We built Inukshuk Capital Management to serve the needs of clients looking for a unique approach – void of conflicts of interest, commission sales and pushed products. We began by putting our own money where our mouth is. With low fees and active risk management, we help families achieve financial longevity, that’s the bottom line.

Stay up-to-date on the latest developments by following us on LinkedIn here.

November 2022: Remember

In this issue:

- Global Equity Market Performance – October

- Stocks and Bonds

- Cash Flow

- The Latest Thing

- Remember

- Health is Wealth

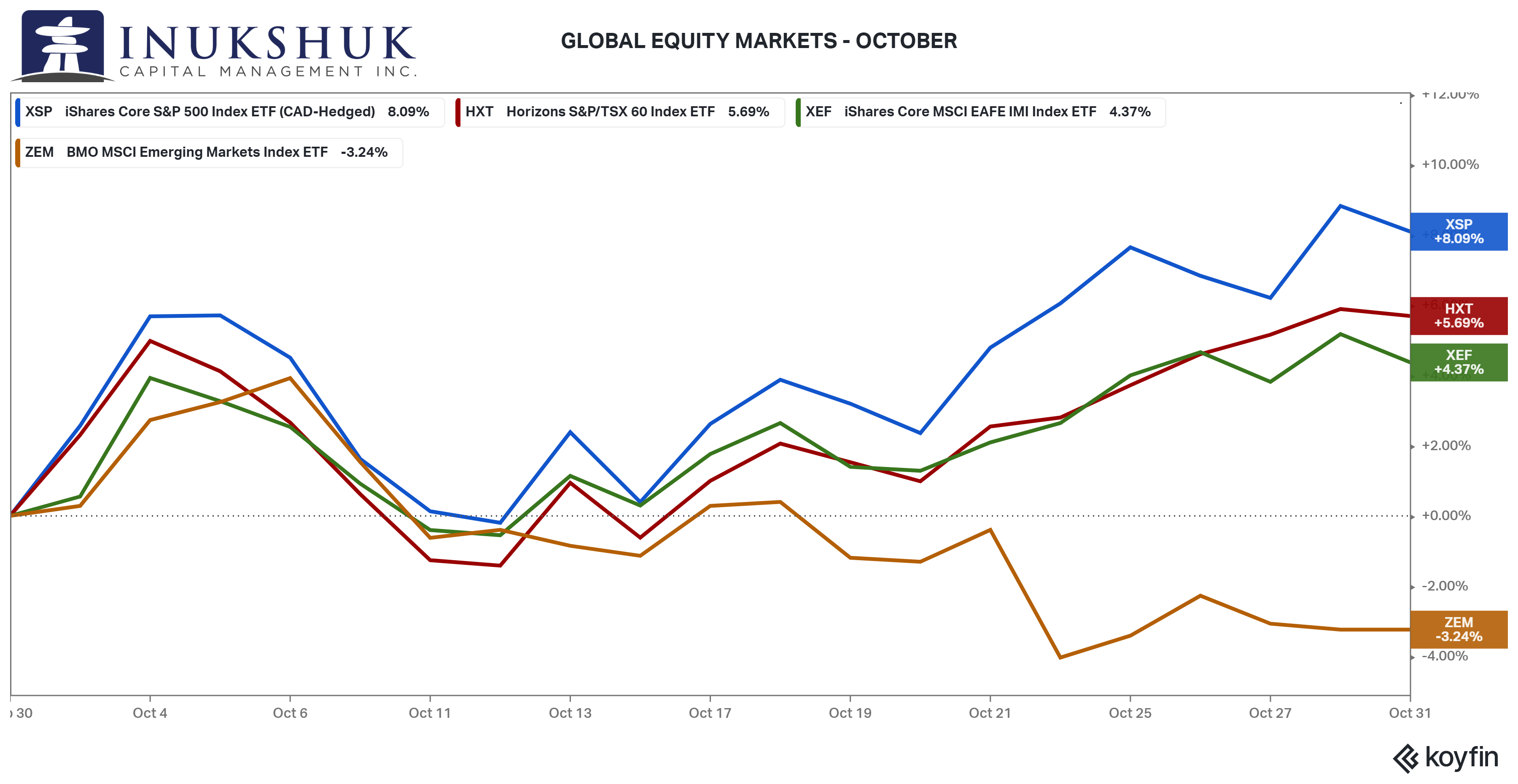

GLOBAL EQUITY MARKET PERFORMANCE – OCTOBER

Following one of the worst months in stock market history, October was a reprieve. Well, three outta four ain’t bad considering Emerging Markets are still dragging and ended down 3.2% after a dismal 7.3% loss in September.

The S&P 500 was up almost as much as it was down in September, on a percentage basis, but as we constantly remind people that doesn’t get you back to where you started. A 9.7% loss followed by an 8.1% gain still leaves you 2.6% in the hole. It’s math.

Our systems have shown some positive signals recently in the S&P/TSX60 and so far those are holding.

If you would like to stay current on our measures of trend and momentum in the markets we follow, please click here

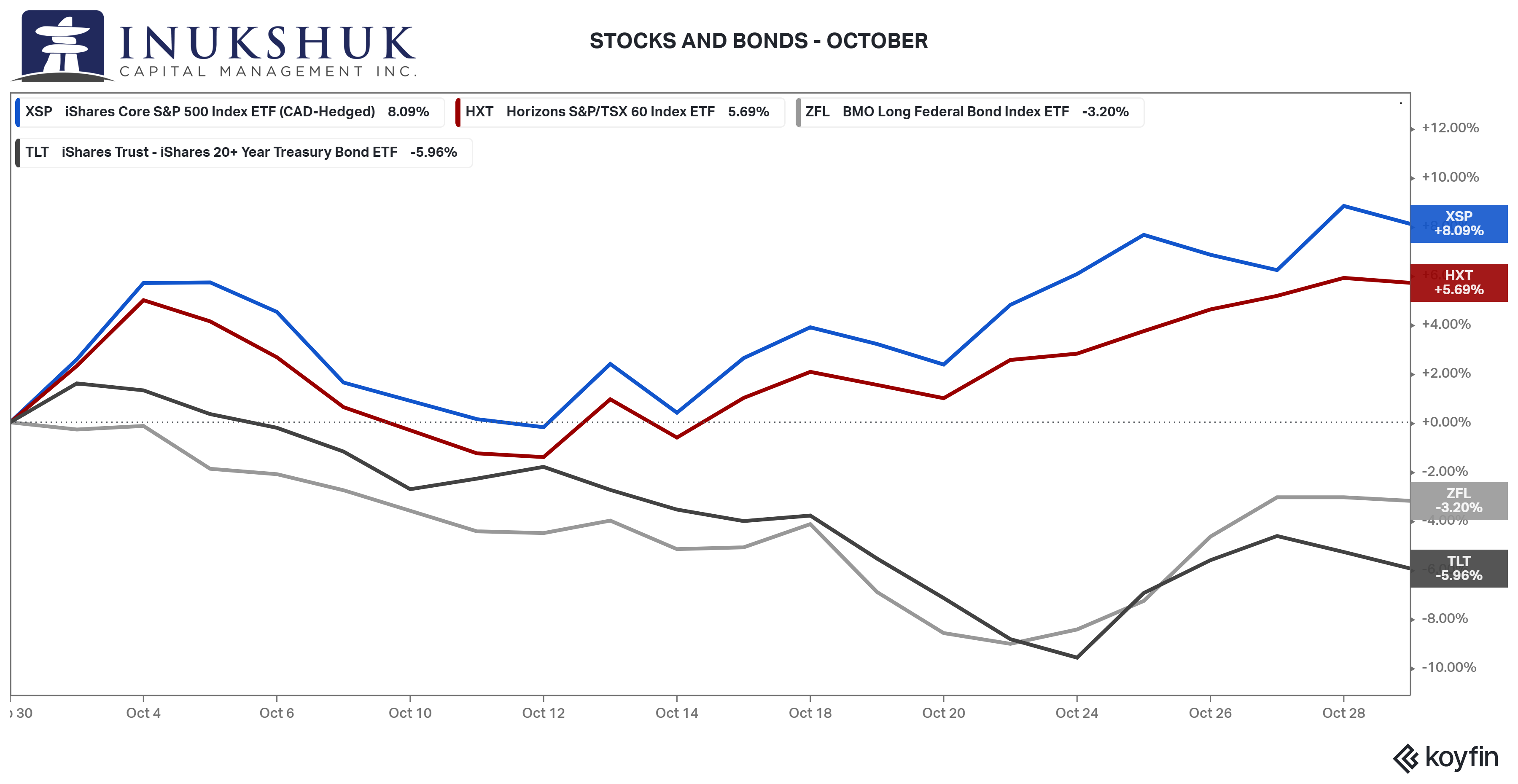

STOCKS AND BONDS

One of the frustrations of navigating a very difficult year in markets across all asset classes is the high positive correlation between stocks and bonds, which we highlighted last month. The classic ‘60/40’ portfolio has not been kind to conservative investors.

Let’s take a look at last month’s relative performance.

The upside from last month is there are hints that the positive correlation between the two asset classes might be eroding. The downside is bonds continue to disappoint. The concern is the total returns for government bonds are (running out of adjectives) terrible, if not the worst on record in any one year. Remember that math regarding the percent gains required to achieve a breakeven result?

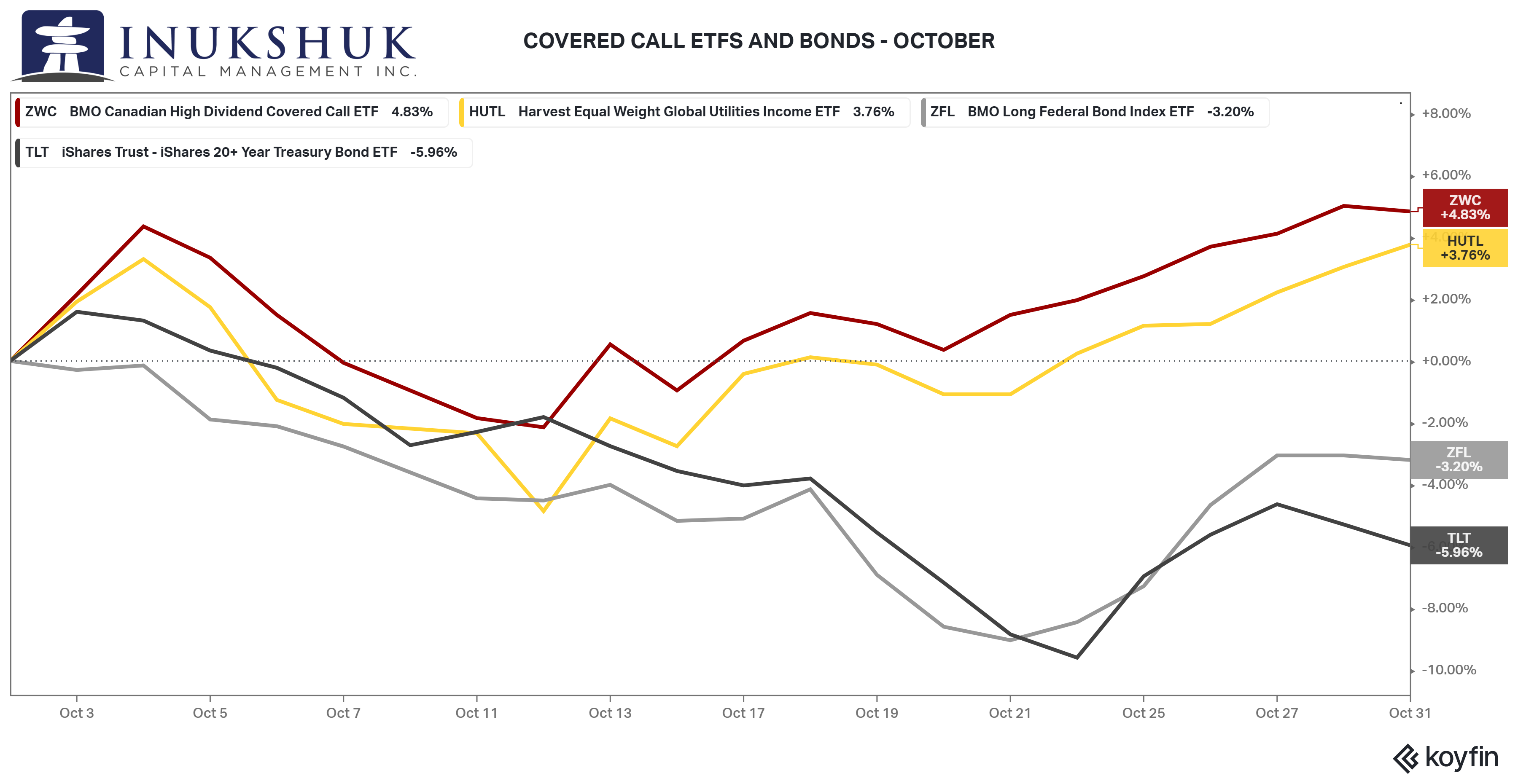

CASH FLOW

Over the past several months, we have reduced our exposure to longer-term bonds and increased our allocation to alternative markets and strategies that have low correlation to both fixed income and equities. We have no idea how long these historical relationships will be broken, so it’s a good time to do different things.

Some of the cash we have raised by selling long government bonds has been invested in alternatives and high cash-flow ETFs that hold quality stocks and sell calls on the underlying holdings – a covered call strategy. Our two primary holdings are Canadian large-cap stocks and global utilities. Let’s see if that was a good move relative to bonds.

It turns out it was a good call. But note, these are difficult markets and one month does not make a year. At some point this equation will flip and we are working on systematic strategies to adjust for that potential outcome.

A straightforward way to play the central bank rate hike cycle is in ETFs which pay interest that matches the target interest rate of the Bank of Canada or the Federal Reserve. After the Bank of Canada’s latest rate hike, these ETFs are yielding over 4.1% after fees. And the good thing is if central banks keep raising rates, the yield will match any increase.

THE LATEST THING

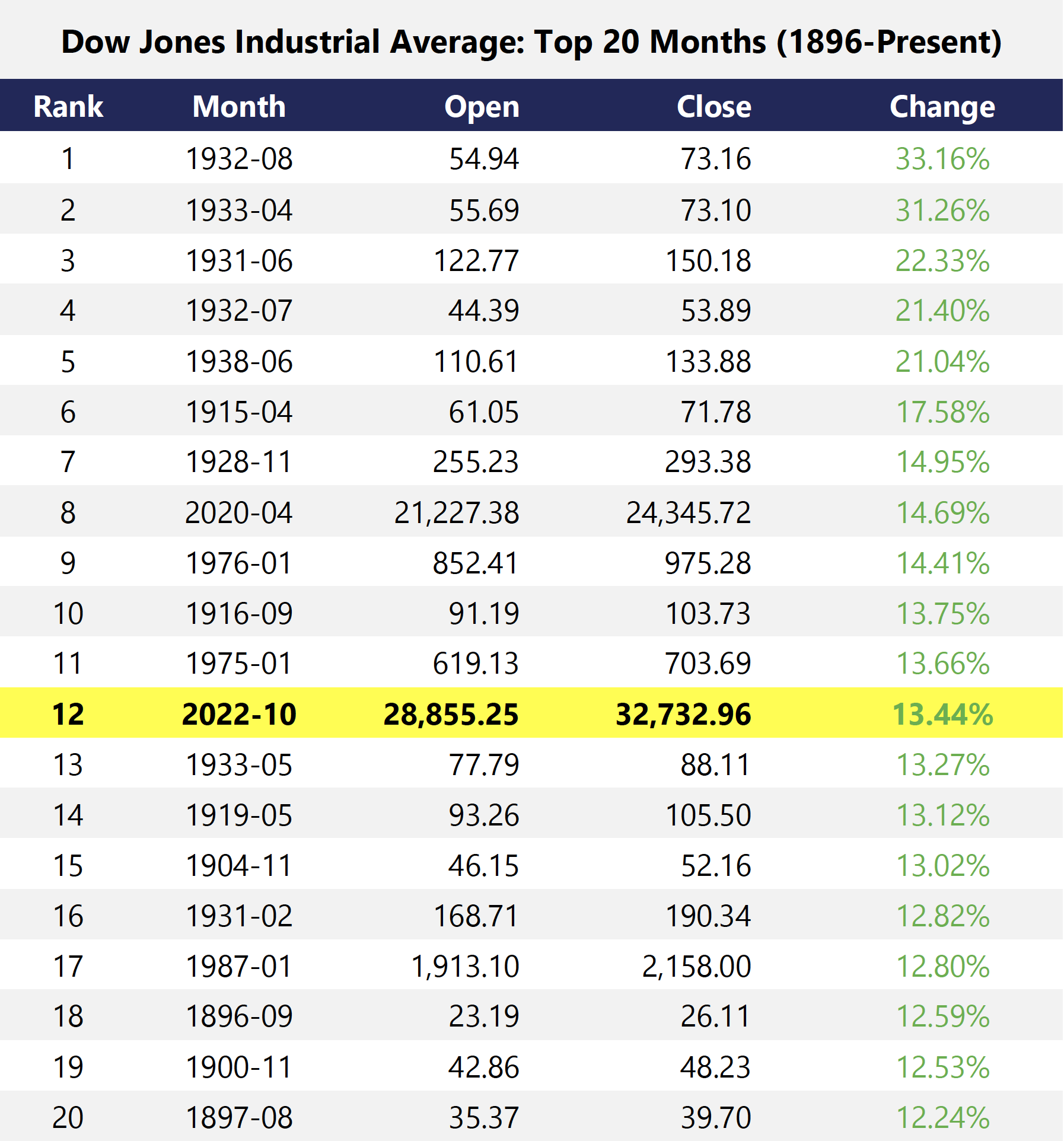

Recently, we’ve heard a lot of how well the Dow Jones Industrial Average has been doing relative to anything else. Let’s look into this a bit.

First, we need to define what the Dow is. It has been a measure of U.S. stock prices since its invention in 1896. It is an index comprised of 30 large capitalization stocks meant to represent the overall equity market in the U.S. In October, the index was up 14% versus the capitalization-weighted S&P 500’s return of 8%.

The odd thing about the Dow is that it is not an index weighted by the market capitalization of its component companies, but rather by the price of the stock. While the S&P 500 is weighted by what the market values the company at, the Dow is different. A stock that is priced higher than any other, after meeting the criteria to join the index, has a greater impact on the index’s performance than a lower priced stock.

There are five companies that comprise 35% of the Dow. UnitedHealth Group Incorporated represents 11% of the Dow. The next four are: Goldman Sachs Group Inc. (7.2%), Amgen Inc. (5.8%), Home Depot Inc. (5.8%) and McDonald’s Corporation (5.5%). This means almost 16% is in healthcare and 5.5% of it is where you ‘drive-thru’ on the way to Home Depot before or after you ‘enjoyed’ the experiences of the insurance and pharmaceutical industries. Though the Dow may correlate well with the S&P 500, it is highly concentrated in a few companies. To be polite, Goldman Sachs is its own asset class.

It’s important to remember that concentrated holdings of any one stock can lead to wonderful or terrible (once again, we’re out of adjectives this year) performance.

We do not play that game.

Just in from Bloomberg on Nov. 9, Amazon is the first company to ever lose ONE TRILLION DOLLARS in value from its peak.

That is roughly half of what it was worth a few months ago. In 2018, Apple was the first company to reach a one-trillion-dollar market capitalization. There is a joke in there, but none of this is funny for investors.

Back to the Dow – the great thing about the index is its historical data. For example, last month was one of its best performances, coming in at number 12, all time. Below are the top 20 months going back to 1896, ranked by performance.

Let’s flip it around twice and see the worst ranked months sorted by time.

Now, let’s visualize this using more data points by including the best and worst 5% of all returns.

|

Note the clusters of volatility. Clusters in returns are things studied by nerds like us. Machine learning, an application of artificial intelligence, also uses these ideas.

Big up months are associated with the worst months. Also note: the historical context of what was going on in the world at those times. Numbers don’t care about that, but if you’re old enough you know the personal stories and have probably studied history regardless of what you may have heard from your elders.

These are simply facts. Guess what you may. Our guess is things will remain volatile and our plan is prepared for what may come.

REMEMBER

Please take time today to think about what Canadians have done to ensure that we are able to enjoy living in one of the best countries in the world.

This is not a song, but a poem from a place where some of our ancestors fought, died and are buried. They did this for their family, friends and country.

It is uniquely Canadian.

In Flanders Fields

In Flanders fields the poppies blow

Between the crosses, row on row,

That mark our place; and in the sky

The larks, still bravely singing, fly

Scarce heard amid the guns below.

We are the Dead. Short days ago

We lived, felt dawn, saw sunset glow,

Loved and were loved, and now we lie

In Flanders fields.

Take up our quarrel with the foe:

To you from failing hands we throw

The torch; be yours to hold it high.

If ye break faith with us who die

We shall not sleep, though poppies grow

In Flanders fields.

John McCrae – 1872-1918

Never forget.

After today comes holiday season. Enjoy what you have and repent later. Victoria will help you with some of that.

HEALTH IS WEALTH

‘Tis the Season….to prepare

The holiday season is a time of celebration and can also be a time of excess. It is the time of year we do less exercise when we should be doing more.

How do we get through holiday season missing workouts and indulging in “treats” without putting on a few extra pounds? We prepare for it – that’s how!

A couple extra pounds that seem harmless, actually are – except for the fact that they can add up year after year. And, as we “grow-up’, they are simply more challenging to lose.

Here are some tips that I incorporate every holiday season.

1. If I can’t commit to my scheduled workout, a brisk walk with my family and dog is an acceptable alternative.

2. If I have an indulgent meal or a few extra treats, I manage a slight caloric deficit over the next couple of days. That way, I don’t even notice it.

3. A litre of water and a small serving of protein or fat (small piece of cheese and or a few nuts) prior to a meal satiates me. Then I’m less likely to go back for seconds.

With a little bit of preparation and planning, the holiday season does not have to be a set back to our health and wellness goals.

‘To sustain it, you must maintain it’

Victoria Bannister

ICM Health Ambassador

Have a question? Contact us here.

Challenging the status quo of the Canadian investment industry.