We built Inukshuk Capital Management to serve the needs of clients looking for a unique approach – void of conflicts of interest, commission sales and pushed products. We began by putting our own money where our mouth is. With low fees and active risk management, we help families achieve financial longevity, that’s the bottom line.

Stay up-to-date on the latest developments by following us on LinkedIn here.

December 2022: Predictions

In this issue:

- Global Equity Market Performance – November

- Fortune Telling

- Prognosticators

- Summing Up (or down)

- Health is Wealth

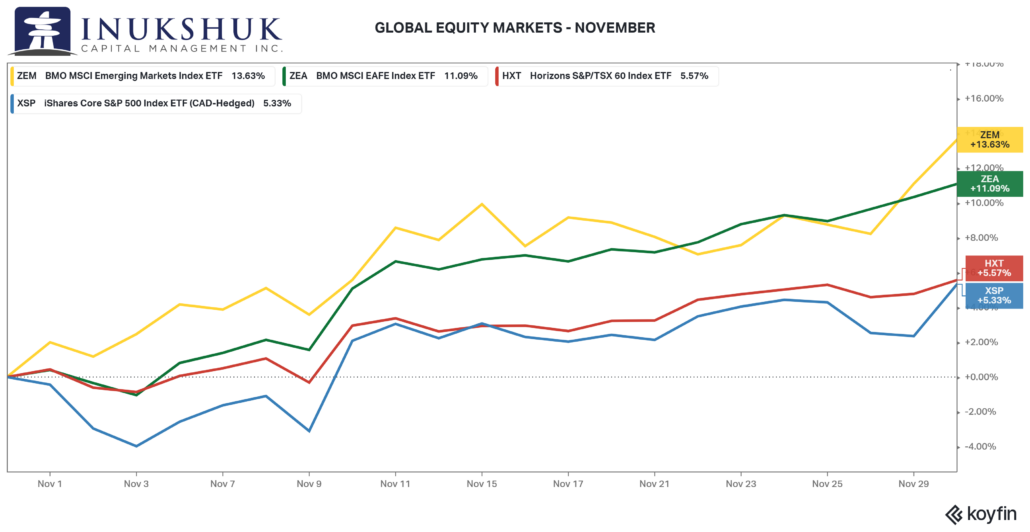

GLOBAL EQUITY MARKET PERFORMANCE – NOVEMBER

The two worst performing global stock indexes for the past few months, MSCI Emerging Markets and EAFE (Europe, Asia the Far East and Australasia) decided to pull up on the stick and had a very good month.

There have been some decent rebounds from the year’s lows, however global equity markets are still significantly lower on the year. Coming into December, the Nasdaq 100 was down 26.3%, Emerging Markets 18.4%, Russell 2000 16.0%, S&P 500 14.4%, and MSCI EAFE 12.8%.

Our systems’ remain long the S&P 500 and S&P/TSX60. They have turned constructive on Emerging Markets.

If you would like to stay current on our measures of trend and momentum in the markets we follow, please click here .

FORTUNE TELLING

For a number of reasons, we do not count ourselves as members of the intrepid club of financial prognosticators.

Of course, we have opinions based on information, experience and knowledge, but we’ve learned over the years that it’s better to let our systems do what they do. Our strength is in determining whether a systematic model is robust enough to go ‘live’, rather than hoping our convictions will actually be any good. In our opinion, attempting to determine the potential for gain or loss, a priori, is preferable to being fixed to any one forecast and hoping for the best.

That said, everyone wants to know the future so they can either profit or avoid loss. Naturally there exists an industry, which has always been around, willing to supply that demand.

At the beginning of the movie The Big Short, based on the book by Michael Lewis that tried to explain the 2007-2010 Global Financial Crisis, there is a quote attributed to American writer Mark Twain:

“It ain’t what you don’t know that gets you into trouble. It’s what you know for sure that just ain’t so.”

There is debate over who said this first, regardless of attribution the message still stands. It’s a distillation of thoughts people, who think about risk, have had for thousands of years. It sets the scene up nicely considering some of Twain’s other comments about markets and investing.

Here’s another one attributed to him, as well as baseball genius Yogi Berra and Nobel Prize winning quantum theory physicist Niels Bohr.

“It is very difficult to predict – especially the future.”

That would be a cool group to have some drinks and dinner with.

On that note, the following is what we predict to be the inaugural annual summary of prognosticators’ predictions about markets and other things. We are currently collecting these so we can look back on them in a year and have some fun, whether right or wrong.

This is in the spirit of emphasizing how difficult it is to predict anything, nevermind the stock market. Things are constantly changing and evolving. And we know that financial types actually seek to be the prognosticator or get put in a box and are demanded to say something, so they do. In this first go around, we emphasize how wrong some guesses are. Hopefully, in a year from now we can cheer on those who were right.

We’ve been doing this long enough to know that it is easy to be wrong – it’s the nature of the business.

But before we look at some predictions let’s get a good baseline of how difficult it is for people with experience to get things right.

PROGNOSTICATORS

Krugman

To kick this theme off, let’s go through an example of prognostication by a well-known expert: Paul Krugman, MIT economics professor, who won the Sveriges Riksbank Prize in Economic Sciences in Memory of Alfred Nobel in 2008. (Note: economics is not physics or ‘hard’ science and Alfred Nobel wanted nothing to do with the discipline, thus the differentiation in the title of the award for economists versus actual scientists.)

This is one of the all-time best. In an article dated June 10, 1998 in Red Herring, a technology-focused media organization, Krugman wrote:

“The growth of the internet will slow drastically, as the flaw in “Metcalfe’s law” – which states that the number of potential connections in a network is proportional to the square of the number of participants – becomes apparent: most people have nothing to say to each other! By 2005 or so, it will become clear that the internet’s impact on the economy has been no greater than the fax machine’s.”

No need to comment on that one.

The hilarious punch line is that the article was titled: Why Most Economists’ Predictions are Wrong. Hats off to him for predicting himself. Further hilarity ensued after he took a shot at bitcoin in his New York Times blog in December 2013. After some pushback on his previous epically bad technology call, Krugman claimed it was a humorous piece that he wrote for The New York Times Magazine’s 100th anniversary in 1996. In his defence, he also claimed he didn’t really know that much about technology. Clearly, Krugman is not a time-traveller or that good on the memory front.

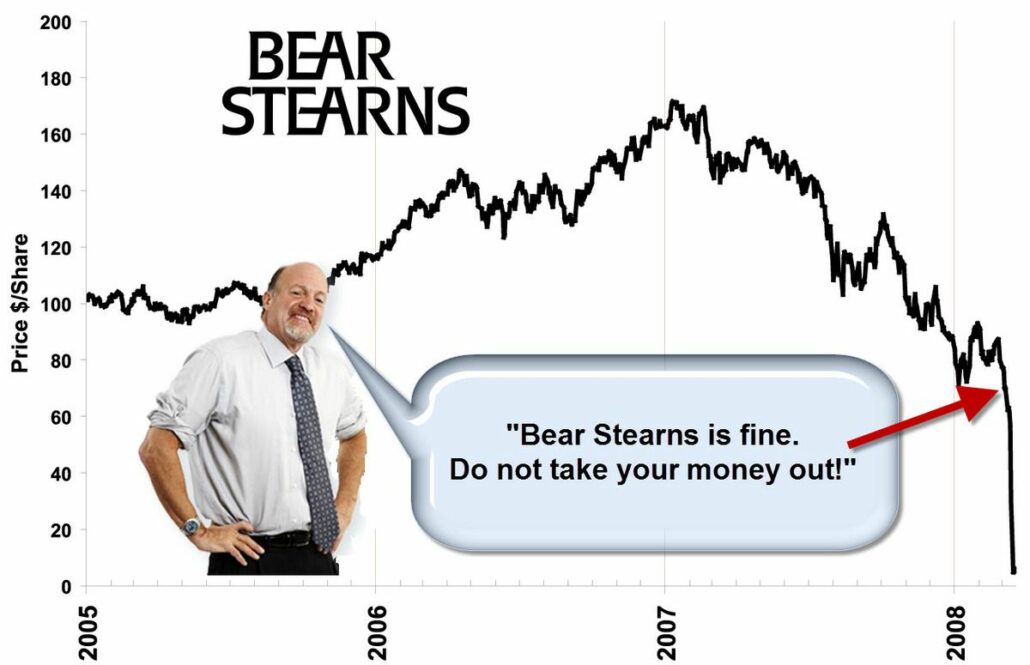

Cramer

Despite being wrong about almost everything, Cramer still makes an estimated $5 million a year prognosticating on CNBC.

Whether you believe his claim that, during the Global Financial Crisis, Bear Stearns was a safe investment and that he was referring to account and security balances at that investment bank, as opposed to the stock, his timing was particularly astounding.

Source: Hedgeye

To end this bit on a positive note, an ETF provider has applied to the Securities and Exchange Commission to launch two Cramer-based ETFs. LJIM will be the symbol for going long Cramer’s calls, while SJIM (inverse Cramer) will take the opposite side.

Some creative financial types at indexone have developed a SJIM index track record.

Jeepers.

The S&P 500 is down around 15% this year. SJIM up 31% is quite an extraordinary result. Good for Cramer to provide this opportunity to investors.

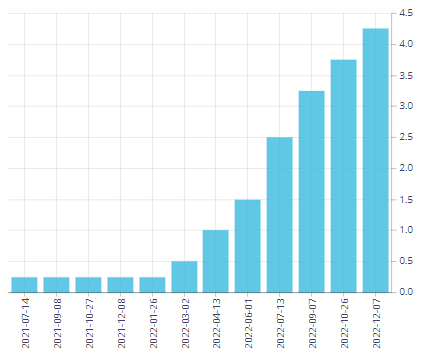

Bank of Canada

A pertinent example to Canadians is related to inflation and the Bank of Canada’s policy rate. In an effort to slow inflation down, the Bank has raised interest rates seven times this year alone. In January, the overnight target rate was 0.25%. As of December 7, it is 4.25%. This is probably one of the most extreme interest rate increases in the history of the Bank.

Source: Bank of Canada

Two years ago, on November 26, 2020, the Governor of the Bank of Canada, Tiff Macklem, made this statement before the House of Commons Standing Committee on Finance:

“Inflation is also unusually weak. The most recent CPI data has inflation at 0.7 percent in October. We expect inflation to stay below our 1 to 3 percent target range until early next year. After that, we project it will rise gradually. But with the economy continuing to operate below its potential, inflation is projected to remain less than 2 percent into 2023.”

Whoops.

But here’s the kicker: prognosticating can harm people significantly. From the same statement (bold highlights ours):

“We have lowered our policy interest rate—the target for the overnight interest rate—to 0.25 percent, which we judge to be its effective lower bound. And we have used exceptional forward guidance to indicate that we expect it will remain there for an extended period. Specifically, we have committed to keeping our policy interest rate at its effective lower bound until economic slack is absorbed so that the 2 percent inflation target is sustainably achieved. In our current outlook, this takes us into 2023.”

Whoops, again.

So, the result is not even close to being in the realm of the many economists’, and the head of the central bank’s expectations (or predictions).

Being totally wrong as Krugman was about the potential of the internet is one thing, because most economic actors will ignore the pundits and do what they think is best for them. It is a much different set of circumstances when humans make decisions based on the words of the person who actually sets the rates.

Ok, we’ve trashed some economists and a television personality. If that wasn’t any fun, here are some quick hits illustrating the latest prediction foibles.

David Hunter

From David Hunter on Twitter, self-described “Contrarian Macro Strategist w/49 years on Wall Street” with more than 192,000 followers.

The S&P 500 immediately fell 10% over the next few days.

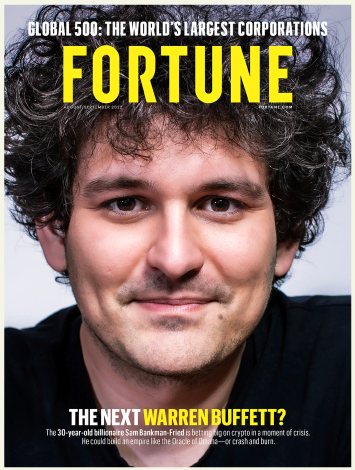

Fortune(?)

One of the best ones from just a few weeks ago.

Hmmm, love him or hate him Warren Buffett has never lost all of his investors’ capital in a few days. The guess now is this disaster caused $8 to $20 billion dollars to vanish, almost overnight. As of this writing Fried is sitting in jail in the Bahamas.

Mike Wilson

Hot off the presses, we present the chief equity strategist for Morgan Stanley, Mike Wilson.

Here is his latest:

Here’s hoping Santa shows up, but if not you can always blame Mike.

SUMMING UP (or down)

This has been a bit of a fun note to emphasize the idea that in the market and most other things prognostication is a tricky business. The idea is to follow your investment plan and manage risk. It’s been a difficult year to accomplish this, but we will still follow our process.

Here’s hoping we generated some chuckles and wishing all of our readers an excellent Holiday season, Merry Christmas and a Happy New Year.

We will see you again in 2023. That’s something predictable. We hope.

HEALTH IS WEALTH

Spirituality

Longevity is a state of living a long and healthy life. At Inukshuk, we believe that health is wealth and that longevity is the ultimate goal in both cases.

There are several factors that contribute to our own longevity, including genetics, lifestyle choices, and environment. As life spans continue to increase, it is important to understand what makes some people live longer and healthier than others.

Studies have been done to identify commonalities among people who live long and healthy lives, such as those in the Blue Zones as defined by Dan Buettner.

Dan Buettner is an American author and longevity expert who is known for his research on the so-called Blue Zones, areas of the world where people live longer and healthier lives than the average person.

Buettner’s research has identified commonalities among people living in these regions, such as spirituality.

These studies have found that spirituality, connection with a higher power, strong social and family networks are key to longevity. They also point to the practice of gratitude and giving to others as factors that help us live longer, happier lives.

As we head into the holiday season, let us all reflect on the things we are grateful for and show appreciation to those around us

“You have to sustain it, to maintain it”

Victoria Bannister

ICM Health Ambassador

Have a question? Contact us here

Challenging the status quo of the Canadian investment industry.