Photographer: Shelly Grimson

Photographer: Shelly Grimson

We built Inukshuk Capital Management to serve the needs of clients looking for a unique approach – void of conflicts of interest, commission sales and pushed products. We began by putting our own money where our mouth is. With low fees and active risk management, we help families achieve financial longevity, that’s the bottom line.

Stay up-to-date on the latest developments by following us on LinkedIn here.

Reminder

The deadline for RRSP Contributions for the 2020 tax year is March 1st.

January 2021- Compounding Ideas

In this issue:

- Markets

- New Games Same as the Old Games

- Innovation and Information is Compounding

- Health is Wealth

MARKETS

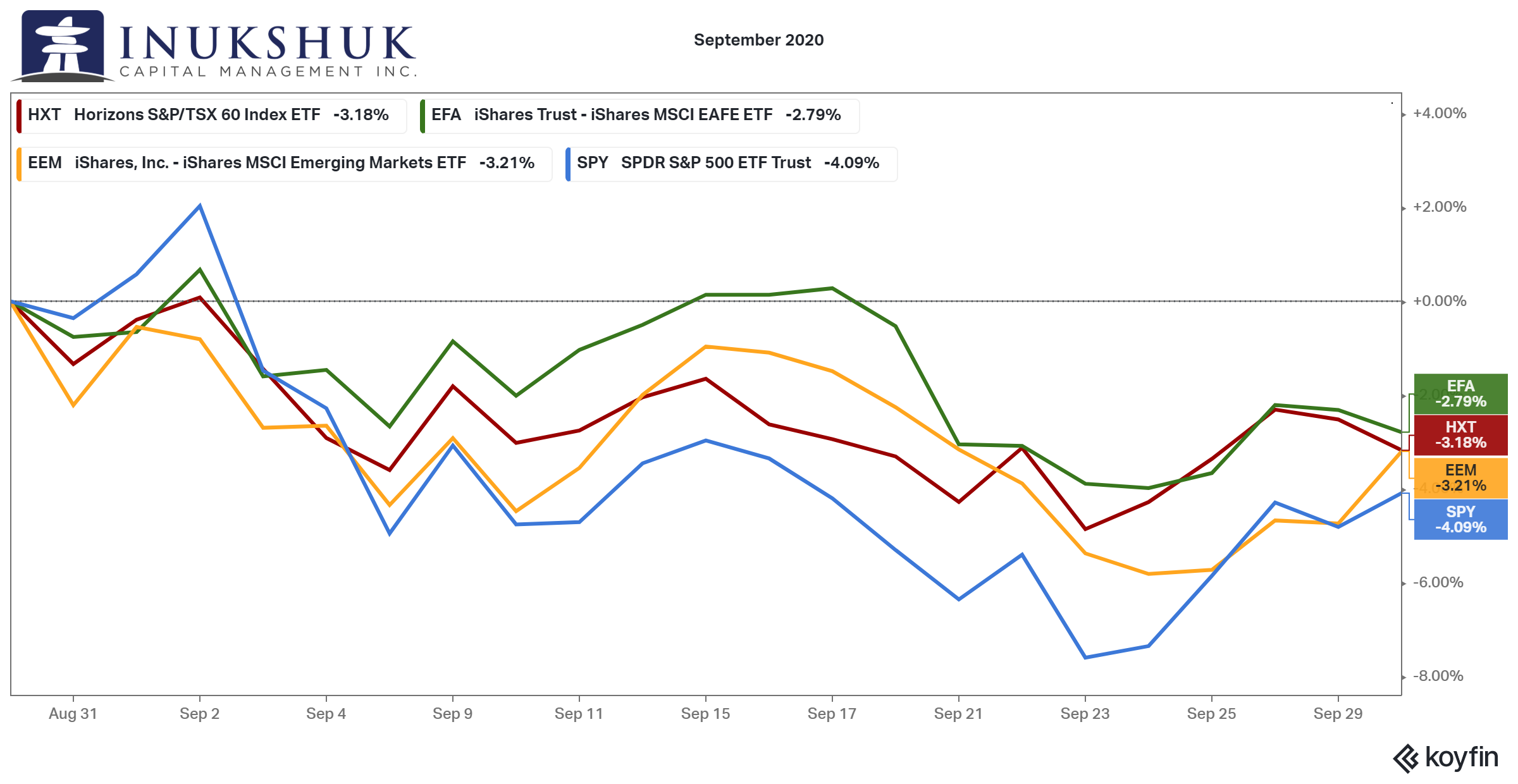

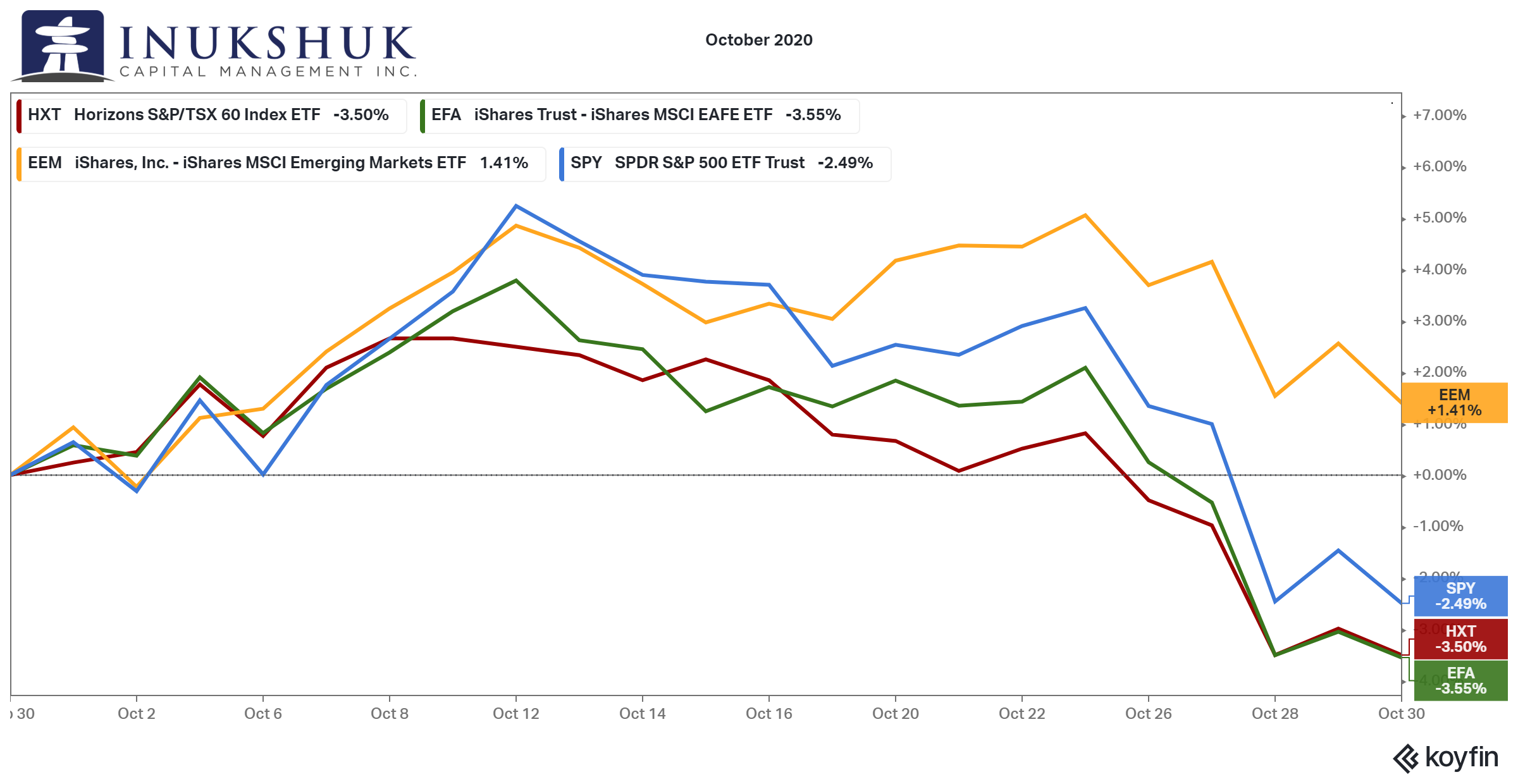

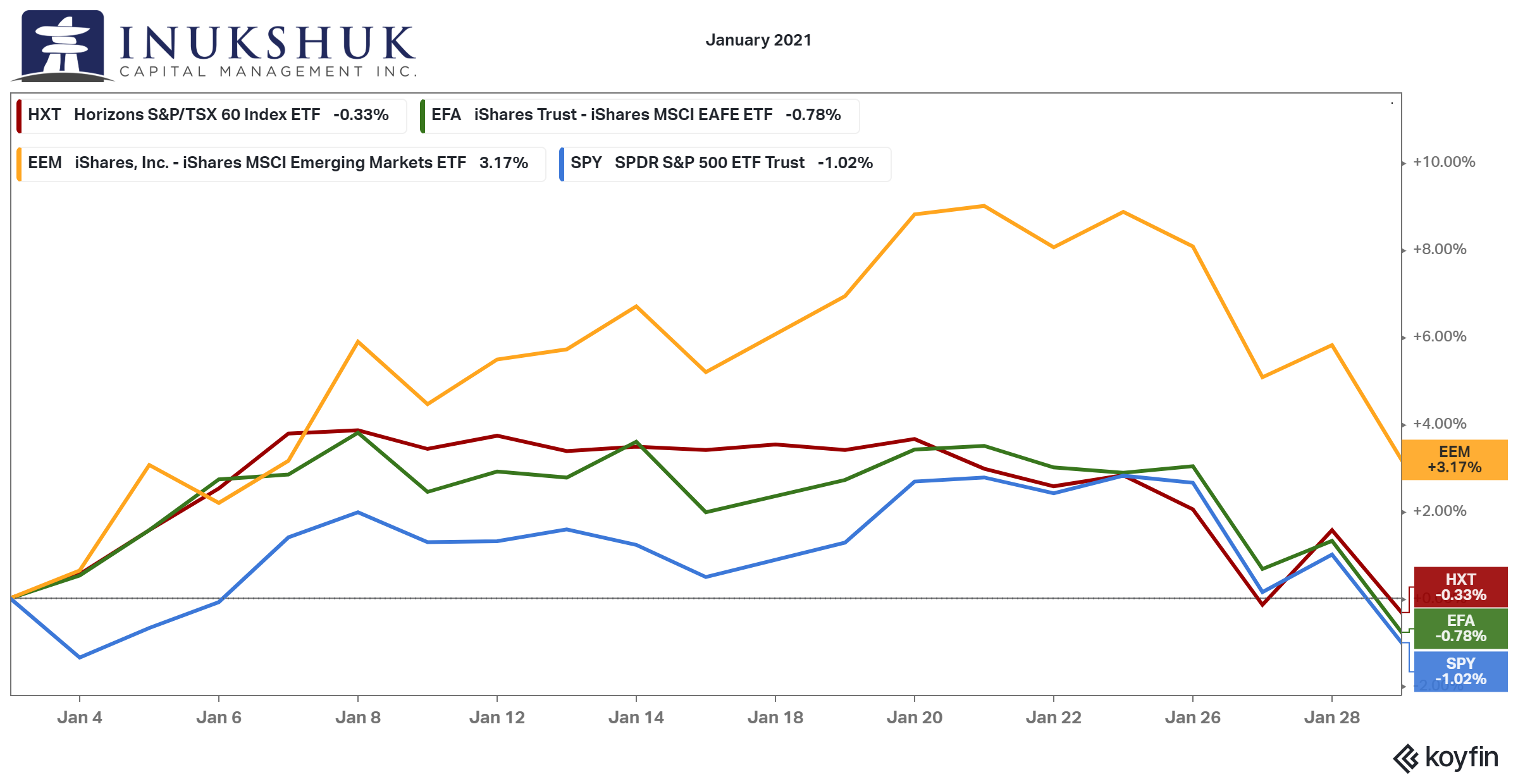

January was similar to September and October 2020 in terms of the performance of the four global equity index ETFs we manage on an active basis. In each case, the markets started out strong, peaked around the third week and then sold off into the end of the month. It’s worth noting that in both October and January MSCI Emerging Markets was the best performer. While it’s not a large sample size the behaviour is interesting in its similarity. Our systems are paying attention, and we and the machines are learning.

Our systematic trend-following program has been fully invested in all four markets since November. Recently, the risk signals in MSCI EAFE began flashing ‘caution’ and we have pared that position back. That capital has been put to good use in our portfolio of innovation equities.

Our systematic trend-following program has been fully invested in all four markets since November. Recently, the risk signals in MSCI EAFE began flashing ‘caution’ and we have pared that position back. That capital has been put to good use in our portfolio of innovation equities.

If you would like to stay current on our measures of trend and momentum in the markets we follow, please click here.

NEW GAMES SAME AS THE OLD GAMES

In last month’s note, we highlighted some of the investment ideas and themes we have been working on. That work has paid off and we continue to look for more opportunities in the innovation realm that suit our risk profile and offer potential rewards for our clients. And it is not simply the risk profile but the trends that we are attempting to capture in these investments. We are, after all, trend-followers when it comes to investing (probably not so much in other realms). These trends in ideas and innovation are very compelling.

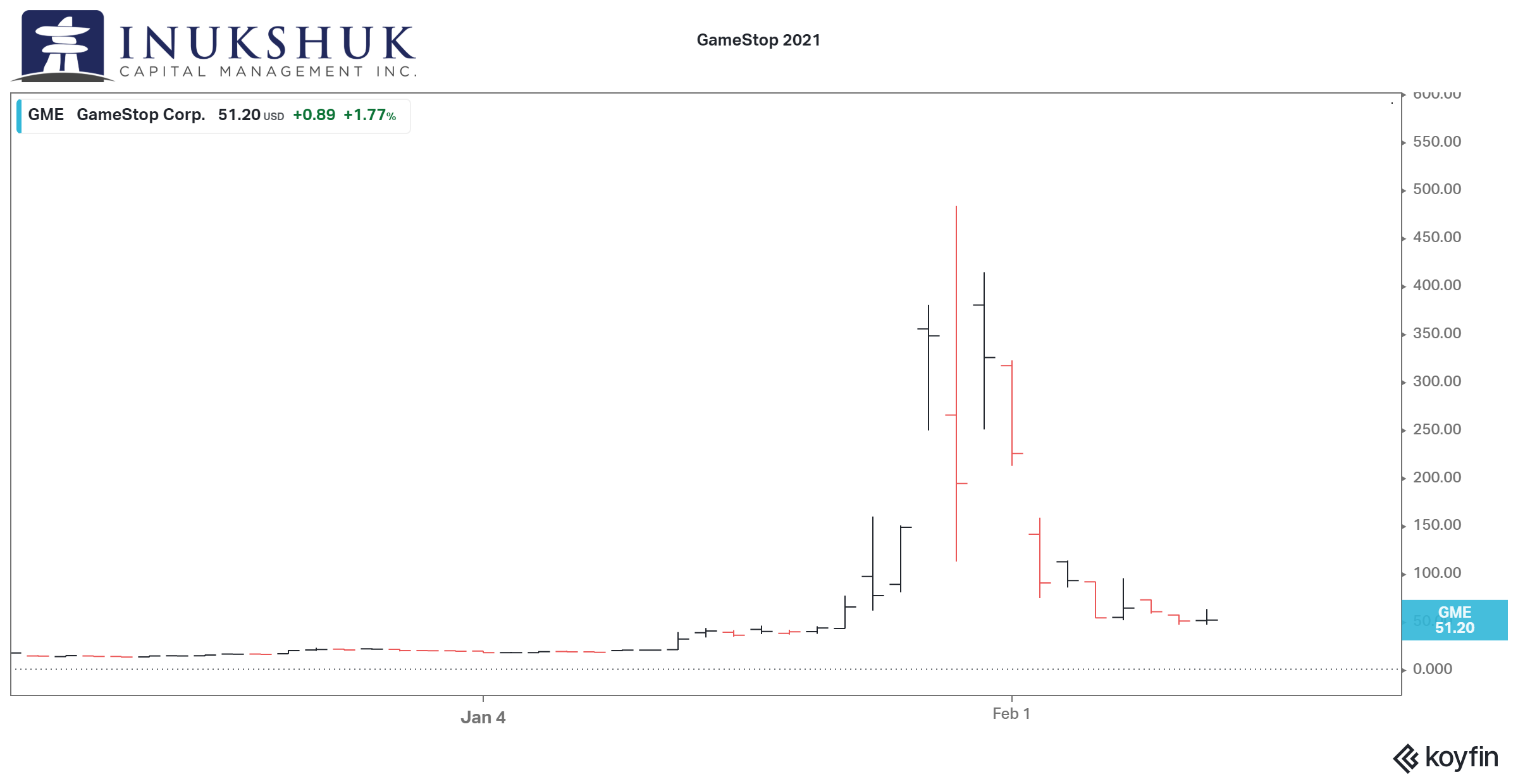

Recently there have been trends that are worth ignoring from a process point of view. It has been almost impossible to avoid a conversation about GameStop and the Reddit social group, WallStreetBets. Anyone who is remotely paying attention to markets is interested. So here goes.

The least amount of time any one of our portfolio managers has been participating in markets is roughly 30 years. This includes all markets, from currencies, interest rate, foreign exchange and equity derivatives, commodities, exotic options, cash fixed income products, and of course, stocks.

One of the reasons our systematic trading strategies work to avoid bad risk, is because humans keep doing what they have done since we have had data to observe. And most probably, for longer than any records exist.

Interesting side note:

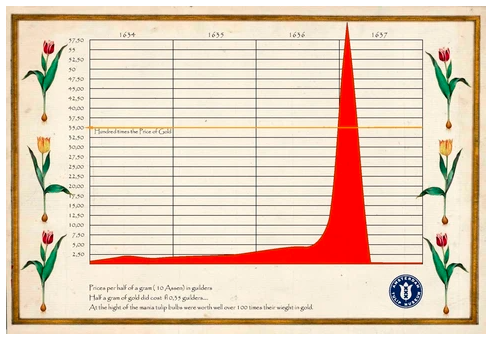

Many reading this might recall stories of the instance of tulip mania in 1630s Holland. The price squeeze in tulip bulb futures was epic and ended up the way many of these things do – a collapse. We have no idea what it means that this speculative frenzy occurred a little more than a year or so after 10% of Amsterdam’s population died of the Black Plague.

Source: Amsterdam Tulip Museum

Back to today’s games – the GameStop situation is not a new development in stock markets. Chat groups that get behind stocks and ideas have been around in some form since AOL began offering them decades ago. If you go back to the 1920’s, an era of few phones and much ticker-tape, groups of ‘stock operators’ worked prices higher in concert – those were called pools.

In the early-nineties in Canada, some of these virtual rooms were cluttered with promoters hyping junior mining stocks. At around the same time in the US, stock chat rooms were used for the same purpose.

Look at the photograph at the top of this letter. When the kids feel they are being denied access to the fountain, they make their own. The kids are now on Reddit. They have grown up in a world where you can have conversations with anonymous humans, half way around the planet. Discord is another social site which is predominantly populated with gamers. They play what we older folks used to call video games. But now gaming is also a virtual social environment. It is not surprising these same people are comfortable with playing anything online – whether it be collaborating in a shooter game or squeezing a stock higher.

It just took longer in the past – an analogy would be dial-up internet access versus instantaneous GIF and meme-sharing while recording yourself clicking the buy button with your online broker on your mobile device while virtually dressed as a cat.

GameStop took days. Tulips took almost a year. It was fun to watch but it is meaningless. Note: the world didn’t come to an end after the Black Plague and tulip futures speculation. We are confident Reddit won’t end the financial markets. That’s the job of central bankers to decide.

Speaking of faster, the things that are going on in the world of technological innovation are extraordinary. Not the valuations but the actual work that is being done.

INNOVATION AND INFORMATION IS COMPOUNDING

There is a statement regarding data that has been true for several years – 90% of all data that exists has been created in the prior five years. It keeps compounding. Data is now effectively an asset or a currency, depending on your purpose. It requires actual physical things to store it. Besides that, the things technology entrepreneurs and massive data-dependent household names are doing with this information is remarkable.

A long-term investment theme and trend that is evolving rapidly is an increasing amount of capital being raised to service the wants and needs of an increasingly older, longer-lived and wealthier planet of humans. Last month we talked about the opportunity we found to invest in the second stage of the cannabis wave, which is mostly health-related. We have also been doing work on other opportunities in healthcare.

This theme applies to the many industries surrounding innovative technology. Whether it is renewable energy, cloud computing or self-driving e-cars, things need to be manufactured to support the expansion of these goods and services. Information needs to be organized and stored somewhere. As information growth compounds on itself it will have an impact on all industries – physical, intellectual or both.

In no way are we claiming we have any idea of what the future holds. All we understand is technology is advancing at an increasingly rapid rate. If you know about the option market’s ‘Greeks’ – that would be gamma. The second derivative of a time series is the rate of change of the rate of change. This is happening in the real world. Some stock prices are doing the same.

If this thesis is correct, we should be investing in the companies that are the innovators as well as those industries that support and surround them. Big data and blockchain, cloud computing, gaming, batteries and fuel cells, robotics and cars – this is what is happening.

On the human side, genomics research is being implemented in a practical way. The recent development of vaccines to fight the virus SARS-CoV2 contains at least one important piece of information: no vaccine had ever been developed for SARS-like viruses. Now there are more than three, a year after this infection was defined as a pandemic by health authorities. That’s impressive.

It turns out – there are ways to be invested in these ideas without being a stock-picker. There are now multiple technology and innovation indexes that we can invest in via ETFs. And we have had some recent success doing just that.

We focus our research on trends and macro themes that have a benchmark rather than on individual stocks. The ETF industry continues to evolve in ways that enable us to do so in a low cost and tax efficient manner for our clients as we search for the good kind of volatility.

Over the coming years we should see some remarkable achievements in pure and applied science and technology. Stay tuned to this note for more on investible trends and ideas.

HEALTH IS WEALTH

As we enter our second year of this pandemic, mental health has been at the forefront. The benefits of physical activity on mental health are now more important than ever. It is a means to maintain and enhance mental health, including mood state and self-esteem.

Research shows that 20-40 minutes a day of simple, steady state aerobic activity results in mood improvements that last several hours. The rise in core body temperature following exercise is responsible for a decrease in symptoms of depression and anxiety. The increase in brain temperature of specific brain regions can lead to an overall feeling of relaxation and decreased muscular tension. An increase in endorphins following exercise is also related to a more positive mood. Exercise leads to an increase in hormones such as serotonin, dopamine and norepinephrine, all of which are suppressed with depression. Some evidence goes as far to suggest that the psychological benefits associated with physical activity are comparable to standard forms of psychotherapy. Anxiety symptoms and panic disorder also improve with regular activity, these benefits are comparable to meditation and relaxation.

When you have mild symptoms of depression and anxiety it is harder to get motivated. But, once you do, exercise can make a big difference. Start with reasonable goals and consider having a workout buddy. Physical activity will distract you from negative thoughts. It will help you with your confidence by meeting goals and overcoming challenges. Improving our physical conditioning helps us feel better about ourselves and will help us live longer, happier and healthier lives.

In order to sustain it, you have to maintain it.

Victoria Bannister, ICM Health Ambassador

At Inukshuk Capital Management, we are firm believers in the connection between Health (physical, mental and spiritual) and Wealth.

Our ICM Health Ambassador is available to our clients for complimentary consultations. Contact us for more information.

Have a question? Contact us here.

Challenging the status quo of the Canadian investment industry.