A significant portion of the wealth of Canadians is invested by active money managers. Active money managers, or what some call “stock pickers”, believe that their research, analytical skills, and experience allow them to pick investments that over time achieve returns that exceed the market benchmarks. Money managers who take a more passive approach are skeptical of the claims of active money managers. Passive money managers believe that clients are better served purchasing financial instruments, such as ETFs, that mirror the returns of an underlying benchmark, rather than trying to beat it.

Active money managers tend to charge higher fees than their passive counterparts, but are these extra fees worth it? Fortunately, we don’t need to speculate on this question as there is data that can provide answers. The SPIVA Scorecard which is published by the S&P DJI provides bi-annual reports on the percentage of active money managers who beat their respective benchmarks.

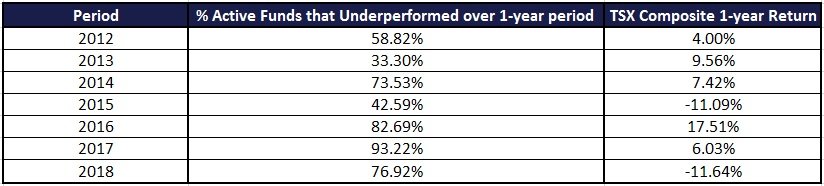

The charts below show the percentage of active fund manager that invest in large-cap, publicly traded Canadian companies, who underperformed their benchmark, the TSX Composite Return. The return of the TSX Composite, which represents the threshold of under/over performance, is shown in the third column of each chart.

Percentage of Active Money Managers that Underperformed the TSX Composite Over a 1-Year Period

Going back to 2012 there have only been 2 years (2013 and 2015) in which the majority of Canadian actively managed large-cap equity funds beat the TSX Composite benchmark.

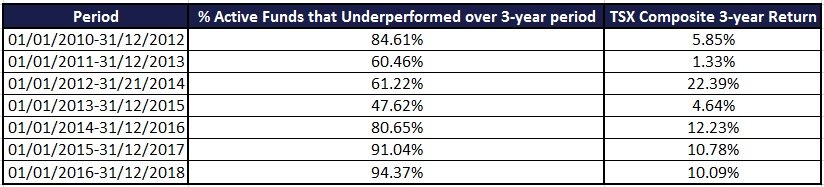

Percentage of Active Money Managers that Underperformed the TSX Composite Over a 3-Year Period

Looking at a 1-year time horizon is not always an ideal metric as most investors leave their money in a fund for multiple years. The following chart show the percentage of actively managed funds that failed to beat the TSX Composite over a 3-year period.

Percentage of Active Money Managers that Underperformed the TSX Composite Over a 5-Year Period

The 5-year results are more discouraging than the 3-year results. Going back to 2008, there is not a single 5-year period in which the majority of actively managed funds beat the TSX Composite.

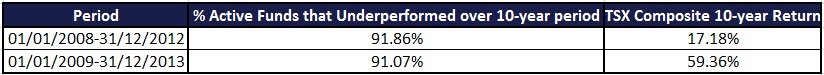

Percentage of Active Money Managers that Underperformed the TSX Composite Over a 10-Year Period

SPIVA only began reporting the 10-year number in their 2017 report so we only have 2 data points for this longer duration, needless to say, the results are dismal.