We built Inukshuk Capital Management to serve the needs of clients looking for a unique approach – void of conflicts of interest, commission sales and pushed products. We began by putting our own money where our mouth is. With low fees and active risk management, we help families achieve financial longevity, that’s the bottom line.

Stay up-to-date on the latest developments by following us on LinkedIn here.

July 2021- The Olympics Edition

In this issue:

- Global Equity Markets

- Couch Surfing

- Japan’s Experience

- Tokyo 2020

- A Year of Firsts

- Health is Wealth

GLOBAL EQUITY MARKETS

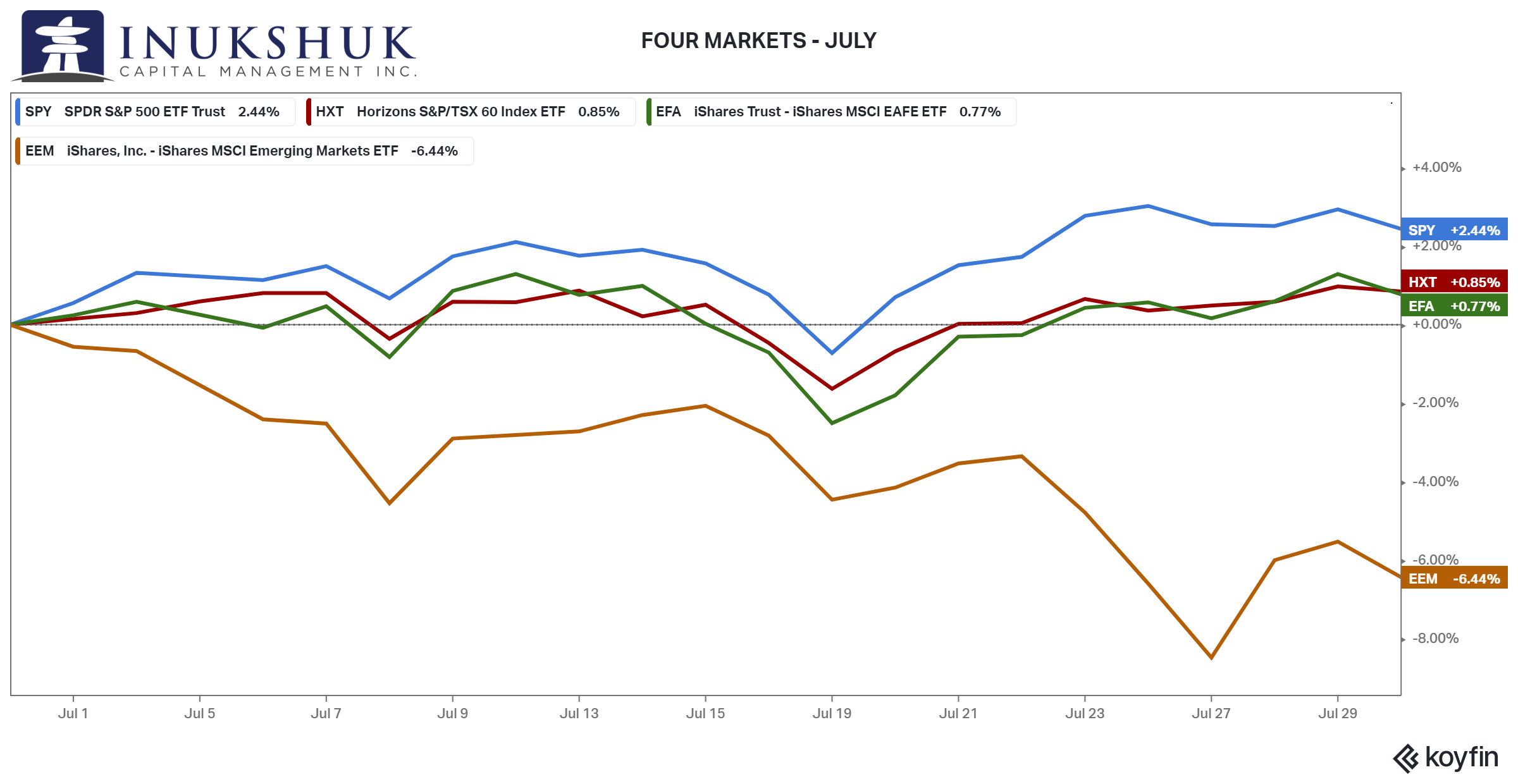

In July, the S&P 500 and S&P/TSX 60 continued to make new all-time highs and were the best performing indexes we actively trade. Just when it seemed the ‘Costanza’ strategy might be the way to play these markets, it wasn’t – this is classic Costanza. It’s also one of the reasons we invest using rules-based systems. MSCI EAFE (Europe, Australasia and the Far East) managed to almost equal the S&P/TSX 60’s gains however, MSCI Emerging Markets (EM) has now given up almost all of this year’s gains and was down 6.44%.

ICM’s positioning across global equity markets has changed with the recent move down in EM. Our active risk management program has cut back its EM exposure to zero and has had no position in MSCI EAFE, since mid-February. Allocations to the S&P 500 and S&P/TSX 60 remain at 100%.

If you would like to stay current on our measures of trend and momentum in the markets we follow, please click here

COUCH SURFING

Last month, we wrote about valuations and inflation. These were the prominent themes amongst the chattering classes. Lately, our inboxes have been inundated with the idea that the traditional asset mix of 60% equities and 40% fixed income, the 60/40 portfolio, may not produce the kinds of returns investors expect. In recent history, this has proven to be a successful strategy to reduce the bad kind of volatility in a portfolio of stocks and bonds. But what if the analysis doesn’t extend back far enough or things are no longer the same as they were?

These are the types of questions ICM tries to understand because they are interesting and have the potential to upset current assumptions about how portfolios are constructed. That is right in our wheelhouse – assume nothing and look at the numbers.

The origins of the simple 60/40 portfolio can be found in Modern Portfolio Theory (MPT). Harry Markowitz won the Nobel Memorial Prize in Economic Science in 1990, almost forty years after his paper Portfolio Selection was published in the Journal of Finance in 1952. (Note: this is not an actual Nobel Prize since Alfred Nobel was not a big fan of economics.) The general idea is: historical analysis of risk (variance), return and correlation between assets can generate an “efficient frontier” for portfolio construction. Or simply put: investors can create a portfolio that should behave well after determining their risk preferences and considering how different assets have historically performed relative to each other.

Markowitz was no dummy, but there are plenty of valid criticisms about this theory. The primary one, which is related to the pricing models of options, is that financial asset returns are not normally distributed and tend to have fat tails. Also, human actions can distort the return relationships between assets that appeared to be stable in the past. The fancy words to describe this are: the covariance matrix of asset returns are not homoskedastic. This problem in finance was a key contributor to the Global Financial Crisis of 2008-2009, since engineered products, based on debt obligations, were supposedly diversified in the characteristics of return expectations. Turns out, they were not.

A more relatable explanation is that asset prices typically have larger loss potential than described by a normal distribution (fat tails) and many asset price returns can become highly correlated to each other, all at once. In these cases, you think you are diversified, but you are not. The couch-surfers of investing have adopted MPT as a strategy, because it has credibility and is simple to implement.

If 60/40 becomes unreliable it is a legitimate concern for investors. Perhaps the recent attention to this problem is due to the low interest rate environment. Most of the developed world’s central banks have implemented target policy rates that are negative or close to zero. And there are trillions of dollars of sovereign debt that yields less than zero. Bloomberg reported last week that the total value of sovereign debt that trades at negative rates is over USD 16.5 trillion dollars, which is very close to the high of 2020.

JAPAN’S EXPERIENCE

For those of you involved in markets long enough, you may remember the late 1990s when big (and vocal) market players could not understand why Japanese Government Bond yields (JGBs) were so low. They kept losing and Mister Market kept winning.

In January 2016, the Bank of Japan (BOJ) unleashed its policy called Quantitative and Qualitative Monetary Easing with a Negative Interest Rate. Captivating title. The 10-year JGB yielded 26 basis points then. It now yields 3.

It’s timely that the summer Olympic Games have just concluded in Tokyo. If you are interested in records, you can find them in the games and the game that is the market. So, let’s have a look at what the numbers tell us regarding the naïve buy-and-hold 60/40 portfolio in a land of recent extremes.

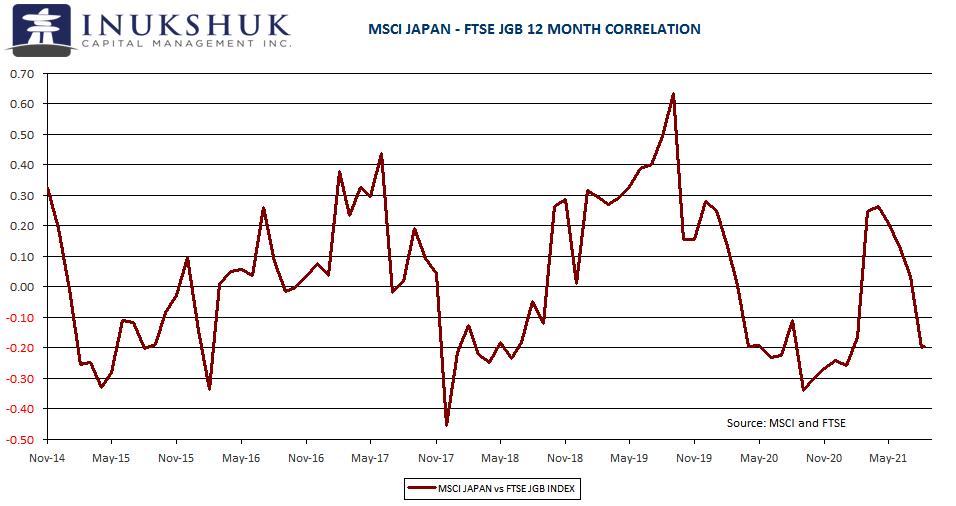

This thought experiment is relevant if you assume North America is headed towards a Japan-style interest rate regime. It is possible. Germany is already there. So how would you study the idea that the traditional diversification strategy is at risk due the negative rates policies implemented by central banks? First you can look at how Japanese stocks and bonds have behaved relative to each other over time. A simple correlation of returns between the two might give you a hint.

The idea behind an effective diversifier in investing is low correlation. Zero is good, negative might be better, but positive not so much – even though low positive correlations do improve risk-adjusted returns. As well, the assets in a 60/40 portfolio should have an expectation of some kind of return. This could be another reason for the concern about the potential failure of this strategy in the future – maybe the expectation of a positive return on bonds is unreasonable.

In early 2016, when the BOJ implemented the zero-rate policy, the correlation of returns of stocks and bonds fell sharply and then trended higher. The average correlation in the 16 months prior to the decision was -0.11. In the following 16 months, it was +0.14. Does that matter? Maybe not, because the average overall is +0.02. So even under unique and extreme circumstances, the correlation is low. But as an investor, an average means very little. You want to pay attention to extremes.

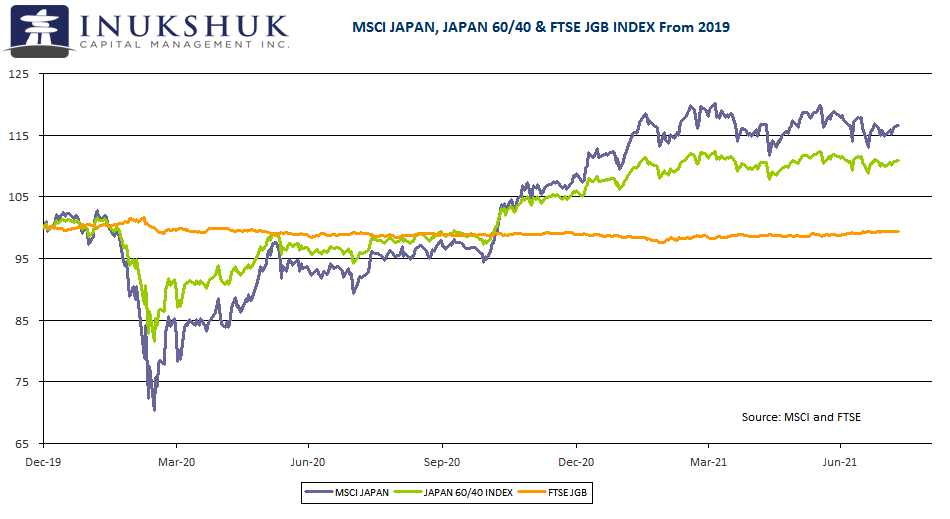

Luckily (or badlucky as some Caribbean residents would describe it), 2020 provided one of the most extreme financial events to ever have occurred. Correlations matter and they change. A portfolio predicated on risk reduction using historical relationships is most at risk when correlations fail to do what you thought they would. The chart below is a portfolio of the total return of iShares MSCI Japan ETF (HEWJ) and the FTSE Japanese Government Bond Index since the beginning of 2020 (JAPAN 60/40), including the component parts. Think of this as a portfolio that delivers the perfect actual total returns of Japanese stocks and government bonds, rebalanced daily at no cost.

The orange flatline isn’t that exciting but when it comes to avoiding losses, it kinda is. Regardless of how unimpressive owning said orange line seems to be, its inclusion in this portfolio saved you a worse outcome, down 34% versus 20%. And remember, the thing is, no one knew at that time if things were going to get worse.

The important observations are:

1. Traditional Modern Portfolio Theory is flawed, but sometimes it works – couch surfing.

2. We do not know if that will continue.

3. Diversifying through asset class only, entails risks that may be unknown.

For these reasons, ICM diversifies across asset classes and investment strategy. Our asset allocation is driven by the systems we have built to determine trends in the four equity indexes we study. We have specific buy-and-hold allocations to the same global equity markets in our portfolios and other broad indexes. Trend following is time-dependant. Buy-and-hold is a base version of that in the realm of stocks. Active trend following is path dependant, thus it is a diversifier. Further, adding volatility strategies and active rebalancing of portfolio components is inherently counter-trend. Finally, our equity index signals are related to other assets and we can, and do, exploit those opportunities in fixed income duration adjustments. There is more than one way to diversify, and we use those that complement each other, while at the same time knowing that any one diversification strategy can let you down at some point.

TOKYO 2020

Spurious correlation is endemic in markets – the Super Bowl Effect, the Skirt Length Theory (which could be also known as the Fashion Theory), the Headline Indicator (although there is some good data suggesting this is a thing). So let’s go for it.

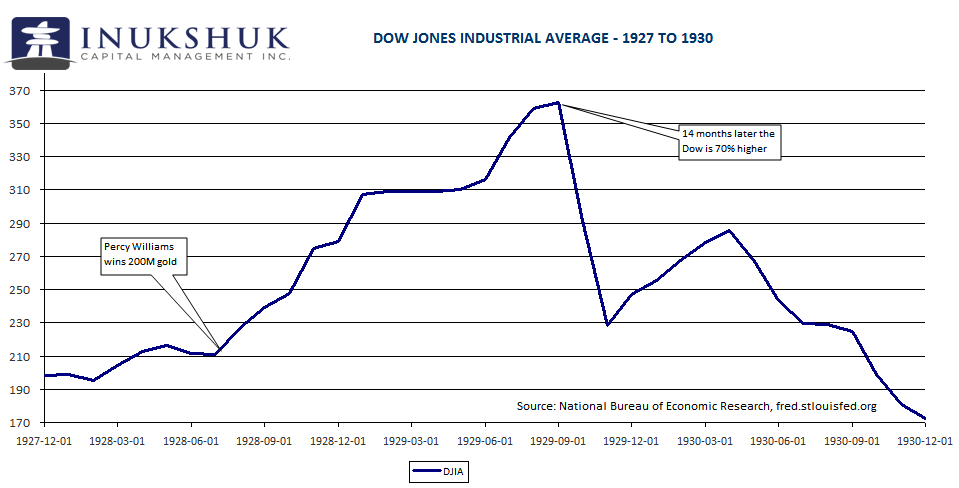

The last time a Canadian won a gold medal in the 200M sprint was in 1928. A 19-year-old kid from Vancouver, Percy Williams won that race, and the 100M.

As an aside, according to Wikipedia:

To earn his travel ticket for the trials, Williams and his volunteer coach, Bob Granger, worked as waiters and dishwashers in a dining car, and Vancouver track fans raised the money to pay Granger’s transatlantic ship passage to the 1928 Olympics.

Unfortunately, not much has changed on the funding front for our athletes.

The only other Canadian to have won the 200M sprint at the Olympics did it last week. Torontonian Andre De Grasse. He also earned bronze in both the 100M and 4×100 relay. After Percy won in 1928, you might’ve wanted to step up to the Dow Jones table to place a bet.

Hopefully, no one reading will think this is investment advice.

A YEAR OF FIRSTS

If you are a regular reader of this note, you might remember a note penned last year about a year of firsts. According to International Olympic Committee doctrine, this year’s Olympics are defined as ‘Tokyo 2020’. So, let’s check out some unique things Canadian athletes accomplished this year… the one that is 2021, but officially 2020.

- The Canadian Women’s Soccer Team earned gold. This has never been accomplished.

- Christine Sinclair (Burnaby) the captain of Canada’s team is now the highest goal-scorer of any soccer player, ever.

- In canoeing – the first time there has been a women’s Olympic event in this sport (this seems inconceivable, but it is a fact) Laurence Vincent Lapointe (Trois-Rivières) earned an individual silver and teamed up with Katie Vincent (Mississauga) to earn a bronze in the pairs.

- Penny Oleksiak (Toronto) now the most successful Canadian athlete in the history of the Olympic Games did not disappoint. The 21-year-old from Toronto added three more medals to her record-breaking tally. The last was a bronze with a fierce swim in the 4×100 medley. She now has 7 (1 gold, 2 silver, 4 bronze). Fearless might be her middle name.

No music this time. The picture above closely depicts our experience enjoying these amazing athletes’ achievements – a dock couch.

This tweet is from Penny.

Let us all try and be more like Penny.

HEALTH IS WEALTH

Athletes come in all shapes and sizes and the Olympics offers us an amazing opportunity to witness the best in the world at their sport. Their body types can determine what sports they excel at.

There are three body types (or somatotypes)—introduced by American psychologist and numismatis William H. Sheldon in the 1940s—and most of us fall into one, or a combination of the three.

- Ectomorphs—are long and lean. They have little fat and muscle. They also have a difficult time gaining weight. Ectomorphs dominate endurance sports.

Evan Dunfee- Ectomorph. Bronze medal 50KM race walk.

- Endomorphs—are heavier and rounder. They have lots of body fat and muscle. They gain weight easily. Endomorphs dominate power sports.

Maude Charon- Endomorph. Gold medal 64kg weight lifting.

- Mesomorphs—are athletic looking and solid. They are not over or under weight. They can gain and lose weight easily. Mesomorphs are good at most sports because they can lose or gain weight quickly.

Andre De Grasse – Mesomorph. Gold medal 200M sprint, Bronze medal 100M sprint and 4x100M relay.

Key components to physical fitness:

- muscular strength

- muscular endurance

- flexibility/mobility

- cardiovascular endurance

- body composition

Skills:

- speed

- agility

- balance

- power

- coordination.

Gymnastics offers an example of everything, as these elite athletes require every component and skill to compete, whereas marathon runners exhibit outstanding cardiovascular and muscular endurance.

An elite athlete’s training is based on performance. They literally eat, sleep, train, and repeat! Some of the athletes have very little body fat, while others need body fat.

For the rest of us, just trying to improve our quality of life with fitness, remember, being fit is not a ‘look’ and there is no ‘ideal body type.’

Just get moving!

‘To sustain it, you must maintain it.’

Victoria Bannister, ICM Health Ambassador

At Inukshuk Capital Management, we are firm believers in the connection between Health (physical, mental and spiritual) and Wealth.

Our ICM Health Ambassador is available to our clients for complimentary consultations. Contact us for more information.

Have a question? Contact us here.

Challenging the status quo of the Canadian investment industry.