We built Inukshuk Capital Management to serve the needs of clients looking for a unique approach – void of conflicts of interest, commission sales and pushed products. We began by putting our own money where our mouth is. With low fees and active risk management, we help families achieve financial longevity, that’s the bottom line.

Stay up-to-date on the latest developments by following us on LinkedIn here.

September 2020 – IT’S OVER, TIME TO WAKE UP

In this issue:

- Fall

- Income Opportunities

- ESG – Trends and Bubbles

- Health is Wealth

FALL

“And all at once, summer collapsed into fall.” – Oscar Wilde

This year, the stock market has had all kinds of firsts, so many in fact that was the title of our last market note. It wouldn’t really be in the spirit of 2020 if things didn’t get a little normal for a brief moment as stocks sold off in September – something that is statistically ‘normal’ as summer collapses into fall.

The temperature drop in these parts led the pullback in stocks by a week or so. That is not a statistically quantifiable relationship. After rallying 15% from the beginning of summer to September, notching all-time highs along the way, the S&P 500 fell roughly 10% over the next three weeks. Despite this shakeout it’s still up over 8% on the year and hanging on to gains that continue to confound many investors.

The other three indexes we trade systematically have been lagging the S&P 500 since the March lows and after managing to get into positive territory for 2020, closed the month negative to flat. Our systems started reducing positions in EM and MSCI EAFE over the month. We are still long 80% allocations to the TSX and 100% to the S&P 500.

Perhaps Billie Joe Armstrong of Green Day was providing secret investment advice when he wrote Wake Me Up When September Ends. While that’s not close to being true – he’s more likely a Wilde fan than a student of financial markets – in retrospect considering the recent early October bounce in stocks, a month-long snooze would have been a good play, as most index losses have been erased.

If you would like to stay current on our measures of trend and momentum in the markets we follow, please click here.

INCOME OPPORTUNITIES

There is a global scarcity in yield. We have done extensive work into how to generate the income our investors require without taking unreasonable risks. Over the past few months we have begun to invest in our Enhanced Income Opportunities (ICM EIO) portfolio on behalf of our clients who seek income, with the potential for capital appreciation.

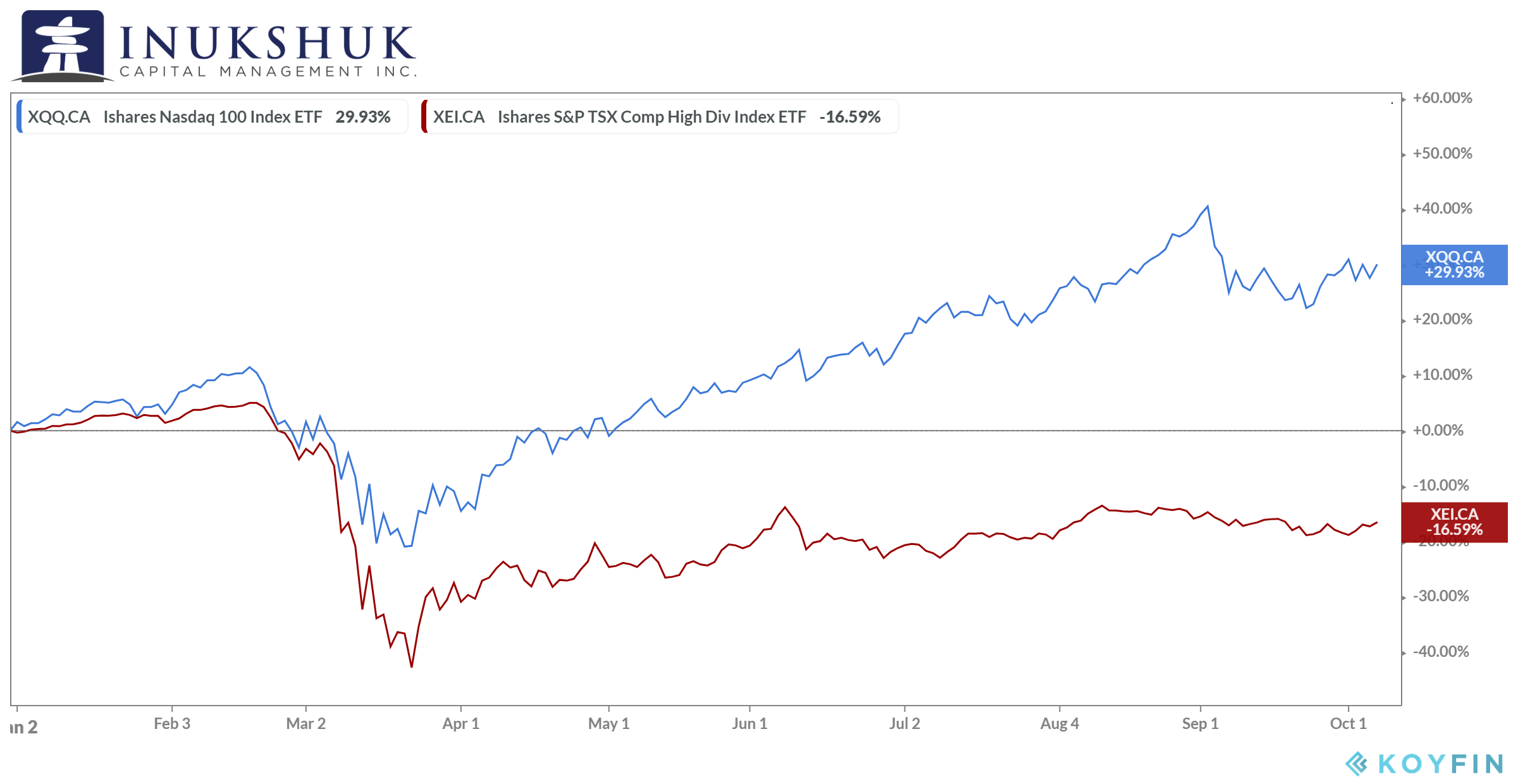

Low dividend-paying technology stocks like those found in the Nasdaq 100 Index have performed exceptionally well this year. Consistent dividend-paying ‘quality’ stocks are still in negative territory on the year. The following is not an analysis of the much talked-about value versus growth conundrum, but a deeper dive into the facts behind the decision-making in building the ICM EIO portfolio.

To get an idea of how two very different groups of stocks have performed this year let’s look at the Nasdaq 100. It yields 0.30% as measured by the most recent distribution of XQQ – iShares NASDAQ 100 Index ETF – and is up 36% on the year. XEI – iShares S&P/TSX Composite High Dividend Index ETF – is down 16% on the year and yields 5.30%. You can see this in the chart below.

Now let’s look at what the market is expecting for the future of S&P 500 dividends. This chart might need a little explaining. The dividend futures contract represents the dollar value of dividends S&P 500 companies are expected to pay by the end of 2021. It is up more than 54% from the lows. It is still not back to the highs but has stabilized since June. Stability in dividend expectations is supportive of this trade idea.

Now let’s look at what the market is expecting for the future of S&P 500 dividends. This chart might need a little explaining. The dividend futures contract represents the dollar value of dividends S&P 500 companies are expected to pay by the end of 2021. It is up more than 54% from the lows. It is still not back to the highs but has stabilized since June. Stability in dividend expectations is supportive of this trade idea.

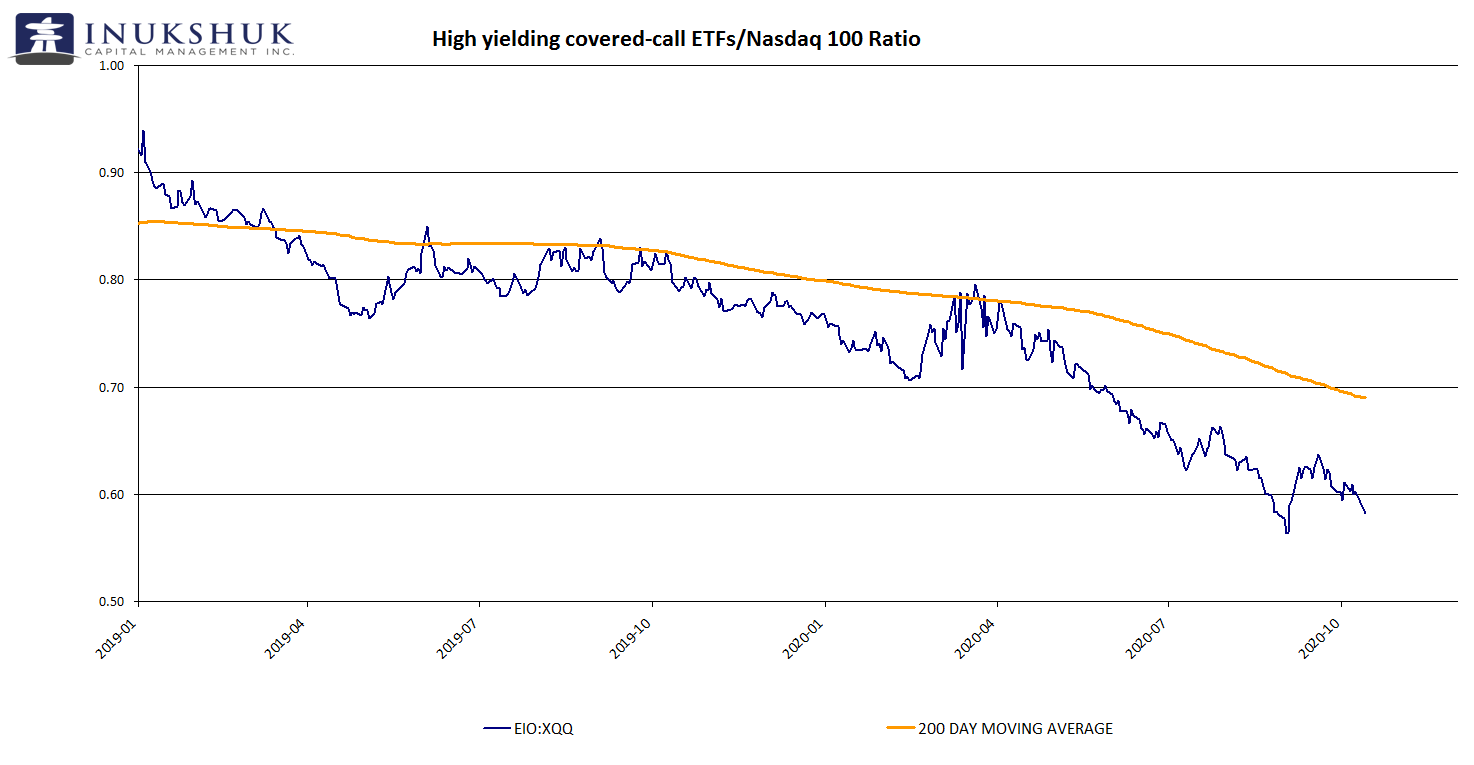

We do extensive research in order to find ideas that complement our strategies. This particular income thesis is about a ‘reversion to the mean’. This chart is the relative performance of high yielding covered-call ETFs versus the Nasdaq 100 ETF, XQQ. We have been tracking this ratio and believe, as illustrated in the chart below, a mean reversion trade now plays in our favour more so than in the past.

We do extensive research in order to find ideas that complement our strategies. This particular income thesis is about a ‘reversion to the mean’. This chart is the relative performance of high yielding covered-call ETFs versus the Nasdaq 100 ETF, XQQ. We have been tracking this ratio and believe, as illustrated in the chart below, a mean reversion trade now plays in our favour more so than in the past.

As you can see, the 200-day moving average of the ratio is 12% higher than the ratio today and the ratio itself has fallen significantly. In other words, the ratio has deviated quite a distance from its mean. If this trend reverts to its mean our clients’ capital will appreciate. In the meantime, if this is a base but takes a while to resolve higher (or stays flat) then investors get paid more than 7% to be patient. In this environment of yield scarcity, that seems like a reasonable proposition. We see opportunity in both our EIO portfolio and large-cap tech stocks. They have a low correlation to one another, represent different sectors of the economy and are diversified in terms of strategy. This trade has many moving parts. Combined with our systematic risk management strategy, we are comfortable that it represents a good risk-adjusted return expectation for our clients.

As you can see, the 200-day moving average of the ratio is 12% higher than the ratio today and the ratio itself has fallen significantly. In other words, the ratio has deviated quite a distance from its mean. If this trend reverts to its mean our clients’ capital will appreciate. In the meantime, if this is a base but takes a while to resolve higher (or stays flat) then investors get paid more than 7% to be patient. In this environment of yield scarcity, that seems like a reasonable proposition. We see opportunity in both our EIO portfolio and large-cap tech stocks. They have a low correlation to one another, represent different sectors of the economy and are diversified in terms of strategy. This trade has many moving parts. Combined with our systematic risk management strategy, we are comfortable that it represents a good risk-adjusted return expectation for our clients.

ESG BUBBLING ?

Depending on the source, there have been inflows of at least USD 20 billion in the US alone into ESG-themed ETFs this year. Blackrock, the provider of iShares ETFs, reported that in the first half of 2020 they alone received USD 11 billion. This was more than double all the flows of 2019 and a record high – a trend with some force behind it.

According to the Economist, 58% of all companies in the S&P 500 publish a sustainability report up from 37% in 2011. The four big global accounting firms are now stepping into the market in attempt to simplify the accounting standards for corporations and investors. It is a bit of a wild-west environment in the reporting world with more than 1700 different regulations and standards of which 360 are accounting-related. An explosion in acronyms of this magnitude has not been seen since Bill James’ SABRmetrics hit the world of baseball in the late 1970s.

As an aside, if you haven’t read Michael Lewis’ Moneyball try to or at least watch the movie. It’s about Billy Beane, Oakland A’s manager and one of the first adopters of SABRmetrics in the early 2000s. Fun fact: the legendary John Henry, who made his billions as a systematic trader, owns the Red Sox. He hired Bill James and tried to hire Beane after learning the manager was using systematic processes to find ballplayers for his low-budget team.

Back to real money: considering the amount of interest, money and confusion in the ESG world, we are cognizant of the risks to this investment style. A recent opinion piece in Bloomberg by Jared Dillion pointed out some similarities to previous investment fads. He makes some good historical observations and our experience in this business is long-enough to have lived through many of them. ESG is definitely trending as an investment approach but we do have to consider the possibility that ESG investing may be showing signs of an early stage bubble. Not all trends become bubbles and usually once the bubble-talk starts it’s almost impossible to know when it will end.

We have done significant research and have built an ESG portfolio for our clients who are so inclined. ESG investing is going to grow from this point forward, as more investors take into account its importance to performance. Our research shows that the consequences to investors who hold stock in companies who seriously breach ESG standards can be severe. The ability to reduce risk and increase potential for outperformance, while incorporating personal values, is now possible.

If you would like to discuss ways of making your portfolio more focused on ESG or learn more about this emerging practice, please contact us.

HEALTH IS WEALTH

At Inukshuk Capital Management, we are firm believers in the connection between Health (physical, mental and spiritual) and Wealth.

If you would like to receive invitations to our complimentary, and for the foreseeable future, ‘virtual’ Health is Wealth events, please click here to join our Health is Wealth mailing list.

Have a question? Contact us here.

Challenging the status quo of the Canadian investment industry.