Inukshuk Capital Management (ICM) is a multi-asset class, high-net-worth wealth management firm that challenges the status quo. We believe Exchange Traded Funds are the best way to build bespoke portfolios.

We are pleased to share our monthly newsletter which contains information on our ETF portfolios, as well as market commentary and other relevant news.

Stay up-to-date on the latest developments by following us on LinkedIn here.

JULY 2020 – RISK AS AN OPPORTUNITY

In this issue:

- The trends keep on keepin’ on

- Buy bonds, wear gold- or at least own it

- Income is getting hard to come by

- The investment world is starting to pay attention to ESG

- The analog we are about to stop tracking – maybe on new highs

- No dress rehearsal

THE TRENDS KEEP ON KEEPIN’ ON

Over the last two months Emerging Markets (EM) has been the best performing global index in our active asset allocation portfolios. We have been fully invested in EM since the end of May and we are now also fully invested in the TSX and continue to be long but underweight the S&P 500 and MSCI EAFE.

The S&P 500 is now up on the year, just below its all-time high. After a strong month across the board, all four indexes continue to push higher, seemingly beyond explanation in some people’s minds.

If you would like to stay current on our measures of trend and momentum in the markets we follow, please click here.

BUY BONDS, WEAR GOLD- OR AT LEAST OWN IT

We remain overweight long duration government bonds, physical gold and gold producers. On a year-to-date basis, these positions have been some of the best performing asset classes and we remain bullish on our barbell approach.

INCOME IS GETTING HARD TO COME BY

Last month we wrote about the global trend in lower government bond yields. On August 4th, 10-year Government of Canada bonds closed at a record low yield of 43 basis points. We expect this trend to continue and are positioned accordingly.

With interest rates this low, we have been doing extensive research on dividend paying ETFs that offer attractive yields for our clients who prefer equity exposure and dividend income in order to meet their financial goals. After weeks of correlation analysis and due diligence, we have built a portfolio of ETFs that is diversified geographically and across industry. The portfolio is constructed with a covered call writing overlay that has produced an outsized and stable income stream: we refer to it as our Enhanced Income Opportunities (EIO) portfolio.

As of Friday August 7th, the S&P/TSX60 as represented by the iShares S&P/TSX 60 Index ETF (XIU) yields 3.30% and the iShares S&P/TSX Composite High Dividend Index ETF (XEI) yields 5.21%. ICM’s EIO portfolio has a current yield of 7.62%.

The added yield is mostly attributed to the covered call-writing strategies. These strategies profit from the high price of volatility without taking increased company-specific risk to earn higher dividend income – the opportunity in the price of risk. We think the combination of ultra-low yields and historically high options premiums offers a very good risk-adjusted return opportunity for those looking for equity returns with enhanced dividend cash flow.

To learn more about the ICM Enhanced Income Opportunities portfolio, please contact us.

THE INVESTMENT WORLD IS STARTING TO PAY ATTENTION TO ESG

If it’s not already on your radar, ESG investing should be.

The emergence of ESG – environmental, social and governance – as a metric in investment analysis is evolving quickly. As individual investors and professional managers learn about what this means to them and the market, they are beginning to understand its growing importance to the investment process.

A few weeks ago Rosenberg Research referenced a Deutsche Bank meta-study from 2016 that showed, going back to 1970 there was a positive relationship between ESG factors and “corporate financial performance”: More importantly, the authors found that the relationship was stable over time, meaning that this is not just a fad or a recent ‘blip’ in the data, but rather a genuine trend.

Moreover, recent experience has shown that high ESG-rated companies have been able to avoid some damaging events that have hurt others. This has translated into better returns for their shareholders. More publicly-traded companies may realize they are better positioned for future challenges if they can avoid the pitfalls of environmental risks and reduce instances of corruption and fraud.

MSCI has developed an ESG rating system that might be compared to what credit rating agencies have been doing for years. Except, this is about developing rating scales to determine how well corporations comply with standards in each category of issues of concern. Companies are scored on their management process to mitigate these risks relative to their industry competitors. ESG ratings range from AAA (leader) to CCC (laggard).

In a recent survey published by the CFA Institute 76% of institutional investors and 69% of retail investors stated they have an interest in ESG but only 19% and 10% respectively, currently invest in this manner.

ESG investing is only going to grow from this point forward, as more investors take into account its importance to performance. The ability to reduce risk and increase potential for outperformance, while incorporating personal values, is now possible.

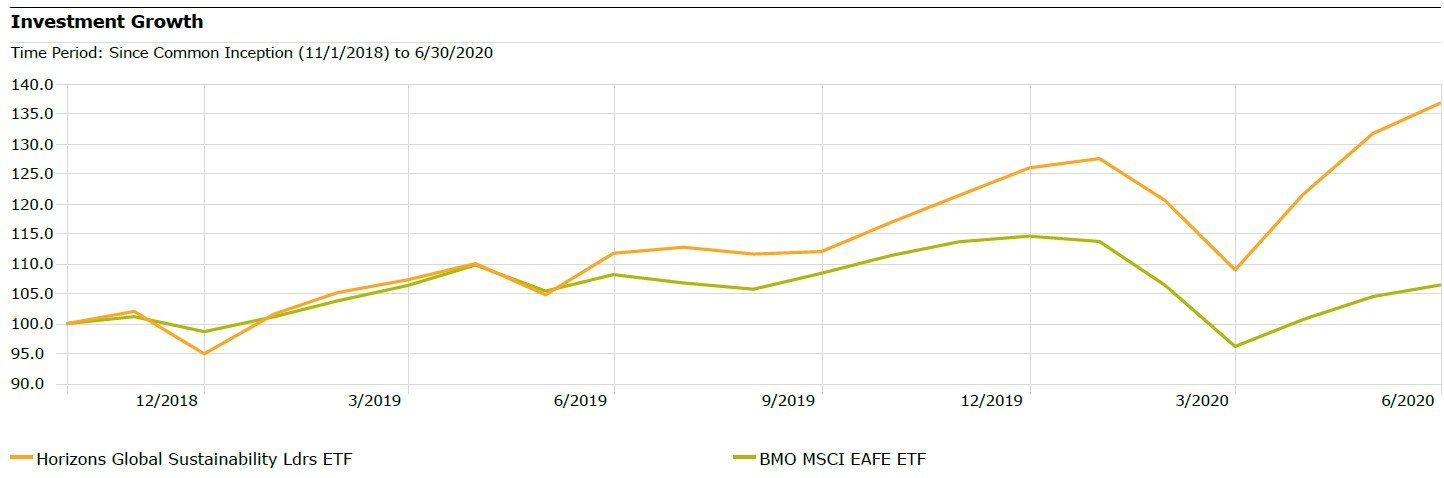

For example, over the past 18 months, the Horizons Global Sustainability Leaders Index (ETHI) has outperformed the BMO MSCI EAFE Index ETF (ZEA) significantly with less downside risk.

Source: Horizons ETFs

This is not meant to imply that investors can earn excess returns solely by implementing an ESG strategy, but there is a place for it as part of an equity allocation.

We believe ESG investing is something our clients should have the option to participate in. For this reason, we have spent a great deal of time researching the ESG opportunities available and speaking with industry leaders in order to provide a solution. This aligns with our client-focused values and we think a portfolio of high ESG-rated companies has the opportunity to outperform its lesser-rated competitors.

If you would like to discuss ways of making your portfolio more focused on ESG or learn more about this emerging practice, please contact us.

THE ANALOG WE ARE ABOUT TO STOP TRACKING- MAYBE ON NEW HIGHS

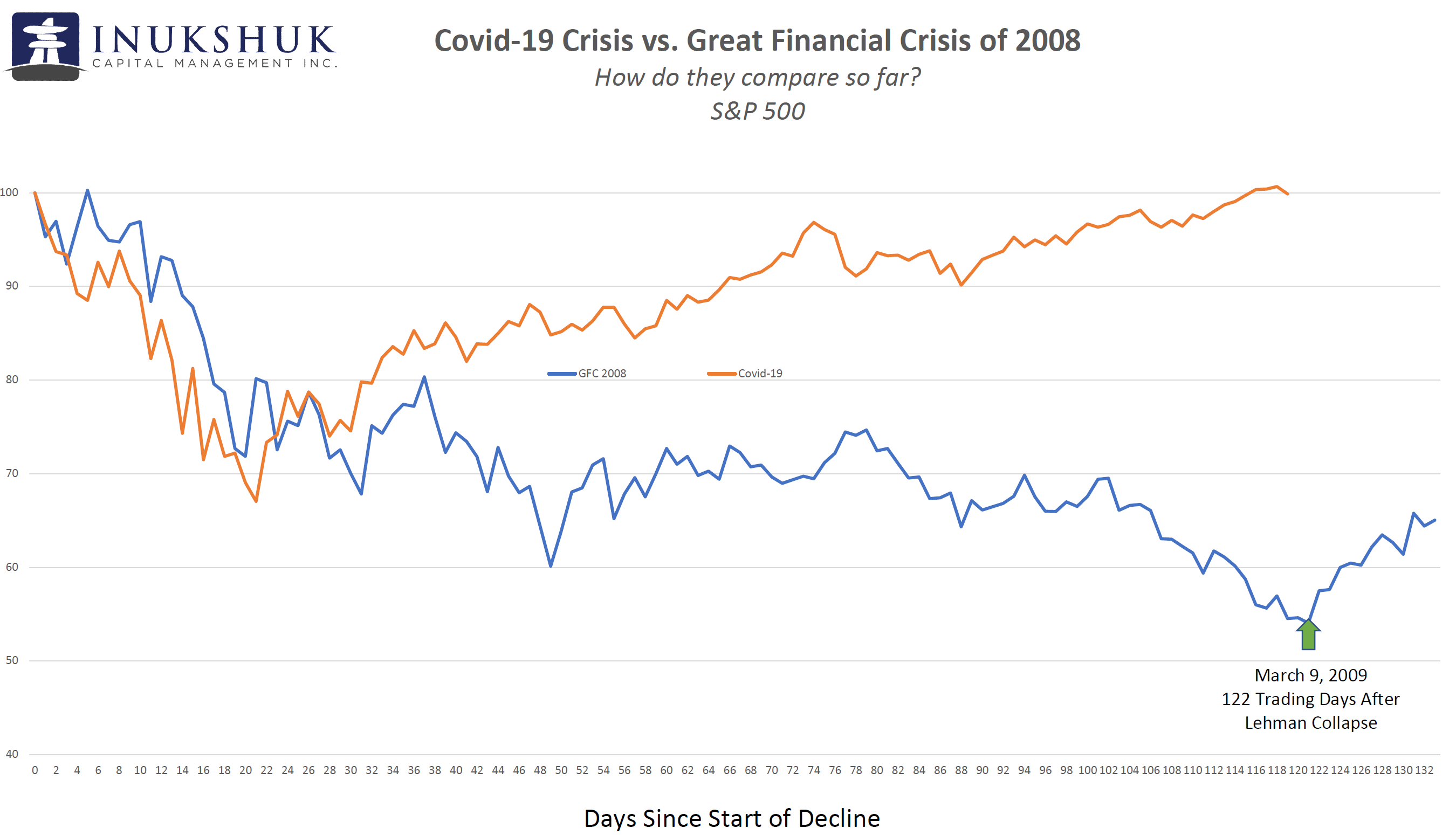

It was an interesting thought experiment, but now the S&P500 is up year-to-date and it is probably time to retire this analog. We think the important lesson here is: if global fiscal and monetary authorities work in unison, quickly and with force, the immediate negative consequences of an economic shock can be minimized. What we don’t know is – will it last?

NO DRESS REHEARSAL

This note started with a reference to trends that continue to persist. Some defy market observers’ beliefs in what ‘should’ happen in this environment of some of the worst economic outcomes since the Great Depression. Employment has collapsed along with economic activity, regardless of recent bounces in the statistics. At ICM we do not prognosticate about what the economy will do over the coming quarters or years. Rather, we spend our efforts trying to uncover opportunities with the potential to deliver attractive risk-adjusted returns for our clients.

There is no ‘dry run’ in the investment process. No rehearsal. What is available is data and the ability to use it to our clients’ advantage. We think we have found some good opportunities and will be investing in them. We know there are risks – there always are. We know the central banks around the world have ventured into a massive experiment that has no historical precedent. We do not know how it will turn out. No one does.

The important point here is: all of the things just mentioned are well known by all of the analysts, pundits, journalists and investment managers around the world. So rather than trying to play a game that is almost unwinnable – determining outcomes – our process is to use what we know to find ideas that have a good chance of being profitable. At the same time, we know there are things we don’t know that may harm these opportunities. That is why we have risk management strategies, because you do not know when the hornet will sting you.*

*The title of this section and the last sentence are paraphrased from a song by The Tragically Hip, “Ahead by a Century”

Have a question? Contact us here.

Inukshuk Capital Management actively and systematically manages asset allocation, using time-tested proprietary technology, to achieve financial longevity for our clients.