Canadian Made

We built Inukshuk Capital Management to serve the needs of clients looking for a unique approach – void of conflicts of interest, commission sales and pushed products. We began by putting our own money where our mouth is. With low fees and active risk management, we help families achieve financial longevity, that’s the bottom line.

Stay up-to-date on the latest developments by following us on LinkedIn here.

| REMINDER

The RRSP contribution deadline for the 2022 tax year is March 1st. |

February 2023: Canadian Made

In this issue:

- Global Equity Market Performance – January

- Artificial Intelligence and Machine Learning

- Microsoft versus Google

- What Chris Knows

- Wrapping Up

- Health is Wealth

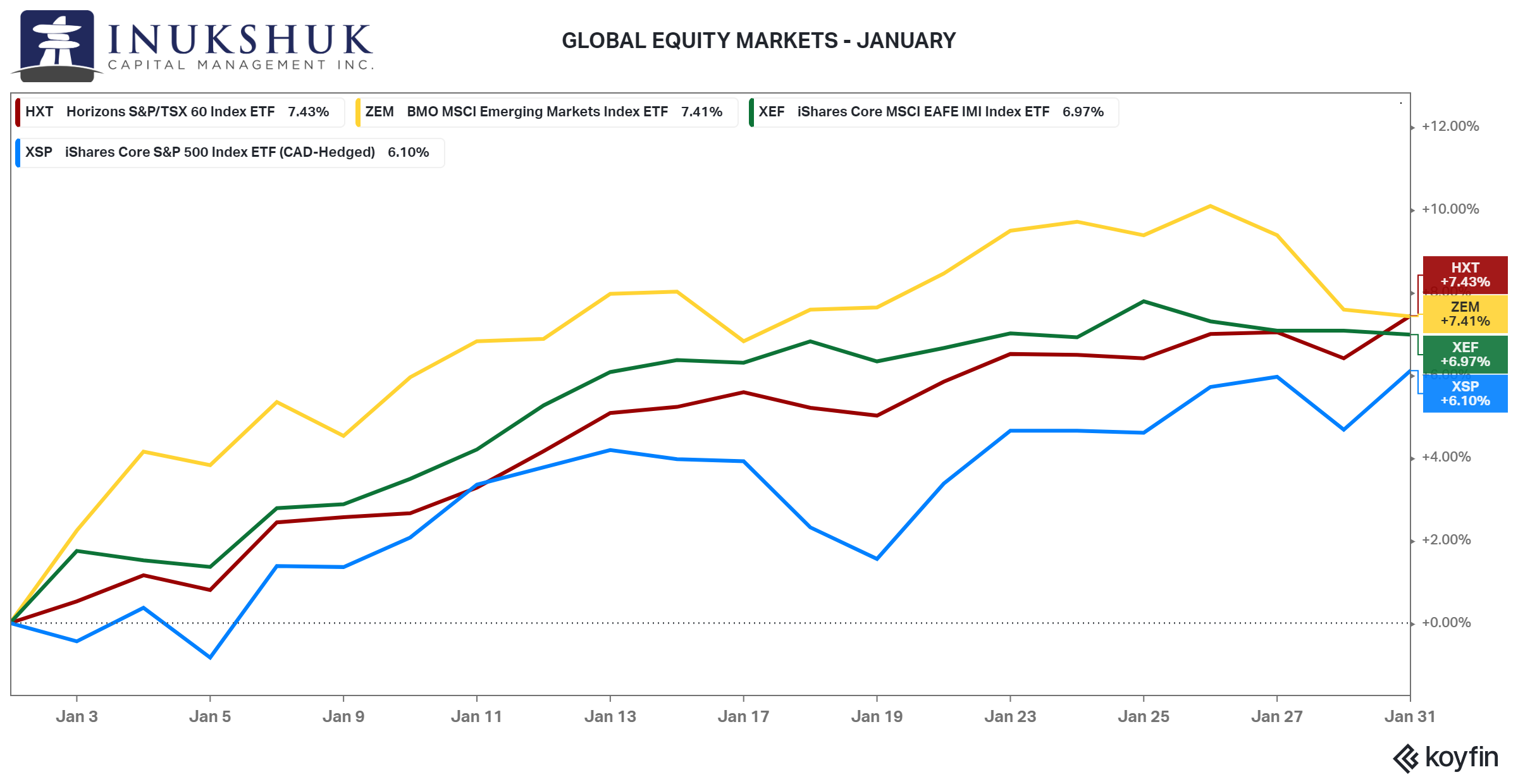

GLOBAL EQUITY MARKET PERFORMANCE – JANUARY

The first two weeks of this year’s performance in global stock markets persisted into the end of the month. Apparently, the reindeers had to shrug off the New Year hangover – carrots, cookies and milk can have that effect.

That said, after the December disappointment, the S&P 500 is back to where it was at the end of November. But, the least poor performers into the end of 2022, the S&P/TSX60, MSCI Emerging Markets and EAFE (Europe, Asia the Far East and Australasia), have managed to be the best performing indexes, so far this year.

Our systems remain long the S&P 500, S&P/TSX60 and Emerging Markets.

If you would like to stay current on our measures of trend and momentum in the markets we follow, please click here .

ARTIFICIAL INTELLIGENCE and MACHINE LEARNING

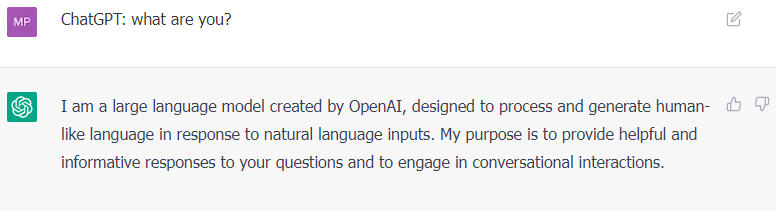

The first examples of scientists programming machines to try to do what humans can do date back to the 1950s. Things have come a long way since then. Recently, in November of last year, OpenAI released a freeware version of their application ChatGPT. These techniques are commonly called Artificial Intelligence (AI) where Machine Learning (ML) is a subset of AI.

Let’s ask it what it is:

The Turing test was introduced early as a method to determine whether you were talking to a machine or a person. Let’s see what ChatGPT thinks about that:

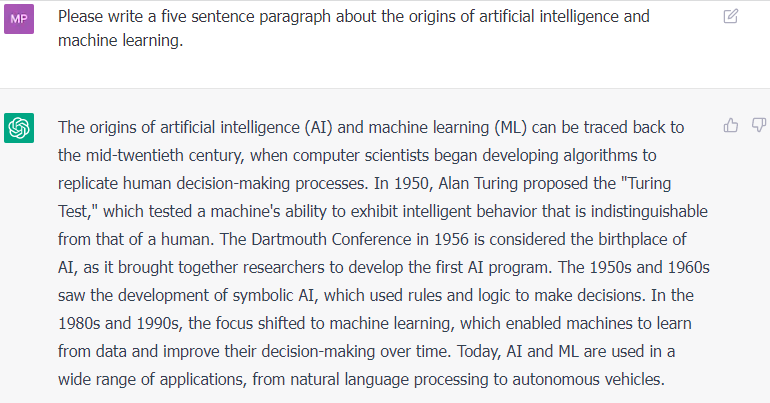

What could anything like this have to do with investing, you may wonder – is it not just a simple parlour trick to be used for fun? The short answer is: no.

One of the first things Chris Keeley, founder of ICM, did was ask it if it could write code in Python to solve a problem. It did. Oh, hi there HAL.

ChatGPT is capable of answering questions about itself, providing general knowledge about its origins, and writing code to solve problems. The immediate market-related importance of this is what Mister Market did with Google (Alphabet, now, but still GOOG) compared to Microsoft (MSFT).

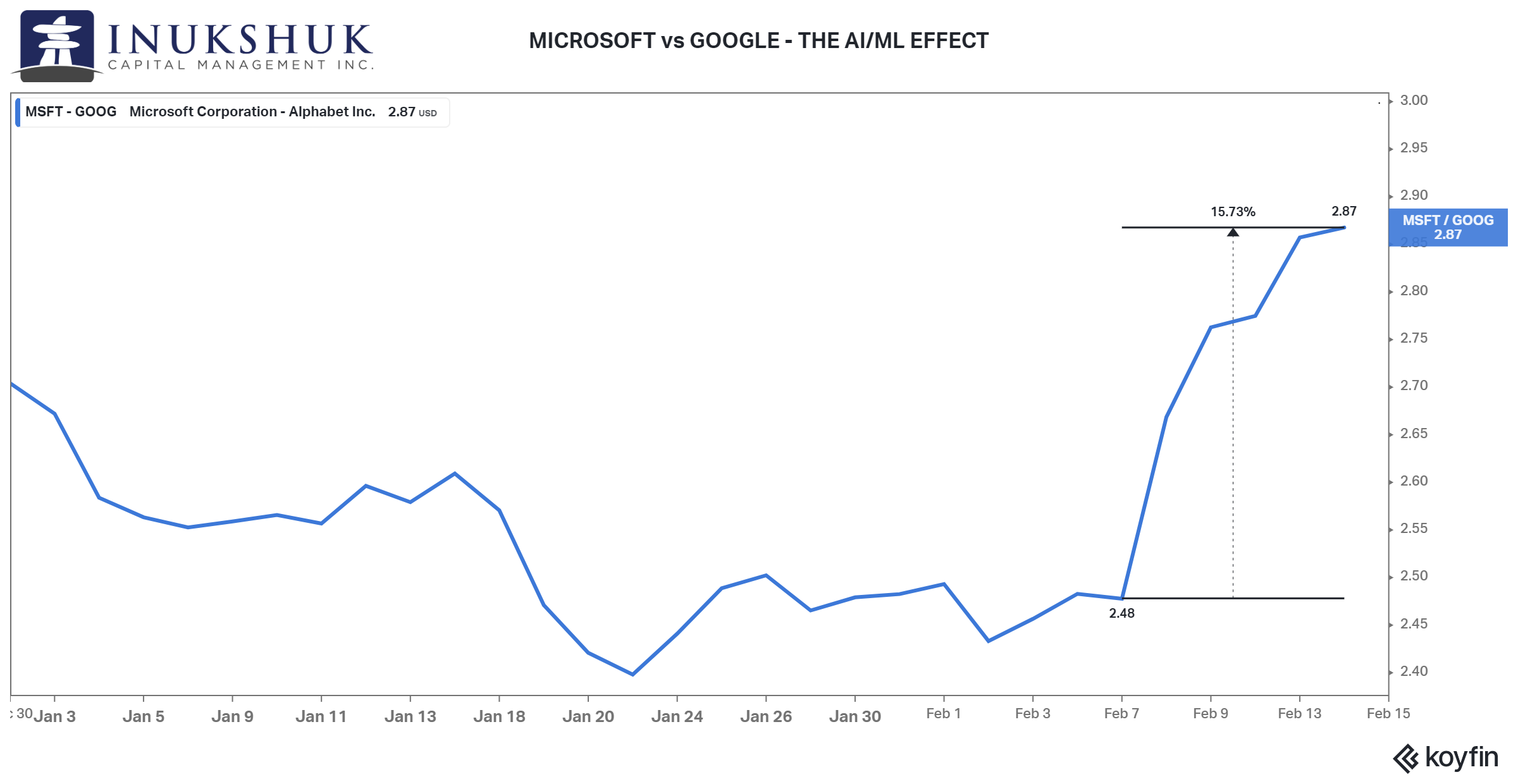

MICROSOFT versus GOOGLE

Microsoft recently invested $10 billion in OpenAI valuing the company at over $30 billion. Google has been working on AI/ML solutions for a very long time. On February 6, GOOG presented their ideas of what they were up to in this realm.

This is from the Google press release:

‘Today, the scale of the largest AI computations is doubling every six months, far outpacing Moore’s Law. At the same time, advanced generative AI and large language models are capturing the imaginations of people around the world. In fact, our Transformer research project and our field-defining paper in 2017, as well as our important advances in diffusion models, are now the basis of many of the generative AI applications you’re starting to see today.

Two years ago we unveiled next-generation language and conversation capabilities powered by our Language Model for Dialogue Applications (or LaMDA for short).

We’ve been working on an experimental conversational AI service, powered by LaMDA, that we’re calling Bard. And today, we’re taking another step forward by opening it up to trusted testers ahead of making it more widely available to the public in the coming weeks.’

The next day, Microsoft had a presentation event outlining how they would integrate ChatGPT into their search engine, Bing.

Here is Microsoft’s statement:

‘It’s a new day for search, Microsoft CEO Satya Nadella said today. For 13 years now, Microsoft has tried to get you to use Bing, but you didn’t want to, so its global market share remains in the low single digits. Now, the company is pulling out all the stops in an effort to better compete with Google. Today, at a press event in Redmond, Washington, Microsoft announced its long-rumoured integration of OpenAI’s GPT-4 model into Bing, providing a ChatGPT-like experience within the search engine.’

GOOG fell 12% over the next couple of days, erasing 100s of billions of dollars of market capitalization. Since then, if you sold GOOG and bought MSFT, which the following chart shows, you would be ahead by almost 16% in one week. These are very large numbers and money talks.

It’s clear the market thinks these are relevant issues regarding the tech giants. This is not surprising to us at ICM. Chris has been on a path regarding systematic trading strategies and the use of the latest technologies to implement these techniques, for over two decades.

WHAT CHRIS KNOWS

Here is a distilled chat with Chris (it has to be distilled, because he will not stop being precise):

When did you start working on systematic trading methods?

I first encountered and learned about systematic trading strategies while working in the futures department (early 1990’s) at Scotia McLeod as a summer student. I worked for a futures broker that was a pioneer in the field of systematic trading system design and development. I was fascinated by the concept of using price data as the driving force to make investment decisions.

When did you start using algorithms to trade?

In the early 2000’s I began recreating trading strategies I read about in my subscription to Stocks and Commodities magazine. A lot of this work was around time-series analysis which uses statistical methods to analyze data that changes over time.

Were these algos simply mathematical/manual (spreadsheets) at first?

At that time I was using TradeStation software to develop simple quantitative strategies. I moved on to programming strategies in VBA to allow for full customization but still used TradeStation because they were leaders in developing state of the art trading technologies.

When did you start building trading systems using machine learning techniques and what were they?

I’m not sure when exactly, I’d guess 2005. I started using genetic algorithms. This is an optimization method that utilizes the principles of natural selection to solve complex problems. It involves generating a population of potential solutions, evaluating their fitness, and selecting the most ‘fit’ to generate the next solutions using operators such as mutation and crossover. This iterative process continues until a satisfactory solution is found, or until a stopping criterion is met.

What have you learned in terms of benefits and constraints in using AI/ML to develop trading systems?

One of the main benefits of using AI/ML is the ability to analyze large and complex data sets that would be difficult or impossible for a human to process. This can lead to more accurate trading decisions that are more adaptable to market events, and the ability to identify patterns that may not be apparent to us..

However, there are also some constraints to using AI/ML. For example, these algorithms may overfit to historical data, which can lead to inaccurate determinations about future trends.

Currently, when you approach a problem and develop a solution, as in the case with ICM’s proprietary active systems and the processes used to build new strategies, are there specific things you have learned to apply from your experience with various AI/ML techniques?

I think this has enabled me to understand how data is used and processed. Also, to know that without good data, the results do not matter. These are the same concepts you will run into in any systematic process using large amounts of data, whether it is stock prices or any other time series you are trying to quantify and use in a manner that is useful to your purposes.

ICM has been running strategies that actively manage risk for well over a decade. Over these past five years the S&P 500 has had three major corrections, 2018, 2020 and then last year. In all three cases ICM’s clients avoided experiencing the full extent of these drawdowns in the active program. How do you think your experience has contributed to that kind of risk adjusted performance?

I believe that the most valuable insight and information about the future directions of prices comes from the price itself. When you are studying large and extremely liquid markets that aren’t easily manipulated, it pays to listen to the messages they are sending. And by that, I mean it’s important to monitor short, medium and longer-term trends. One of the things we are very good at is collecting and processing massive amounts of data. We do this to be alerted of foreshocks that might warn of an impending quake.

Two years ago, ICM was contracted by an institutional fund manager to develop a systematic liquid alt fund. The fund was launched a year ago, when the S&P 500 was within a few percentage points of its all-time high. The market then fell 20%. Not only did investors not lose money but this primarily equity-focused fund was up on the year. How much of this could be attributed to your knowledge of using AI/ML and systematic processes to develop customizable investment management solutions?

The work we carried out on this fund’s development represents an extension of our ongoing research into actively managed investment strategies, which has been ongoing for several decades now. A robust strategy, to me, is a strategy that is logical, intuitive and simple. Complexity leads to poor results.

Often managers will try to create a perfect looking backtest by adding more and more rules and then they top it all off with a bunch of filters. This will not work in real-time. No strategy will always catch the very top or the very bottom and trying to build one, is a fool’s errand.

Our strategies are designed to stay invested when the markets are trending higher and reduce positions when the trend turns down. We believe in winning by not losing and the math of loss supports this – it takes a 100% gain to recover from a 50% loss. Think about that.

One lesson to be learned from this seems to be that you do not have to be a massive organization to be creative, use the latest technologies available, and produce solid results – made in Canada, eh. ICM’s clients have benefitted from this. Would you say that your work has brought institutional-level investment management techniques to the average investor?

Absolutely, and it’s largely due to the open-source code movement. Take for example Google’s TensorFlow, or Facebook’s PyTorch or Scikit-Learn, a Python library for machine learning. These and many more frameworks are available to anyone and everyone who is willing to work their way up a very steep learning curve. It’s a wonderful age for research.

So, you’ve been working in this area for almost thirty years now. Would it be fair to say your work is close to being a laboratory for solving investment management problems using the scientific method that can be applied to almost any sized mandate?

Yes. We do not run systems on illiquid markets. We trade broad market indexes using some of the most liquid and inexpensive investment vehicles in the world that can scale into the billions of dollars.

WRAPPING UP

We’ve heard from the machines, tech executives and the founder of ICM. There are many ways to understand what is going on and what the implications are to our day-to-day life and the complex automated systems using these techniques. One positive takeaway is: human imagination knows no bounds… hang on a sec that could be good or bad. We will let you figure that out.

Back in the early 1970s a band out of Germany, Kraftwerk, was at the cutting edge of analogue computing and synthesiser technology to create music. They were and continue to be pioneers and their influence has been huge in the evolution of how musicians use technology to create sounds and songs. That is good.

In the 1978 song “Robots” they imagined what is possible now:

We’re charging our battery

And now we’re full of energy

We are the robots

We’re functioning automatic

And we are dancing mechanical…

We are programmed just to do

Anything you want us to

And we will dance and sing for you

We are the robots

We’re functioning automatic

And we are dancing mechanical

HEALTH IS WEALTH

The Dangers of Regular Alcohol Consumption: How a Dry Month Can Help Your Health

With increasing numbers of people designating January a dry month and many more doing the same in February to support the Canadian Cancer Society, I figured this would be a good time to write about the impact of regular alcohol consumption on our health. Recent data shows that even moderate alcohol intake can have negative effects on our mood, cognitive health, and overall well-being. Dr. Andrew Huberman, a neuroscientist at Stanford University, has studied the impact of alcohol on the brain, and his findings show that alcohol can have effects on us in between drinks.

Dr. Huberman explains that alcohol affects the brain in many ways, including altering our moods and cognitive functions. Even when we are not drinking, the effects of alcohol can linger, leading to anxiety, depression, and impaired cognitive performance. This is because alcohol affects the levels of neurotransmitters in our brains, including dopamine, serotonin, and GABA, which are responsible for regulating our emotions and cognitive processes.

In Canada, the guidelines for alcohol consumption were recently revised to no more than 2 drinks per week. This may seem restrictive to some, but research has shown that exceeding these limits can have serious health consequences. Regular alcohol consumption can lead to an increased risk of cancer, liver disease, heart disease, and other health problems.

When we stop drinking, the benefits can be significant. Not only do we reduce our risk of developing serious health problems, but we also cut out a significant number of calories. A single drink can contain as many as 200 calories, which can add up quickly if we are consuming multiple drinks a week. By cutting out alcohol, we can reduce our calorie intake and lose weight, improve our sleep, and reduce inflammation in the body.

In addition to the physical benefits, many people report improved mental health and well-being when they stop drinking. They experience less anxiety, better sleep, and more stable moods. They also have more energy and are better able to concentrate and perform daily tasks.

If you are considering a dry month or simply want to reduce your alcohol consumption, it is important to set realistic goals and develop a plan to achieve them. You may want to start by tracking your current alcohol consumption and gradually reducing it over time. It is also important to find alternative ways to cope with stress and social situations that may trigger the urge to drink. This could include practicing mindfulness, exercise, or spending time with friends and family.

By reducing our alcohol intake, we can improve our physical and mental health, lose weight, and reduce our risk of developing serious health problems. A dry month can be a great way to jumpstart a healthier lifestyle and achieve long-term benefits.

‘You have to sustain it, to maintain it’

Victoria Bannister

ICM Health Ambassador

Have a question? Contact us here

Challenging the status quo of the Canadian investment industry.