Inukshuk Capital Management (ICM) is a multi-asset class, high-net-worth wealth management firm. We help individuals and families achieve financial longevity by tailoring solutions that integrate their unique financial planning considerations with modern wealth management approaches designed to deliver superior returns while minimizing tax and fees.

We are pleased to share our monthly newsletter which contains information on our ETF portfolios, as well as market commentary and other relevant news.

Stay up-to-date on the latest developments by following us on LinkedIn here.

ICM’S SYSTEMATIC STRATEGIES DID THEIR JOB

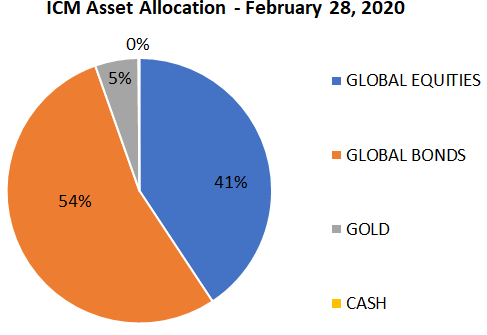

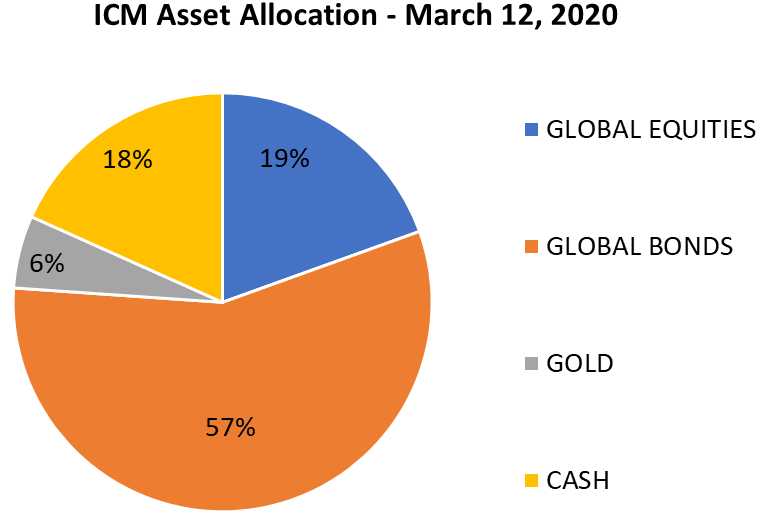

We are fortunate to have avoided much of the global carnage in stocks during the recent sell-off. Our active risk management strategies have protected our clients’ capital – our primary investment goal. Our systems started lightening up equity holdings at the end of January and have continued to sell over the past several weeks. This has taken our equity allocation down to 19% as of the close Thursday.

The last week of trading in February gave a hint as to what might happen in March. After notching another all-time high on February 19th, the S&P 500 fell off the ‘wall of worry’ and closed the month down almost 8%. This price action was very similar to January’s move, except more extreme. The late January collapse in Emerging Markets (EM) led to our first major sell signal, taking our EM allocation to zero by mid-February. After falling 6.2% to start the year, EM declined another 3.8% in February and is down another 16% after the first 9 trading days of March.

If you would like to stay current on our measures of trend and momentum in the markets we follow, please click here.

SOMETIMES EMERGING MARKETS ARE THE ‘CANARY’ – HERE WE GO AGAIN

Our EM strategies will sometimes give clues as to what might happen in the broader markets. This quarter is similar to what occurred prior to the late 2018 sell-off when Emerging Markets were the first to fall. By the end of November, 2018 our strategies were 100% cash. That December, the S&P 500 fell 15% by Christmas Eve.

In February of this year, a little over a week after sell signals took our EM position to zero, sell signals were triggered on the rest of our equity book.

For more information about systematic investing, please click here.

OTHER MARKETS, CENTRAL BANKS AND THE DOLLAR

Interest rates have moved dramatically since the end of February. A month ago the market was pricing a 30% chance the Federal Reserve would lower rates 50 basis points by the end of the year to a 1.00-1.25% target range. Last Tuesday, March 3rd the FOMC decided at an emergency meeting to do just that, immediately citing “…the coronavirus poses evolving risks to economic activity.” Interest rate markets are now betting on an even chance the Fed lowers rates a further 50 basis points by December. At the beginning of February, the 10-year Treasury yield had declined significantly to 1.60%. Over the past few days, that yield has plummeted as low as 0.40% and is now trading around 0.75%. It looks like the global trend to negative rates may be on its way to North America.

One day after the FOMC panicked, in a show of central banking independence, the Bank of Canada followed suit by cutting its policy target rate from 1.75% to 1.25%. The statement on the decision said, “…the COVID-19 virus is a material negative shock to the Canadian and global outlooks, and monetary and fiscal authorities are responding…” It’s almost as if the central bankers have a hotline to each other. The small chance of a 50 point cut by the end of the year became a reality and encouraged speculation rates would drop another 50 basis points by December. The lowest available 5-year fixed major bank mortgage rate has fallen 50 basis points from 2.84% earlier in February to 2.34% today, on a combination of the actual rate cut and the expectations of more. This may be a unique move by Canada’s major banks – matching a BOC cut.

The USD/CAD exchange rate has not been higher than 1.3660 since January 2019. The Canadian dollar has been worth around 75 US cents for more than a year. It is now trading at 1.3920. This could be a false breakout, but as we mentioned last month when markets consolidate for long periods of time, they can move surprisingly fast. And this move has been fast. The low in January was 1.2975 and today, March 13th it is trading at levels not seen since 2016. The 3-month BA rate (BA = Banker’s Acceptance, a key rate for Canadian financial products) has moved much lower to 1.41% from 1.82% a month ago. The 3-month LIBOR rate (London Interbank Offered Rate, one of the most important USD reference rates, globally) has fallen from 1.74% to 0.78%. The US dollar no longer enjoys a rate advantage over the Canadian dollar, but it seems this is not the primary focus in the foreign exchange market as the Loonie continues to trade lower.

Have a question? Contact us here.

Inukshuk Capital Management actively manages equity risk through our proprietary strategies which have shown to significantly reduce drawdowns, while outperforming their benchmarks over time.