InstaGram:kimdorland

We built Inukshuk Capital Management to serve the needs of clients looking for a unique approach – void of conflicts of interest, commission sales and pushed products. We began by putting our own money where our mouth is. With low fees and active risk management, we help families achieve financial longevity, that’s the bottom line.

Stay up-to-date on the latest developments by following us on LinkedIn here.

Reminder: the RRSP contribution deadline for the 2021 tax year is March 1st.

February 2022: Breathe

In this issue:

- Global Equity Markets

- Undertow

- Changing of the Guard

- It Goes to Eleven

- Breathe

- Health is Wealth

GLOBAL EQUITY MARKETS

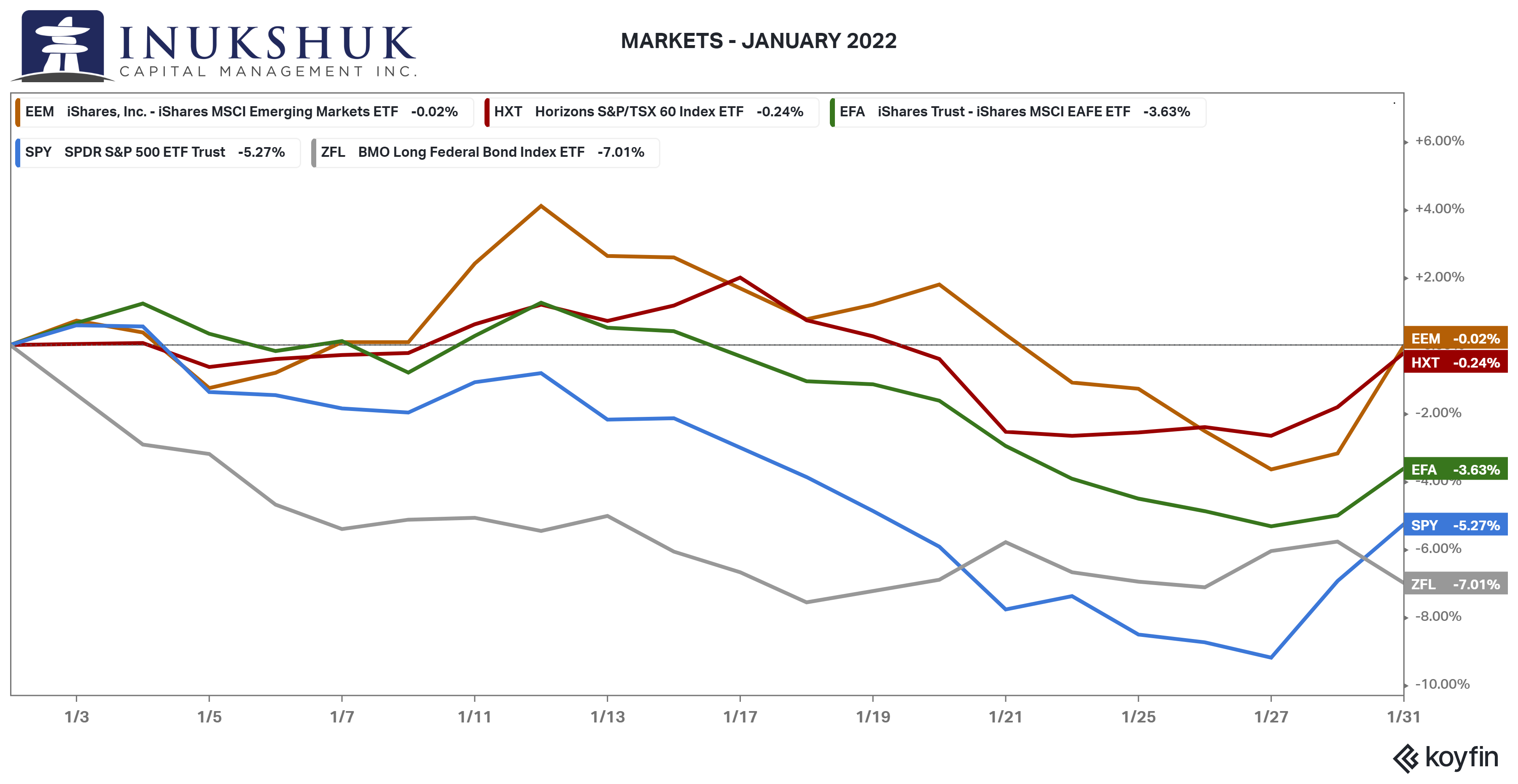

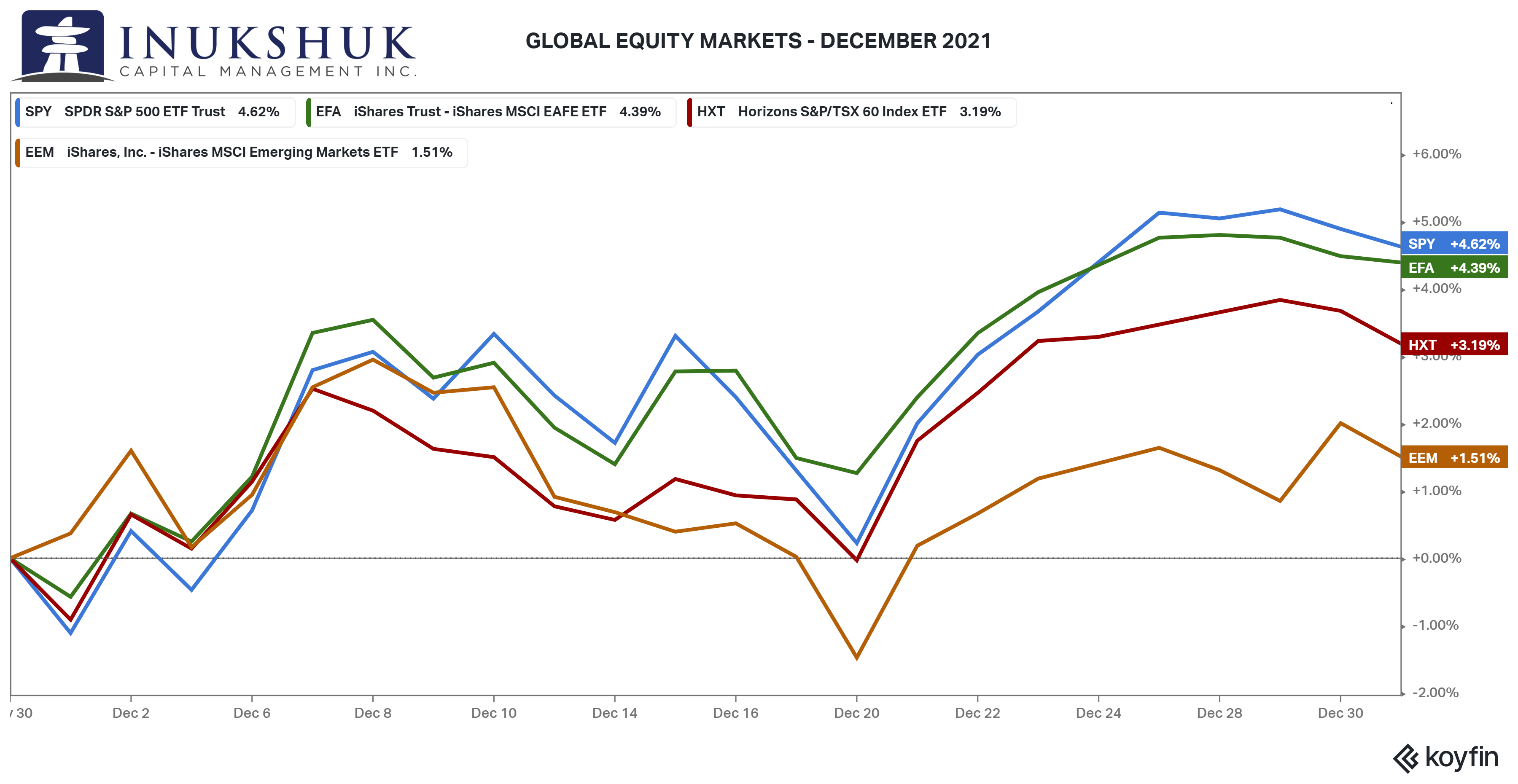

January was a bit of a rude surprise to investors. After a strong end to the year, each of the four indexes we actively manage risk allocations to, were down. The S&P 500 lead the way with a loss of 5.27%.

This result was an exact mirror of December.

Our systems continue to signal caution in both MSCI EM (Emerging Markets) and MSCI EAFE (Europe, Australasia & the Far East) and are warning about the major North American indexes. This is also the opposite of how things were looking at the end of 2021, when some positive signals in EM were spotted.

If you would like to stay current on our measures of trend and momentum in the markets we follow, please click here

UNDERTOW

If you’ve ever had the chance to swim or surf at some of the world’s best beaches, down under, you’ve likely heard of the undertow. The beach is endless, the waves are coming in nicely and setting well, but beneath that beauty is something dangerous for us oxygen-dependant types. If you get slammed by a wave and end up a little closer to the seafloor than you want to be, bad things can happen. Undertow is a current beneath the surface of sun and fun that can drag a hapless human a long distance away from or along the shore. In fact, in 1967, then Australian Prime Minister Harold Holt, a strong swimmer, vanished and was never seen again. One theory suggests he was swept away while swimming at a beach just outside of Melbourne, which is known for its undertow. Another theory postulates he was a Chinese spy and escaped to China in a submarine that was offshore. Either way, it probably didn’t end well for Harold.

On the surface, the above review of equity performance seems relatively benign. The TSX and EM finished the month close to flat. The S&P 500, however, was a different story. On January 4, the largest equity index on the planet made an intraday all-time high of 4,818, but then closed down on the day. The next few sessions were a bit rough – there were a couple of relief rallies and then it plummeted more than 10% in just over a week. The tech-heavy Nasdaq made its low around this time, down 18% from its all-time highs from late November.

After drifting higher into the end of the month, after some very choppy trading, things calmed down. Then, during the first week of this month, after the market close on February 2, Meta Platforms – formerly known as Facebook – disappointed the street, losing 20% of its value in an hour or so, and $180 billion of wealth vanished. But wait, there’s more. The very next day things were getting a bit sporty in tech stock world. Amazon was down 8% ahead of their earnings announcement expected after the close. Tensions were high – many breathless, thinking that if the tech giant disappoints Mister Market, it could be another bloodbath. But then… it was Amazon to the rescue, they crush expectations and viola: $220 billion is restored to the overall market value of the S&P 500.

It’s tricky out there. The first chart shown above is an example of diversification across asset classes failing as Canadian government bonds fell dramatically (ZFL down 7%), while stocks went nowhere or were down. Year-over-year, bonds are down 10%, gold 2%. Global equity diversification has faired a bit better, but MSCI EAFE has not gone anywhere since April 2021, while EM is down 7% the past year. As well, there are some large divergences in performance in the underlying sectors of the overall market of stocks – more on that later. Then, at the individual stock level, when you have relative and absolute moves greater than 20% in a matter of hours in the biggest names on the planet, it’s starts to feel a little personal.

CHANGING OF THE GUARD

Change is good, so we are told. It can be but sometimes, not so much. Quarterback legend, Tom Brady, retiring (is he really?) is a recent example of change. The GOAT has won seven Super Bowls in his career. No one has done that before. It may be a good thing for his ankles and knees, but there are many mixed emotions in football fan-world, in response to this news. Since this is a family-friendly read, 50% of those will not be referenced.

And now, look who’s next. Amongst a crew (not sure of the plural for QBs – a gaggle?) of very successful young men, Joe Burrow, the QB for the Bengals is heading to the Super Bowl after only his second year of pro football. And that is not exactly right, because in week 11 of his rookie season his knee exploded, and he was out. Although it’s cool to see younger athletes succeed, at the same time, some might miss the comfort of seeing the greatest compete, week after week, at the highest level.

So, what’s that got to do with stocks, you ask? Here’s a long-winded attempt at an answer.

The thing about any sport is that everything, especially now, is well documented. The data is endless. NFL coaches, the younger ones, are starting to sound like the A’s baseball manager Billy Beane in the late nineties. That is a great story told in the book, Moneyball – The Art of Winning an Unfair Game,which was also made into a movie. There are many statistics and a huge amount of money involved in sports, at all levels. Add emotion to this, and it’s starting to sound a bit familiar.

In any sport, you want to ride your winners. This applies to the managers and coaches, as well as the couch potatoes who are betting on the teams and players they think will win. Some of the amateur punters gambling on sports via mobile apps for entertainment have turned that into a fulltime gig. It’s always been a job for the bookmakers because someone needs to make the markets.

It is the same in trading financial products. The technology that provides professional-level access to almost anyone and any market on the planet is the same technology that allows ‘amateurs’ to trade lines in sports, intra-game. There is a reason the name for a bank’s market maker in foreign exchange trading is called a dealer. Step right up to the table, folks.

The hard part is finding the winners and avoiding the losers. The numbers are there. The technology is there to analyze and implement decisions, in real time with real money. And change is a constant because everyone is seeking the same goal. That’s why it is important to see where the changes are occurring.

IT GOES TO ELEVEN

To extend the analogy, in sports there are leagues, or some kind of entity, that makes the rules and organizes the competitions (exchanges). Then there are teams (indexes). The players are the components of the teams (stocks), and the front office and coaches create the teams (portfolio managers). Then anyone else can bet on the success or failure of any of those components, including the exchanges.

Sectors of the market of stocks are defined by what the underlying corporations actually do. A quarterback is nothing like an offensive lineman, so it wouldn’t be a good idea to compare their statistics with one another. These are the player positions. This is similar in all sports, individual or not, and they are the sectors. In snowboarding, it would make no sense to compare Mark McMorris, the Canadian Slopestyle legend, to Jasey Jay Anderson, the fastest blueberry farmer in the world on an Alpine snowboard. They do different things.

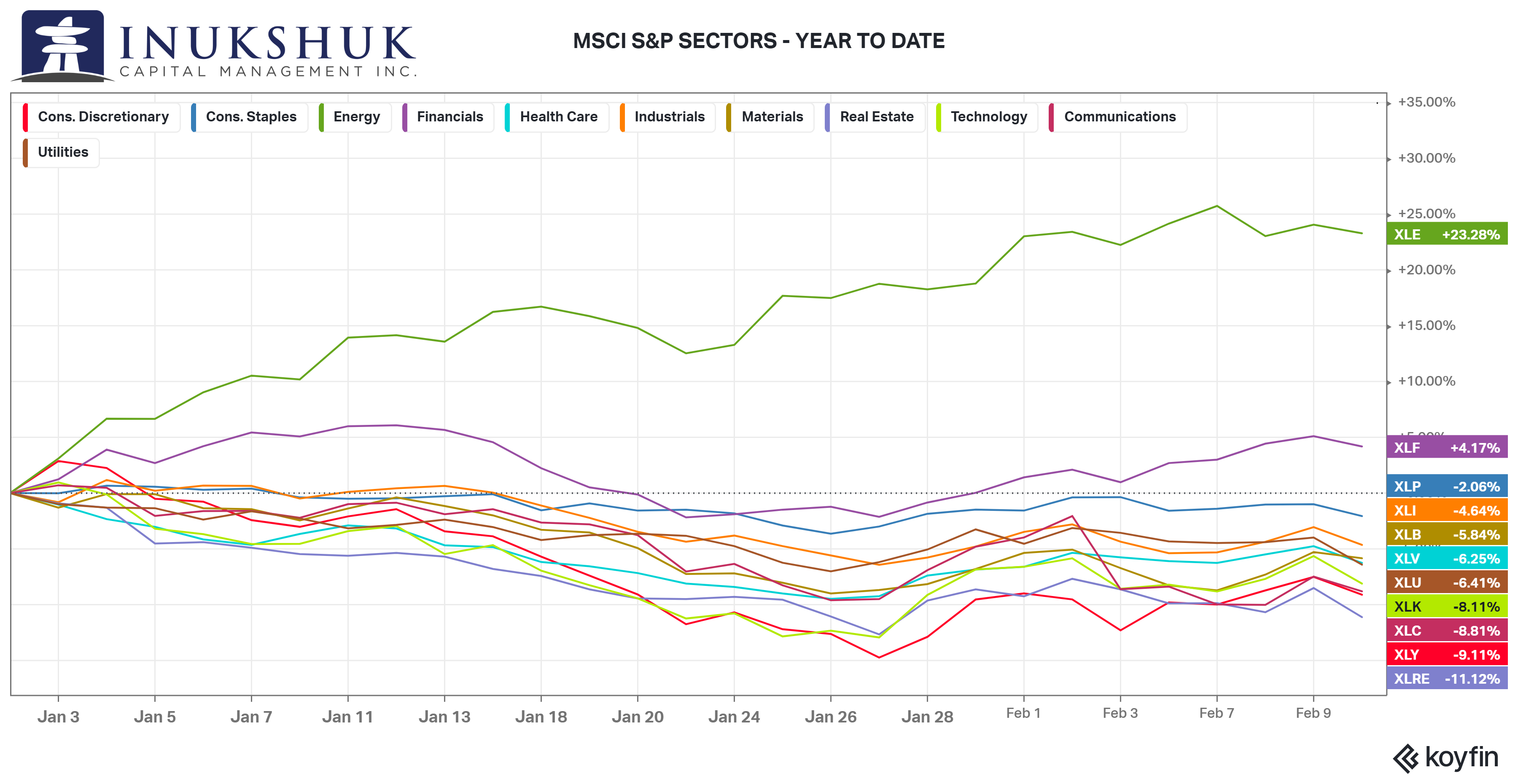

In the United States, the organization of these sectors (player positions) was formalized by MSCI in the late nineties. There are eleven of them. Every company in the S&P 500 index is assigned to a sector. And every sector has an ETF that is benchmarked to it.

Below is a chart of how each of these sectors has performed this year.

This might be a real eye opener for some readers. The first chart at the top, of the broader indexes shows the S&P 500 down 5% in January. When looking at what the sectors are doing, notice that of the 11, only two are up on the year. Energy is on fire, financials are solid, but then it is a bit of a problem after that.

This does not contribute to prognostications. It is an observation – sort of like having a QB and running back on a team and no one else shows up. That’s a burden. How it resolves itself is why we watch the games.

BREATHE

Continuing on the theme, both sports and markets are quantifiable and emotional. Most cannot completely separate their emotional self from the raw data provided to them – especially when it comes to money.

Over the past few weeks when looking at the markets humans would have experienced moments of breathlessness, breath-holding, deep inhalations, dramatic sighs, or none of the above. The latter is a better way to live.

Investors sometimes stop breathing when they are in panic mode. That’s not good for the brain. There is a non-zero chance some bad decisions were made in January when the ‘techocalypse’ reversed many gains, built over a year, in just a few days. If you bought Facebook at the beginning of last year, by September you’d have made a 40% return. If you still own it, you are now down 16%. What to do?

Musicians seem to have an instinctual idea of what breathing (or the inability to) means from an emotional perspective. In a quick scan of our resident music geek’s memories of songs related to breathing, four favourites were immediately recovered (miracles do exist).

In chronological order with lyric samples and interpretative notes:

Breathe, Pink Floyd

All you touch and all you see

Is all your life will ever be…

A critic’s observation – it’s not all anyone should be, hopefully. A reminder of what makes you think what you think at any time. To keep working the analogies: it is a good description of what you may feel as you watch the market seemingly try to destroy your dreams. Lesson: try to avoid these thoughts but listen to the song, at 11, if you encounter them.

Every Breath You Take, The Police

Every breath you take

And every move you make

Every bond you break

Every step you take

I’ll be watching you

This is easy – don’t be Sting. The market owes you nothing and neither do any of the people you know. Stop obsessively watching it. Stewart Copeland, the drummer (and genius) had some thoughts on this as it relates to the band.

Breathing Underwater, Metric

I’ll wait

Is this my life?

Am I breathing underwater?

Is this my life?

Am I breathing underwater?

This is a great Canadian band and a wonderful song – if you’ve seen them live, you’d get it. Breathing underwater is not recommended without the appropriate scuba gear. Oh, a metaphor.

Exit Music (For A Film), Radiohead

Breathe, keep breathing

Don’t lose your nerve

Breathe, keep breathing

Good advice – also recommended for listening when you are struggling to do so. It’s not for everyone, but once again, when you hear it performed live, it makes total sense.

Similar themes expressed over decades across multiple and very different musicians. Breathing is not typically on your mind, unless you are drowning. It is an automatic reflex. But when stressed, humans don’t necessarily breathe normally. The psychological aspects of breathing are related to peace of mind, or the lack thereof. It is also the ‘proof of life’ in the immediate sense. It is a minimum requirement for participating in something that demands no other challenges, other than to be alive. And maybe a little bit of light stalking action on the part of Sting.

The thing that is fascinating about music is it is related to math. Music is a kind of math that most humans understand. It is also a connection to our emotions, so the lyrical aspect can sync up with the music and tell a story about almost anything. Math, despite unfortunately what many have experienced, can take thinking to levels that are almost incomprehensible. Math is the base language of everything. Physics is math. Read some thoughts Einstein and other physicists (favourite is Richard Feynman) have written about the ideas that were revealed to them when doing their work. Awesome stuff.

Ok, time to take a breath and hand it over to Victoria, who actually knows how to make you better by… breathing.

HEALTH IS WEALTH

Using Your Breath

The way you breathe can impact your entire body, helping to regulate important functions, such as heart rate and blood pressure. It can also reinforce proper body mechanics that put less stress on your body as you move.

The diaphragm is the primary muscle used for breathing. This dome-shaped muscle sits at the base of the chest and separates the abdomen from the chest. As you inhale, your diaphragm contracts and flattens out, creating space in your chest cavity for your lungs to expand. When you exhale, the diaphragm relaxes and the air is pushed out of lungs.

We were all born with the ability to breathe properly, so what happens? Life!

Most of the population are chest breathers, unfortunately not ideal for feeling great.

Breathing from your chest relies on secondary muscles around your neck and collarbone instead of your diaphragm. (Are you constantly trying to release tension from your neck?) When this breathing pattern is accompanied by poor posture, many muscles in your upper body can’t function properly. Research has shown that people with ongoing mild-to-moderate neck pain or sore, stiff neck muscles have issues using the lungs and respiratory system to their full capacity.

The longer you sit during the day, the less your body can fight the forces of gravity and maintain a strong, stable core. Poor posture makes breathing more difficult and contributes to breathing pattern dysfunction. Rounded shoulders and a forward head posture cause the muscles around the chest to tighten, limiting the ability of the rib cage to expand, so we breathe into our chests, leading to more rapid and shallow breaths.

Several factors can impair respiratory function, creating a pattern of quick, shallow breathing. Sudden or chronic pain, for example, can activate a section of the nervous system that governs many bodily systems, including your breathing rate (the average adult takes 12-18 breaths per minute) heart rate, and body temperature. Chronic stress and strong emotions, such as rage or fear, intensify your fight-or-flight response, which can also impair your breathing rate.

The good news is, like all muscles in our bodies, we can train it to work more efficiently and assist in postural corrections. Proper breathing also helps us foster a sense of calm, reduce stress and anxiety levels, and lower blood pressure. In fact, that’s why deep breathing is the basis for all meditative and mindfulness practices.

Practicing healthy breathing patterns also allows you to build your endurance for strenuous exercise.

Here’s a short video tutorial to kick start that breathing training.

‘To sustain it, you must maintain it.’

Victoria Bannister, ICM Health Ambassador

At Inukshuk Capital Management, we are firm believers in the connection between Health (physical, mental and spiritual) and Wealth.

Our ICM Health Ambassador is available to our clients for complimentary consultations. Contact us for more information.

Have a question? Contact us here.

Challenging the status quo of the Canadian investment industry.