Inukshuk Capital Management (ICM) is a multi-asset class, high-net-worth wealth management firm. We help individuals and families achieve financial longevity by tailoring solutions that integrate their unique financial planning considerations with modern wealth management approaches designed to deliver superior returns while minimizing tax and fees.

We are pleased to share our monthly newsletter which contains information on our ETF portfolios, as well as market commentary and other relevant news.

Stay up-to-date on the latest developments by following us on LinkedIn here.

MARCH 2020 – A MONTH TO REMEMBER…and forget

We hope this note finds you healthy and safe as we adjust to the new realities of living with the Covid-19 pandemic. It’s a very uncomfortable time for everyone as we worry about our friends’ and family’s health and wealth. Let’s be sure to check in on those who may be especially vulnerable, and to express our gratitude to the essential and frontline workers who, by their actions, keep our communities operating safely.

We are thankful that our systems once again did their job and our clients are very well positioned as a result. Our active risk management strategies reduced our equity exposure to 15% by mid-month. March 2020 will go down in history as one of the most volatile of all time – the S&P 500 had an average absolute daily change over 5%. At one point, the TSX Composite was down roughly 35% from its highs.

If you would like to stay current on our measures of trend and momentum in the markets we follow, please click here.

DIGGING UNDER THE HOOD

Our substantial cash position, raised by liquidating our global equities early in the decline, has given our firm ample resources to take advantage of opportunities as we uncover them. We are comfortable with this position given the incredibly stressed state of financial markets.

Most every component of the credit markets has experienced severe dislocations and liquidity issues. Some money market ETFs were trading in full panic mode, with daily ranges of up to 5%. Not as a result of the ETFs themselves, but because the underlying markets were, and still are, illiquid. To take advantage of this dysfunction, we started buying at levels we considered to offer good value in select ETFs with holdings of at least 90% government securities. The most compelling opportunities we initially identified were in the provincial bond market.

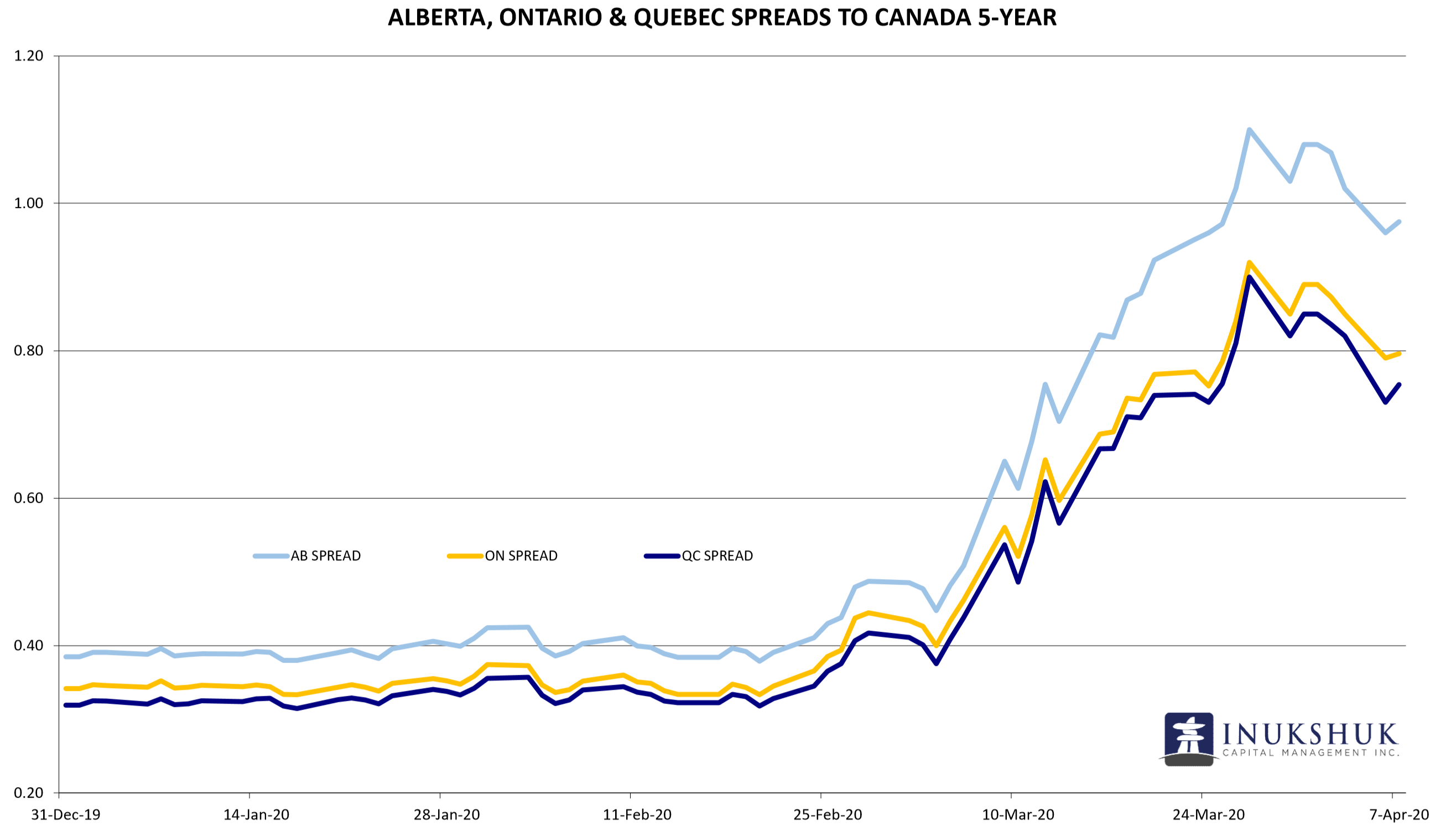

Provincial bonds trade at a spread (yield premium related to credit quality) over Canadian government bonds (Canadas) and those spreads blew out very quickly during this recent market event. Due to the underlying liquidity issues we were able to acquire ETFs at very attractive levels – considering the safety of the underlying securities. Since 2006, Ontario 5-year bonds have traded at an average of 55 basis points (bps) over Canadas. At their worst in 2008, that spread was as high as 200 bps. The average provincial spread is now greater than 80 bps, with Alberta around 100.

We identified another excellent opportunity in government bonds – medium-duration Canadas, Canadian agencies and provincials. At some point we will consider adding some prudent credit risk as we look for attractive valuations in the convertible bond and preferred share markets.

In addition to our ongoing proprietary research, we work closely with portfolio managers and risk analysts at the major ETF providers in order to uncover investments for our clients that offer favourable risk-reward profiles.

OTHER MARKETS, CENTRAL BANKS AND THE DOLLAR

On March 3rd the Federal Reserve cut rates 50 bps to a target range of 1.00 to 1.25%. Then, on Sunday, March 15th at a special FOMC meeting, the decision was made to cut rates another 100 basis points, announcing it “…expects to maintain this target range until it is confident that the economy has weathered recent events…” This policy is combined with outright purchases of “…Treasury securities by least $500 billion and its holdings of agency mortgage-backed securities by at least $200 billion.”

The next day, staying on script, the Bank of Canada (BOC) cut its policy target rate from 1.25% to 0.75%. And then on Friday the 27th the BOC cut another 50 bps, close to matching the Federal Reserve. Along with rate cuts, the Bank of Canada has injected hundreds of millions of dollars through the purchase of mortgage bonds and provincial money market securities.

Its largest intervention is in the Banker’s Acceptance (BA) market. Over the past three Mondays the BOC has purchased, in total, more than $40 billion in BAs out to just over three months in maturity. This is a key market for banks to fund corporate lending programs. One of the problems in the funding markets is that the BOC has cut rates by 150 bps, but the three-month BA rate has not followed suit, declining by only 100 bps to around 0.80%. And, while the major banks matched the first 50 point cut, where the lowest available 5-year fixed major bank mortgage rate dropped from 2.84% earlier in February to 2.34% shortly after, that same mortgage rate is 2.94% today. These are telling signs of severe credit market distress.

The USD/CAD exchange rate soared to 1.4660 in the days following the Bank of Canada’s rate cut and is now hovering around 1.4000. The USD/CAD high back in 2016 was just under 1.4700. For now, the trading range that has been in place for more than a year around 75 US cents is broken and, considering current events, we could see a new range of 1.3700 to 1.4700 being established.

Have a question? Contact us here.

Inukshuk Capital Management actively manages equity risk through our proprietary strategies which have shown to significantly reduce drawdowns, while outperforming their benchmarks over time.