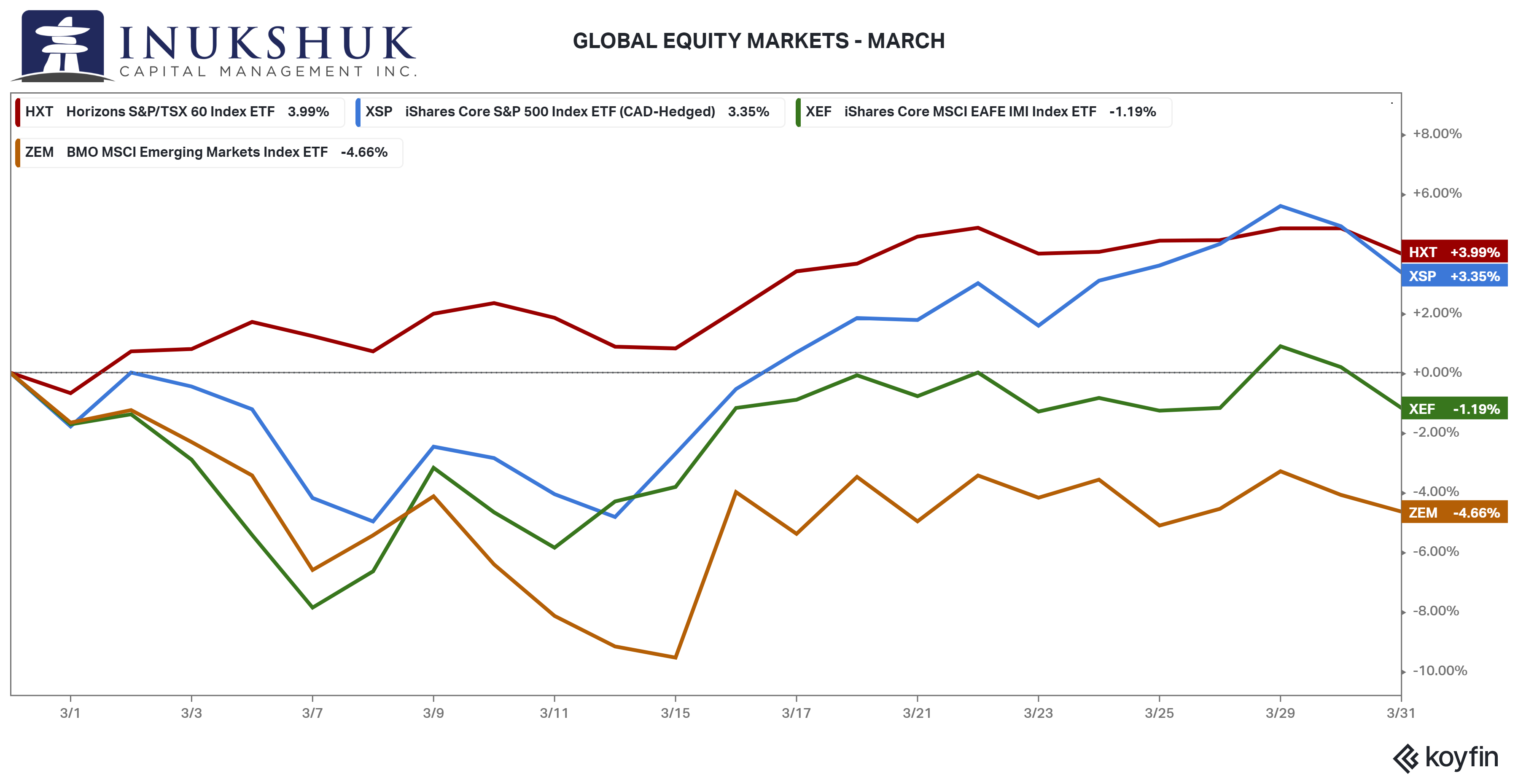

February’s trends continued for the first half of March with Emerging Markets (EM) falling another 11.1%, MSCI EAFE (Europe, Australasia and Far East) 8.7% and the S&P 500 4.5%. Around mid-month, there was a sharp reversal and three of the four equity indexes we actively manage closed higher, while EM continued doing its best imitation of a submarine and finished with a 3.3% loss. Canada continues to be the brightest bulb on the tree, up almost 4.0%, just ahead of the S&P 500, up 3.7%.

Year-to-date, the S&P/TSX 60 is the only one of these four markets in positive territory with a gain of 3.6%. The others continue to maintain a consistent rank that matches our systems’ positioning. We are fully allocated to the S&P/TSX 60, have a partial allocation to the S&P 500 and have been flat EAFE and EM for quite some time.

Year-to-date, the S&P/TSX 60 is the only one of these four markets in positive territory with a gain of 3.6%. The others continue to maintain a consistent rank that matches our systems’ positioning. We are fully allocated to the S&P/TSX 60, have a partial allocation to the S&P 500 and have been flat EAFE and EM for quite some time.

If you would like to stay current on our measures of trend and momentum in the markets we follow, please click here

STOCKS,BONDS and GOLD

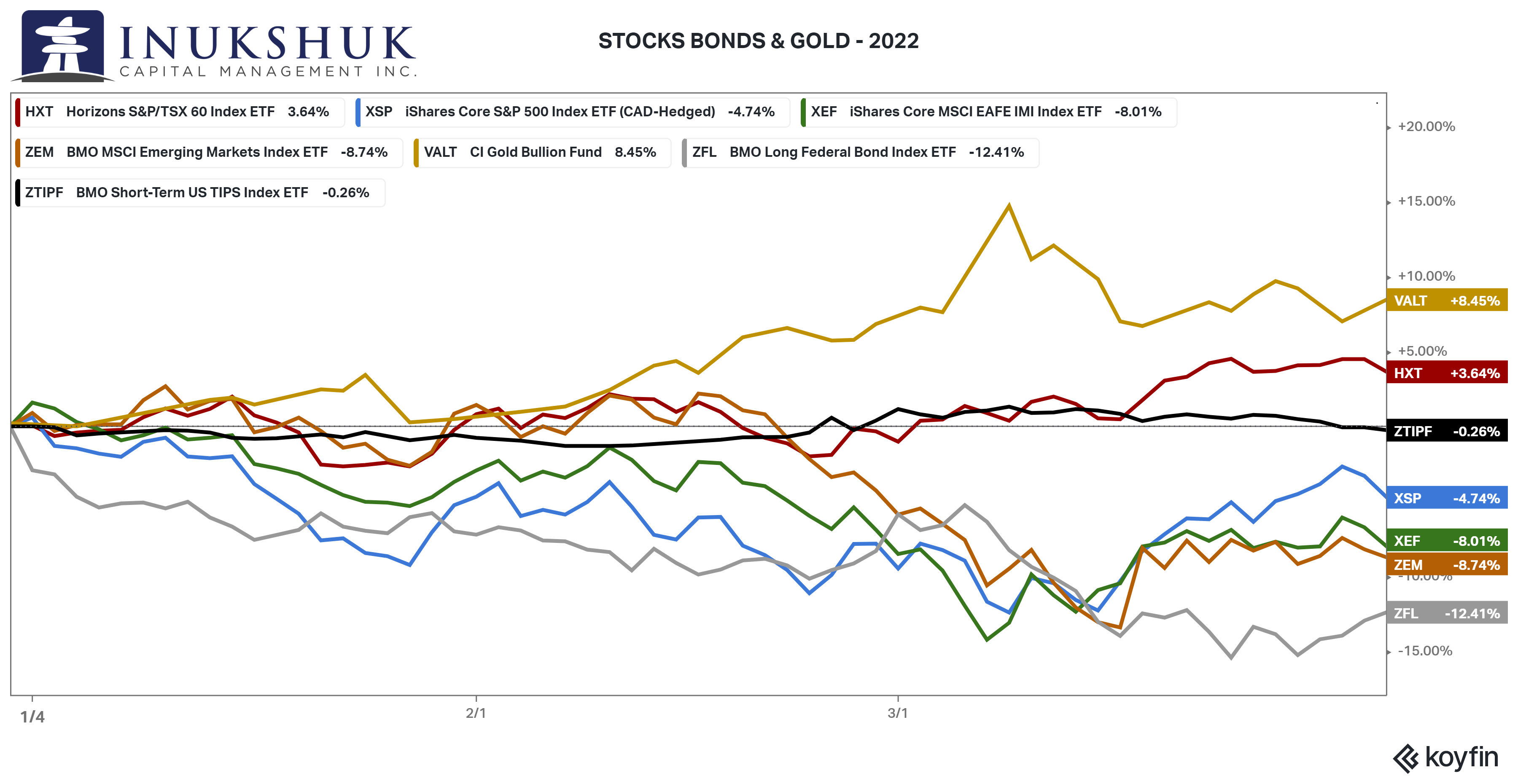

At the most recent lows, EAFE and EM were down roughly 15% on the year, the S&P 500 12% and the S&P/TSX 60 just over 2% – but what about other markets?

The only non-equity asset that we invest in that is up on the year is gold. The ‘unreliable hedge’ (trademark to be determined) is a small part of our portfolios, so a little help from bonds would have been appreciated. Market pundits have been talking about inflation for a while now and it seems the Federal Reserve and the Bank of Canada are reading their macroeconomics textbooks and getting nervous. This has resulted in both central banks hinting that their target policy rates might go higher and faster than the market expected. We don’t do forecasting.

The only non-equity asset that we invest in that is up on the year is gold. The ‘unreliable hedge’ (trademark to be determined) is a small part of our portfolios, so a little help from bonds would have been appreciated. Market pundits have been talking about inflation for a while now and it seems the Federal Reserve and the Bank of Canada are reading their macroeconomics textbooks and getting nervous. This has resulted in both central banks hinting that their target policy rates might go higher and faster than the market expected. We don’t do forecasting.

Looking at prices, relative prices and price trends is the basis of our investment process. A question might be: what’s wrong with inflation-protected bonds? The short-term version of an index of these securities is the BMO ETF, ZTIP.F. It is down on the year. There have not been many places to hide, figuratively and literally, nevermind earn a decent return. What to do?

MORE PRICES

We addressed a topic related to price inflation last year in a note titled Complex Connections that highlighted the risks of tightly coupled systems, such as supply chains. That was after the logjam of container ships off Long Beach, the Suez Canal shutdown, and the multiple aftershocks of the pandemic. Now in 2022, there is a war in Europe and just recently, China locked down 23 cities due to fears of more coronavirus variants infecting populations. This includes Shanghai, home of 26 million people and the largest port in the world.

The following are some related charts.

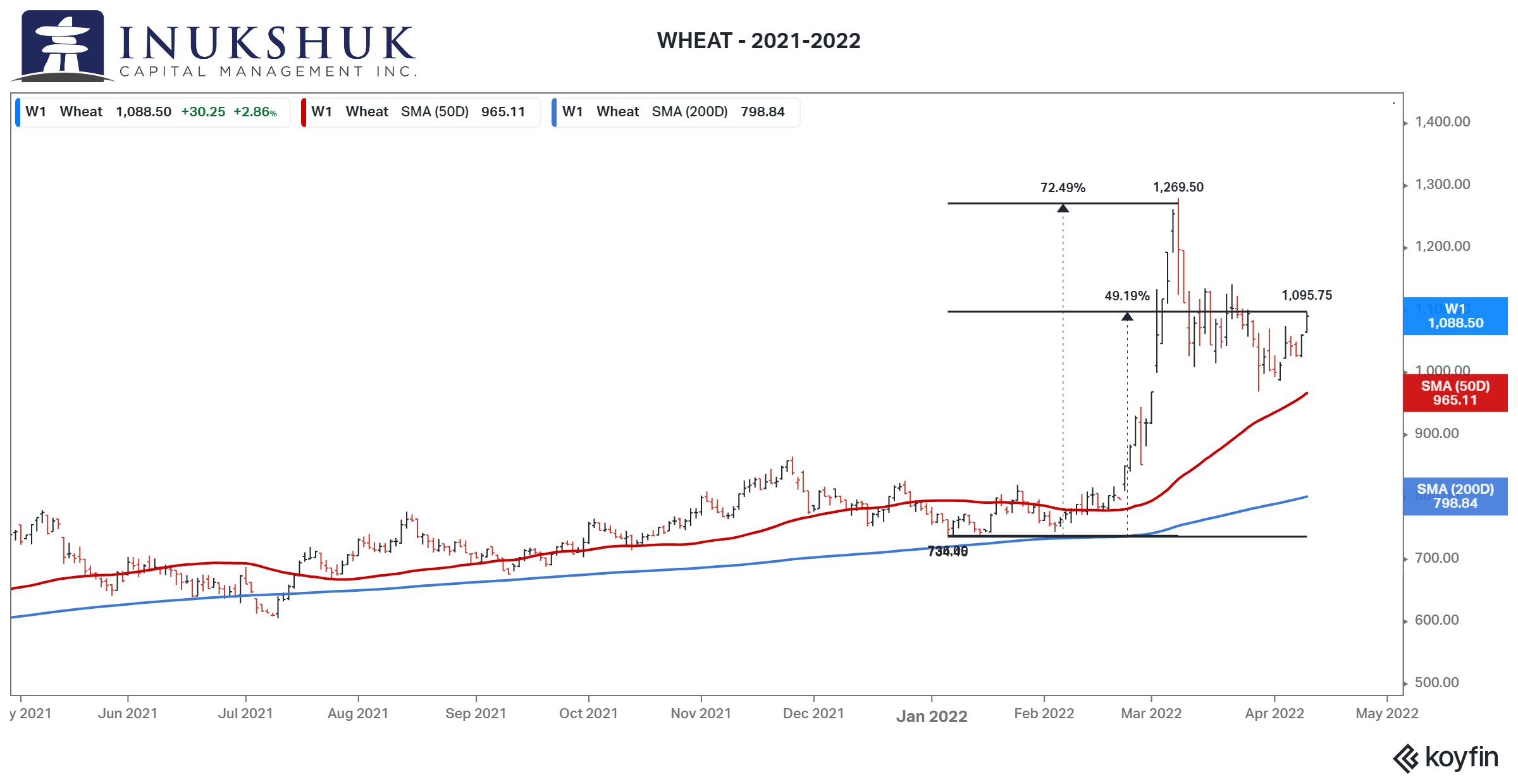

Wheat

Anyone who fills up their car knows that oil prices are high. But there are two commodities that have that price action beat – wheat and natural gas.

Wheat is up almost 50% this year after pulling back from its highs in March, when it was up 79%.

Two of the top five global exporters of wheat, are at war.

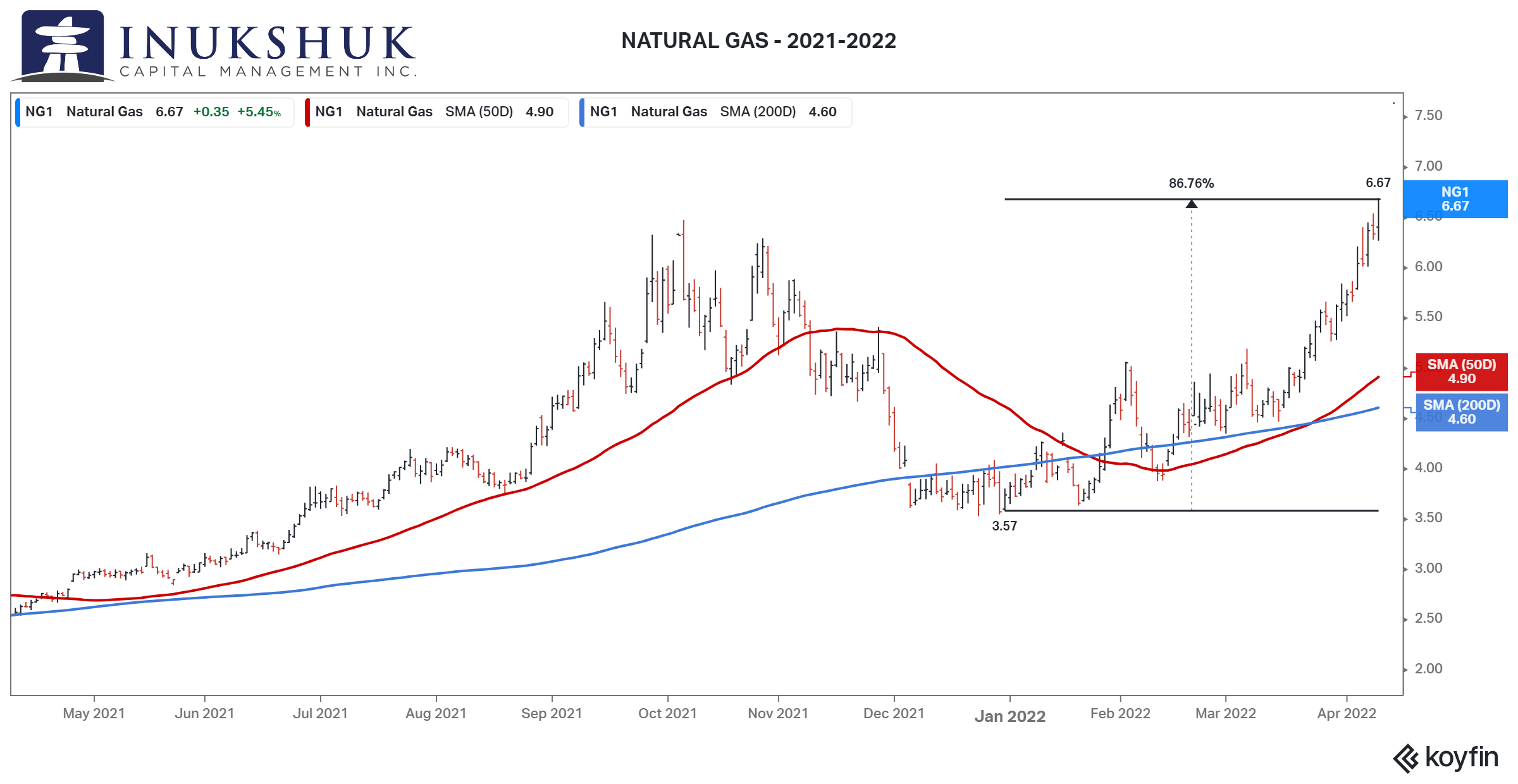

Natural Gas

The largest exporter of natural gas in the world is Russia.

Natural gas, while being what many Canadians use to heat their homes and fuel their BBQs to grill increasingly higher-priced meats, is also one of the primary inputs in manufacturing fertilizer. Everything is connected.

To reiterate, as stated in the above mentioned note we sent in the fall of 2021, inflation is a tricky thing. Economists talk about cost-push inflation, wage-spiral inflation, inflation of the money supply, and other things-inflation. The guess is that various explanations exist because it’s a difficult thing to attribute a direct cause to, so competing theories abound amongst the many tribal groups of economists.

None of that matters because, as practitioners of investing, we need to figure out how to protect our investors’ capital and earn a rate of return that exceeds the cost of living. If we can’t do that, then saving is out the window.

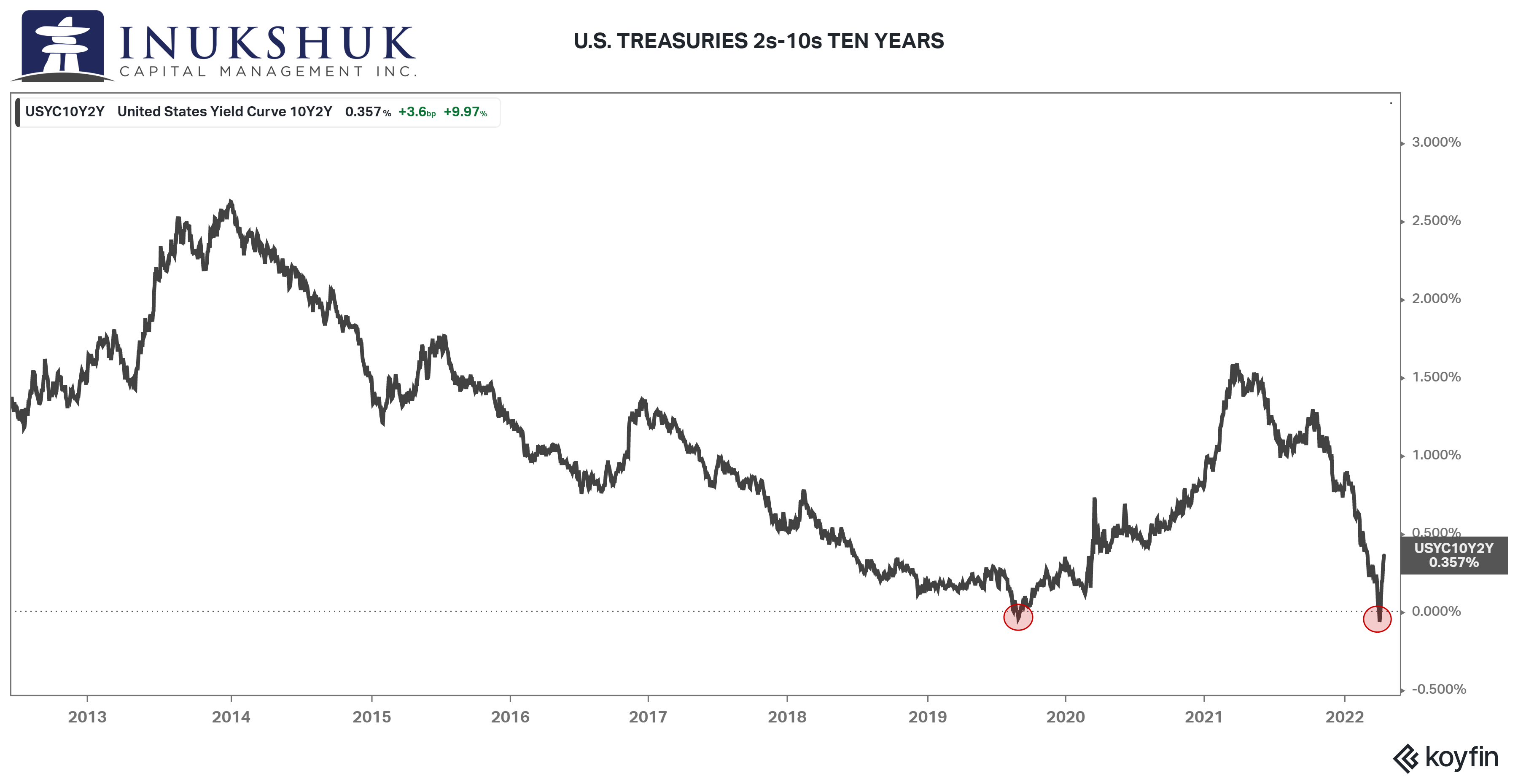

YIELD CURVES

This is related to all of the above, so bear with us.

The focus is on the U.S. Treasury market, since it is still the largest in the world at $23.5 trillion. Plus, the U.S. dollar is the world’s reserve currency and every economy on the planet is affected by the Federal Reserve and Treasury policy concoctions.

Fun fact: the Federal Reserve owns almost $9 trillion in securities, of which the majority is the United State’s own debt. Who says Modern Monetary Theory is just a theory?

The point is that the bond market is behaving in a way that may indicate an economic slowdown. While interest rates are going up across the board, longer-term rates have not been going up as much. This, in the sophisticated parlance of the fixed income types, is called a bear-flattener.

So, back to prices or in this case, interest rates – which are the same, but the inverse.

If you were given the facts, after being asleep for three years, without any information other than the Fed Funds target range is 25-50 basis points, the two-year Treasury yield is 2.5%, plus the following:

1. The Federal Reserve is raising rates and has hinted there are many more rate-hikes to come.

2. Headline inflation is over 8.5%.

3. Supply chains are, umm, a mess.

4. There is a war in Europe causing all kinds of difficulties regarding commodities and shipping.

5. China is shut down.

Now, answer the question: what is the yield on the 10-year note?

A reasonable response, after choking on your post-slumber coffee, might be something around 5.0% to 7.0%. The actual yield, as of this writing, is 2.75%. At the end of March, it was 2.35%. Huh.

If you subtract the 2-year yield from the 10-year yield it looks like this.

Just a few days ago that was inverted, meaning the 10-year note was yielding less than the 2-year note. But it has recently ripped higher by 35 basis points.

Note: something was up in the summer of 2019, prior to all the chaos that ensued in 2020. Markets give clues, but don’t tell you what they actually mean. The two circled areas are prior to the pandemic panic and just a few days ago.

The 10-year note is one of the most important interest rates on the planet. It is the backbone of consumer (think mortgage rates), corporate and derivatives debt pricing. These moves are extraordinary.

Now let’s look at longer term rates. So, if 2s-10s went inverted, what is happening to 10s-30s may give us further insight.

This is interesting to say the least. The long bond is offering a yield of just over 10 basis points more than the 10-year that was yielding less than the 2-year a few days ago. Will the Fed hike rates and create a recession? And how would more rate hikes solve a supply chain problem?

REALIZE CASH

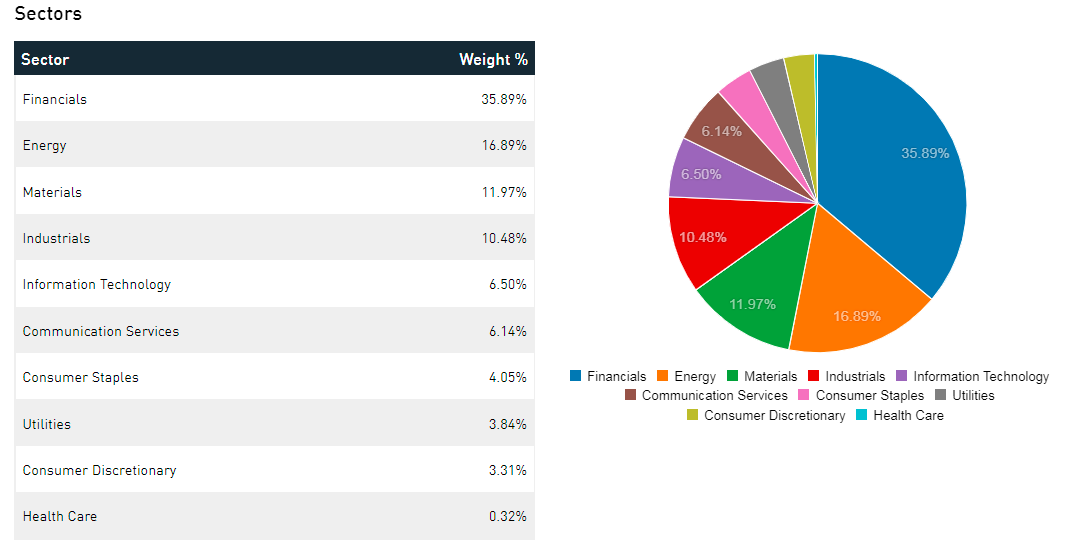

We aren’t macro-investors. Meaning: our calls are not solely predicated upon macro themes, but our macro views are insight into what we invest in and are fully supported by our systems. Canadian stocks are holding up, and our models are long. Maybe that has something to do with the components of the S&P/TSX 60. Recall the above global leaders in exports that are very important to economies working and, more importantly, humans being able to eat and keep themselves warm. Canada is in the top five in both wheat and natural gas. Imagine if there was a way to get our energy to Europe…

Simply stated Canada (the stock market), so far, is working. Further, the benchmark index, the S&P/TSX 60, as represented by the Horizons total return ETF, HXT, has a more than 50% weighting to the industries that benefit in this kind of environment.

S&P/TSX60 Index Sectors

So our models have us invested in Canada. What else can we do?

Fixed income is a bit of a mess now. That doesn’t mean it always will be and that asset class has been a somewhat historically reliable earner of income and hedge against equity selloffs. If the bond market is anything close to being right about future yields, patience may pay off. In the meantime, we need to put some money to work, since our models do not like EAFE and EM and are increasingly suspect about the S&P 500.

Since we try to keep things simple and find uncomplicated solutions, we need the answer to this question: What do we invest in if bonds aren’t behaving well, and inflation is a current problem for our clients?

It’s like trying to keep up with your budget when food and gas prices are soaring – either you make more money, own something that is tangible you can sell when you need to, or a bit of both (or go into hibernation, as some of our ursine friends are doing, despite it being spring). In that light, the things we think should perform reasonably well are those that spin off good dividends and capital gains so we can try and earn a decent risk-adjusted total return – the boring stuff.

Boring is good, in our world. It’s not necessarily the best way to live in the real world, but if you want to keep your money and earn something on it, boring works. One of the more stable sectors in equity investing is utilities. Think about it: you pay your electricity bill, cell phone, internet, gas, and so on. It’s not as though you have a choice – well, actually you do, but that requires a complete change in lifestyle, which is occurring in some parts of the world, but it is not something we can directly invest in.

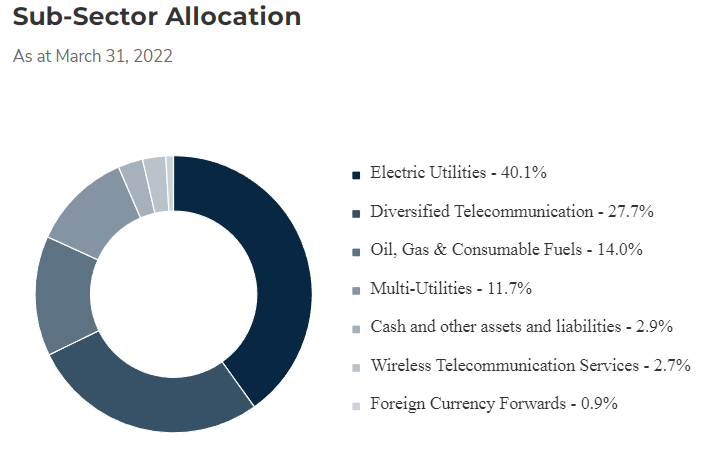

So, if most of the developed world requires utilities to deliver their basic needs, why not invest in that? Harvest’s ETF, HUTL, yields 6.9%, and does just that.

Here is how that unit breaks down in terms of sector

It is spring. The vernal equinox has just passed and that means that we are on our way to the longest and warmest days of the year, up here in the Great White North. Things always change. That can be good or bad, but just because it seems grim now, doesn’t imply that will be the case in the future (or maybe it will be). We don’t know. If you don’t know what may happen, which is one of the foundations of our investment process – do what you can with what you’ve got. That’s what we are doing.

Seasons come and go, whether they are investment fads or the actual world. The world is physics and our planet flies around the sun every 365.25 days, on a tilted axis, and spins every 24 hours. Investing, is not as much related to physics as some would prefer.

As Wayne Coyne of The Flaming Lips sings, in the beautiful song, Do You Realize??

One, two, three, four…

Do you realize

We’re floating in space?

Do you realize

That happiness makes you cry?

Do you realize

That everyone you know someday will die?

And instead of saying all of your goodbyes

Let them know you realize that life goes fast

It’s hard to make the good things last

You realize the sun doesn’t go down

It’s just an illusion caused by the world spinning round

Seems about right. There is a sense of reassurance and love in there. Listen, if you want to.

Now let’s take it over to Victoria who knows some ways, other than music, to improve your mental and physical health, and be good to yourself.

HEALTH IS WEALTH

IF NOTHING CHANGES, NOTHING CHANGES

“When you arise in the morning, think of what a privilege it is to be alive-to breathe, to think, to enjoy, to love.” ~Marcus Aurelius

Spring days are longer, weather is getting warmer, flowers are blooming, and hibernating animals awake. What a wonderful time for a reset. If nothing changes, nothing changes.

Spring is a re-awakening, a great time to upgrade our habits. Our lifestyle determines our health, and our health has a powerful influence on our happiness.

Healthy habits re-wire the brain for more healthy habits. The simple act of getting outside and going for a walk increases blood flow throughout the body and to our brain, which boosts the “happy hormones.”

Walking also improves cardiovascular health, balance and management of joints and muscle pain, increases flexibility, and keeps bone and cartilage tissues strong. A daily dose of sunshine and the smells of spring naturally boost our energy and a connection with nature decrease stress levels.

We have two options in life: to control it or let it control us. Our past or present circumstances can be limiting factors for moving forward and achieving our optimal health. If we believe that we are not worthy of health, love, happiness or success, we will not try to attain it.

“Self love” is personal. What do you do to relieve stress, to improve your sleep, and to increase your energy? Are they healthy choices and do they work?

We can make the decision to move forward towards our best life. But to change our life, we must change our thoughts. In the teachings of Buddha, “what we think we become”.

Holding ourselves accountable, with gentle reminders that we are putting in the “work” for a happier and healthier life, is key. By taking the time to think about who we are and what we want out of life, we can have it all!

“A mindset that combines discipline, strength, confidence and ambition is a powerful MINDSET. This can achieve anything it sets its sights on.”

‘To sustain it, you must maintain it’

Victoria Bannister

ICM Health Ambassador

Have a question? Contact us here.

Challenging the status quo of the Canadian investment industry.