We built Inukshuk Capital Management to serve the needs of clients looking for a unique approach – void of conflicts of interest, commission sales and pushed products. We began by putting our own money where our mouth is. With low fees and active risk management, we help families achieve financial longevity, that’s the bottom line.

Stay up-to-date on the latest developments by following us on LinkedIn here.

July 2023: Burning Down the House

In this issue:

- Global Equity Market Performance

- Banking Basics

- Talking Banker

- Borrowing

- Burning

- Health is Wealth

GLOBAL EQUITY MARKET PERFORMANCE

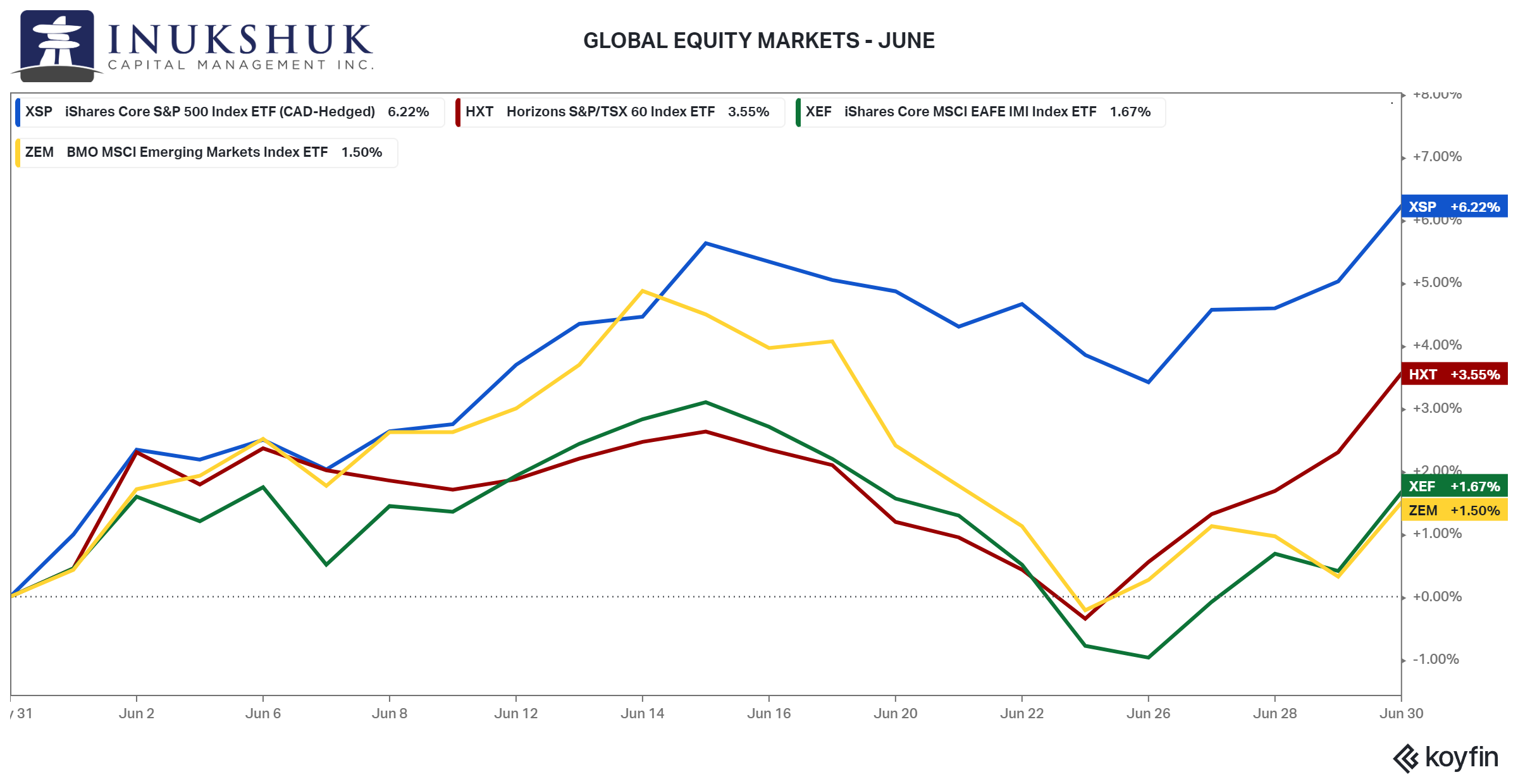

The S&P 500 had a strong June and led the pack for the second month in a row. The S&P/TSX60 had a decent rebound after closing lower in May and was up 3.5%. MSCI EAFE (Europe, Asia the Far East and Australasia and Emerging Markets) were both positive but continued to lag North America.

This outperformance can be attributed to six mega cap technology companies and a new arrival to the trillion dollar market cap club, NVIDIA. It is now up 189% on the year.

Our systems continue to remain fully long the S&P 500 and S&P/TSX60.

If you would like to stay current on our measures of trend and momentum in the markets we follow, please click here .

BANKING BASICS

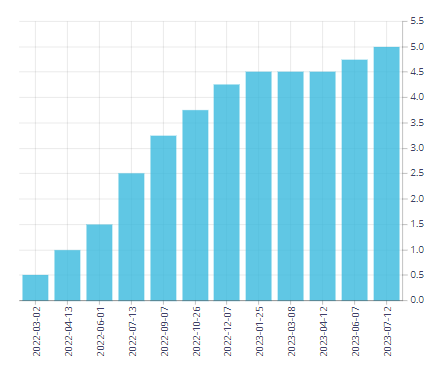

As this is being written the Bank of Canada increased their target policy rate 0.25%, for the second meeting in a row, to 5.0%. Three years ago it was 0.25%. The increases starting March 2022, eight meetings in a row, to 4.50% were the most rapid series of rate hikes in the Bank’s history.

Source: Bank of Canada

The explanations for these actions are multiple but centre on inflation. The mandate of the Bank is: We work to preserve the value of money by keeping inflation low and stable. By that, they mean they have a target of 2% for inflation. Three years ago inflation was below the target and now it is too high.

Inflation targeting as a central bank mandate is the subject of mountains of academic papers and debates. Non-academics might ask: why 2% and how does that preserve the value of money? Because there is no good answer for the 2% number and any inflation will not preserve the value of money. This monetary policy stuff is tricky, eh?

These policy decisions, amongst many others in the fiscal realm, directly affect Canadians’ lives. So let’s take a look at a bit of recent history and how we arrived here.

TALKING BANKER

There are two mechanisms the Bank can use to alter monetary conditions: the policy rate and asset purchases and sales, which both affect how much money is in the system. We will focus on the first here since its direct effects on humans are straightforward.

Surrounding the actual change in the interest rate are words central bankers use to tell a story to convince market actors to behave the way they want them to behave. The official parlance is: ‘forward guidance’.

In the summer of 2020 there was confusion as to how events may proceed. People had been locked down, rates had been cut and the Bank was buying the debt the federal government was issuing because they required money to spend to support the economy.

Tiff Macklem is the Governor of the Bank of Canada and in that role is the spokesperson for policy. Here is what he said almost exactly three years ago in the press conference after the Bank made the decision to hold the policy rate at 0.25%:

Our message to Canadians is that interest rates are very low and they’re going to be there for a long time… If you’ve got a mortgage or if you’re considering making a major purchase, or you’re a business and you’re considering making an investment, you can be confident rates will be low for a long time…

That is the definition of ‘forward guidance’.

Not too long after that, in March of 2022, the Bank doubled the policy rate to 0.50% and in the accompanying press release said: told ya so.

In January’s Monetary Policy Report, we told Canadians that the emergency monetary policy put in place to support the economy through the pandemic was no longer needed. We ended our exceptional forward guidance and signalled that a rising path for interest rates was on the horizon.

It’s not clear when central bankers turned into day-traders but by almost any definition a “long time’’ is not 17 months, unless you are eight years old. That could be more than two birthdays away. Further, most academics and central bankers (same club) acknowledge that monetary policy takes time to have its effect on the economy. No one knows how much time.

July 12, 2023, from the press release after the Bank hiked to 5.0%:

And we know many Canadians are asking: Is the Bank done raising interest rates, or will rates need to go higher still to relieve price pressures? The short answer is we will be taking each decision based on the information available at the time.

As I said, we are trying to balance the risks of over- and under-tightening. If new information suggests we need to do more, we are prepared to increase our policy rate further. But we don’t want to do more than we have to.

This could be translated to: we have no idea what we are doing, but please bear with us. Oh, and we are of the firm belief that the way to lower inflation is by increasing the cost of living.

Interest rates have not been this high since 2001 and the policy target rate is now 20 times higher than it was 17 months ago. Mortgage rates are significantly higher. Mortgage rates are determined by lenders based on what rate they can borrow in order to lend and make some money. And all of this is dependent on what the Bank of Canada does.

BORROWING

According to The Canadian Real Estate Association (CREA) the ‘benchmark price’ of a single family home in August 2020 was $618,400, up significantly from just months earlier. Let’s walk through a scenario based on the median Canadian household.

Say you had been locked down during the spring of 2020 and couldn’t get outside to buy a house that you had been saving for, for many years. Worried that due to skyrocketing prices you will never be able to own a home and encouraged by the promise of the governor of the Bank of Canada to keep rates low for a “long time”, you decide to enter the fray of the ‘busiest housing market ever’, according to the CREA at the time.

So you take your life savings to put 20% down on a house. That means you have to get a mortgage of around $500,000. Once again, following the sage wisdom and guidance of Macklem you find the lowest variable rate mortgage you can find. It turns out you can get approved for a mortgage from your local credit union at the low, low rate of 2.0%. Your monthly payments will only be $2,100 per month. It seems very affordable.

Note: we would like to thank our friends out west at Pro Financial Solutions, an asset-liability consultant to financial institutions, for providing mortgage data and calculations.

Fast forward to today. The rate on your mortgage is now 6.8%. Your new monthly payment is $3,500. That is an increase of 67%. You just saw a headline that said, according to Statistics Canada (StatsCan) the average price of a litre of gas in Canada has gone from 104.6 in August 2020 to 158.8 in May 2023, an increase of 52%. And to really pile on, they report that ‘food purchased from stores’ as defined in the Consumer Price Index is up 22% over the same time.

StatsCan calculates shelter, transportation and food are the three largest components of household spending at 29.3%, 18.5% and 14.9% respectively, for a total of 62.7% of a budget. To translate into dollars, the median after-tax income per household was, according to the latest data, $68,400. That means after the necessities of life you have $25,513.20 in after-tax income left over.

If we total up the percentage change in inflation on the top three budget items compared to three years ago the median household now has only $3,330.17 or 87% less than what they used to have. As a side note: it’s a nasty coincidence that the larger the budget expense category, the higher the increase in cost.

BURNING

From StatsCan February of this year:

In fall 2022, over one-third (35%) of Canadians reported that it was difficult for their household to meet its financial needs in the previous 12 months. When asked whether their household had the resources to cover an unexpected expense of $500, 26% said that they would be unable to do so…

Contrast this with what the Bank reported in its 2022 Annual Report:

Salary costs increased by $23 million (or 10%) due to new positions being filled for strategic initiatives as well as the annual compensation adjustment.

Note: “annual compensation adjustment” is bureaucratese for annual bonuses.

It’s not clear whether Tiff Macklem is a Talking Heads fan, but he’s doing his best to create a reality that imitates art.

Talking Heads, Burning Down the House

Hold tight

Wait ’til the party’s over

Hold tight

We’re in for nasty weather

There has got to be a way

Burning down the house

We’ve walked through the consequences of policy makers’ decisions on a theoretical Canadian household. The art above could be a metaphor for that – the terrifying beauty of nature. Over the past few weeks actual wildfires have hurt real Canadians. Our thoughts are with those who are suffering, on both counts.

HEALTH IS WEALTH

Aspartame: Dispelling Myths and Celebrating Safety in Your Favourite Foods and Drinks

In the world of food and beverages, few things have stirred up controversy and concerns like aspartame. Recently, claims of its alleged dangers have resurfaced, causing uncertainty among consumers. However, let’s delve into the scientific studies and discover the truth. Brace yourself for some fascinating facts and a journey through the world of food additives, where safety is the priority.

Aspartame is safe. Countless scientific studies, conducted by reputable organizations such as the U.S. Food and Drug Administration (FDA), the European Food Safety Authority (EFSA), and the World Health Organization (WHO), have consistently concluded that aspartame is safe for human consumption. So, what exactly does that mean?

To put things into perspective, let’s look at Diet Coke—one of the most popular beverages containing aspartame. To reach potentially dangerous levels of aspartame, an average adult would need to consume an astonishing number of Diet Cokes per day. In fact, you would have to drink around 21 cans of Diet Coke every day for the rest of your life to even approach the acceptable daily intake set by regulatory bodies.

While aspartame stands tall as a safe food additive, there have been instances in history where additives have proven to be toxic. One example is saccharin, a once-popular artificial sweetener that faced scrutiny due to potential health risks. However, subsequent research revealed that the concerns were based on specific laboratory animal reactions that did not translate to humans. As a result, saccharin is now recognized as safe for consumption.

Have you ever wondered how scientists discover some of the things that make it into our food? The vibrant red color of many foods and beverages, like strawberry-flavoured treats, was historically derived from crushed insects known as cochineal.

Imagine indulging in ice cream that glows in the dark! Well, thanks to bioluminescent proteins from jellyfish, some innovative ice cream makers have created a variety that emits a soft, ethereal glow under UV light. It’s a unique and visually stunning experience that brings a whole new level of excitement to your favourite frozen treat.

Thankfully, you won’t find insects on many ingredient lists anymore, although they are becoming a popular form of protein (powder).

Despite periodic controversy, Aspartame has stood the test of time and scientific examination. The overwhelming consensus among regulatory authorities affirms its safety for consumption. So, rest assured that your favourite foods and drinks containing aspartame need not be tossed out.

Cheers to the safety of aspartame and the fascinating world of food additives!

‘You have to sustain it, to maintain it’

Victoria Bannister

ICM Health Ambassador

Have a question? Contact us here

Challenging the status quo of the Canadian investment industry.