Paul Nabuurs

Instagram:@nabuursart

We built Inukshuk Capital Management to serve the needs of clients looking for a unique approach – void of conflicts of interest, commission sales and pushed products. We began by putting our own money where our mouth is. With low fees and active risk management, we help families achieve financial longevity, that’s the bottom line.

Stay up-to-date on the latest developments by following us on LinkedIn here.

September 2021- Money Money Money

In this issue:

- Global Equity Markets

- Modern Monetary Theory

- Storytelling

- Health is Wealth

GLOBAL EQUITY MARKETS

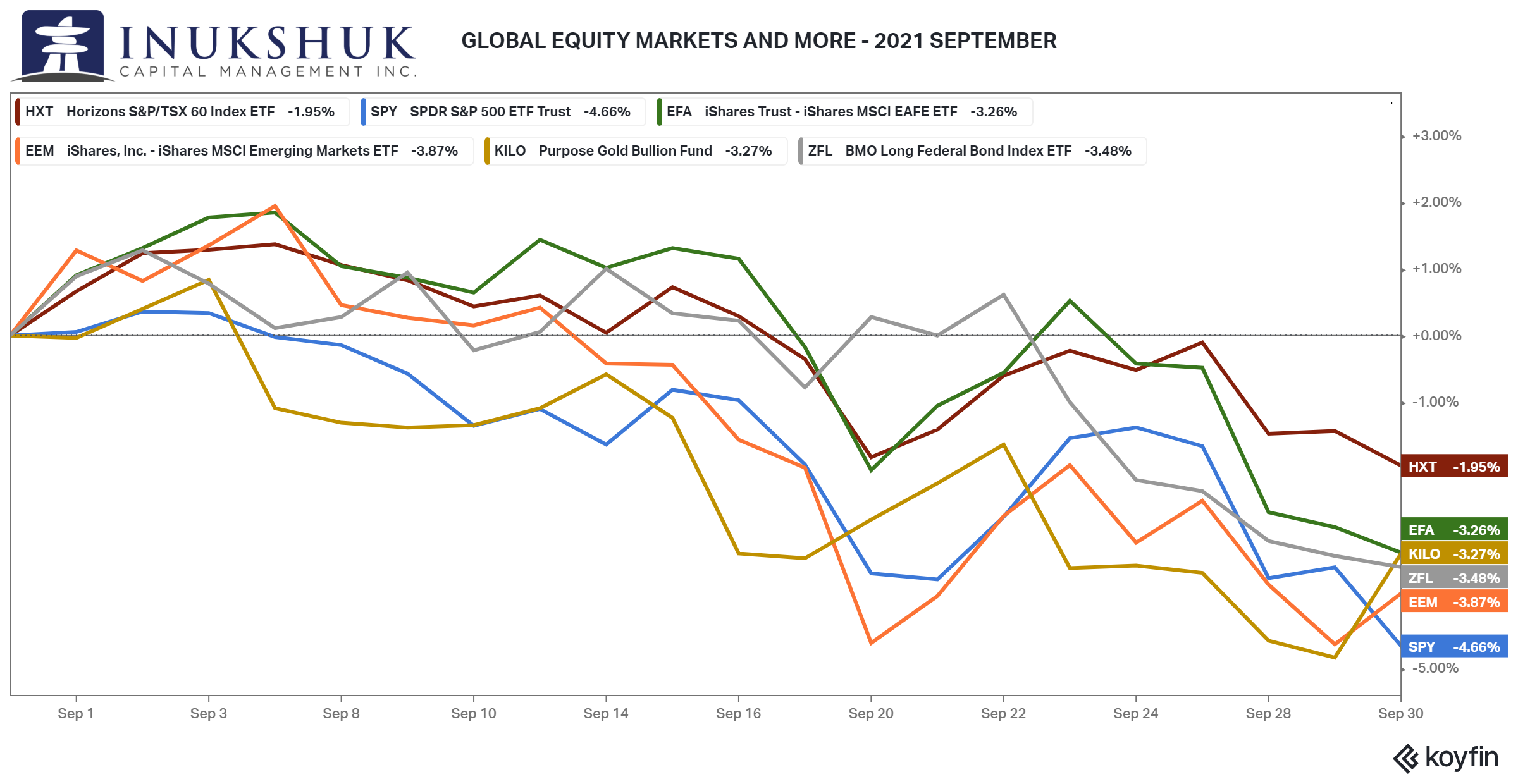

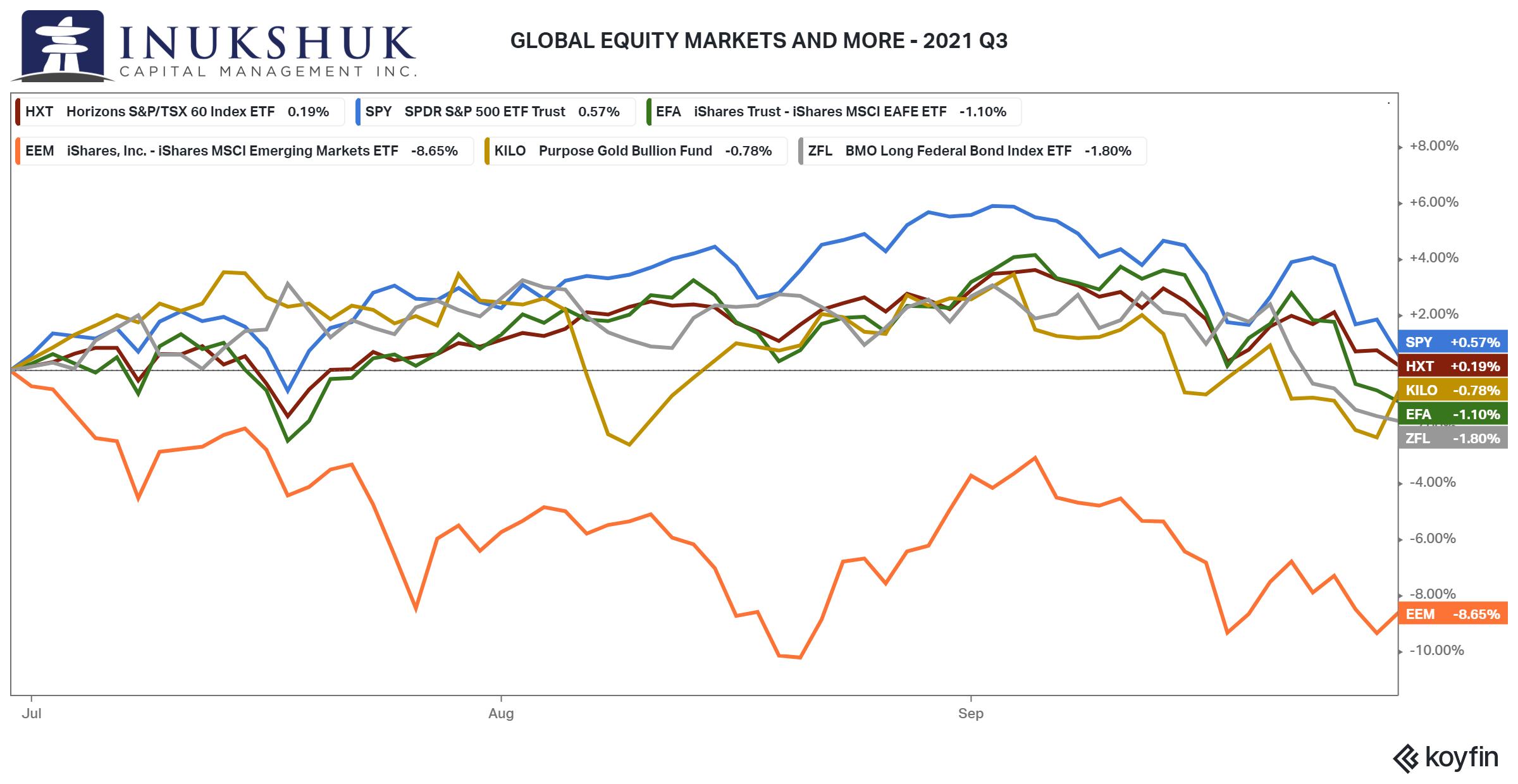

Since it is the end of the third quarter of the year, let’s review how various markets have performed in three different timeframes. These charts represent the four primary equity indexes we trade actively, plus a gold and bond ETF.

September was not kind to any major asset class. The S&P/TSX 60 was the ‘winner’ because it only fell 1.9%. Every other market, along with bonds and gold, lost 3 to 4%.

In fact, the widespread selloff across all of these markets wiped out almost all gains made over the prior two months.

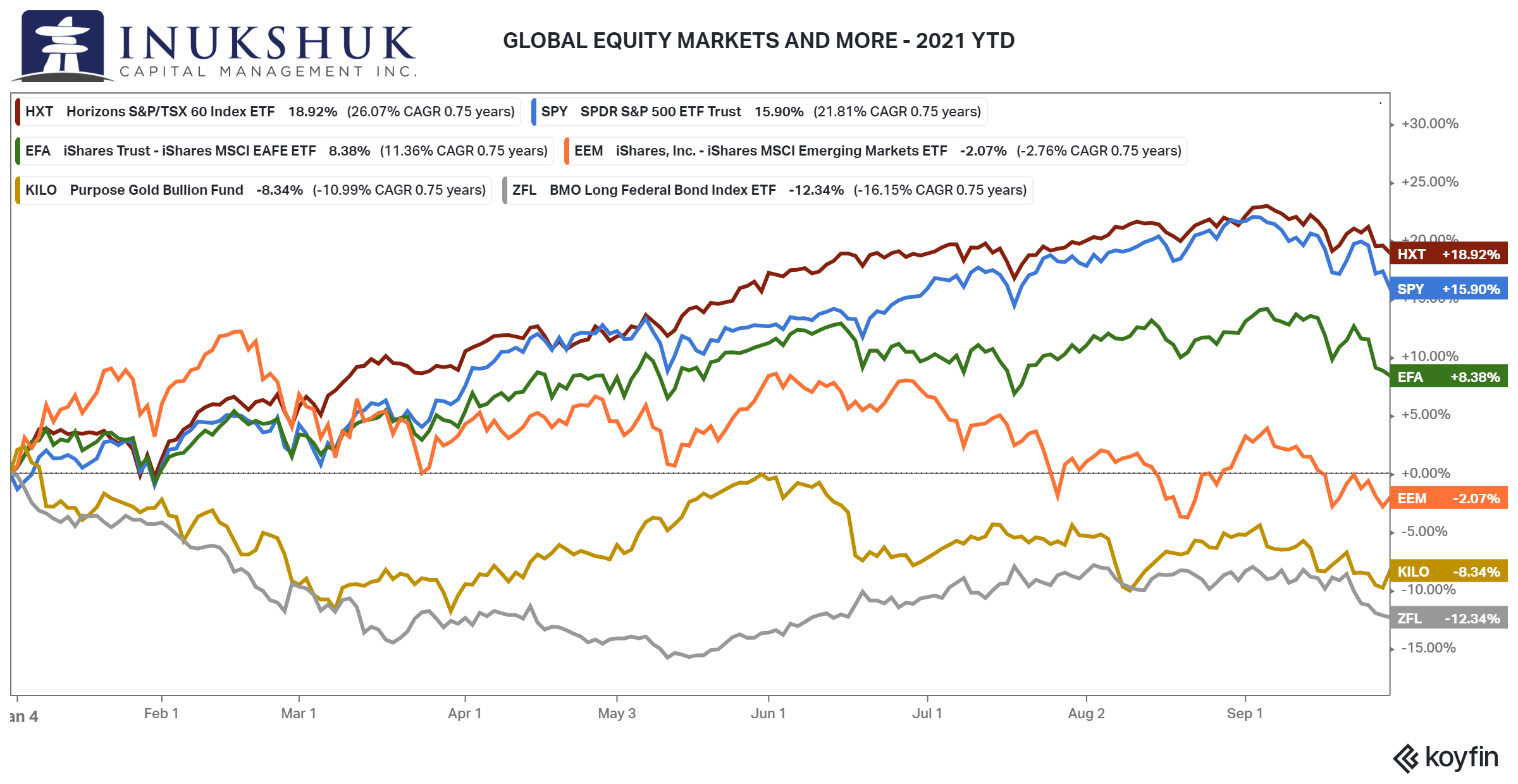

For further reference, here are the year-to-date returns.

First: if you look at the three charts above, the relative losers keep losing versus the relative winners – across the three timeframes. That is evidence of trends. Something we are very familiar with. Second: diversification across asset classes can and will fail investors at times. That is something we wrote about a couple of months ago: A portfolio predicated on risk reduction using historical relationships is most at risk when correlations fail to do what you thought they would.

Regardless of whether you diversify across asset classes that have low historical correlations, once in a while everyone is going to lose. We diversify across strategies, as pointed out in that note, so our portfolios were underweight equities, but there was literally nowhere to hide. The good news – that was one month. The bad news – we don’t know if this will become a regular thing.

Our strategies have avoided some fairly serious and rapid wipeouts and, over time, have reduced risk to capital. The systems that drive our asset allocation are still very cautious. We are flat emerging markets and MSCI EAFE (Europe Australasia and the Far East), slightly underweight the S&P 500, and 100% long the S&P/TSX 60.

If you would like to stay current on our measures of trend and momentum in the markets we follow, please click here

MODERN MONETARY THEORY

A reader requested a bit on Modern Monetary Theory (MMT) – yes, we take requests. We’re here all week – try the veal. If you haven’t heard of MMT yet, lucky you, but the guess around here is that you will hear more about it soon. The reason being: Canada and the United States have been spending much more than they receive in tax revenue. That means massive deficits and growth in total debt. So cue those who believe that this is not a problem. The eternal search for free money continues.

MMT is a somewhat convoluted explanation of how monetary and fiscal policies interact and the role money plays in the economy. Sounds like a barn-burner, eh? Here is a very brief summary of the primary macroeconomic theories that dominate these discussions.

Keynesian Interpretation

English Economist John Maynard Keynes developed his theories of how economies work prior to and during the Great Depression. He published the highly influential book, The General Theory of Employment, Interest, and Money in 1936. This became the foundation of the economic theory known as Keynesian Economics.

The basic theory on the fiscal policy side is – governments tax economic activity and then spend the revenue on goods and services they believe are important. When the economy slows down, they should spend more than they receive, also known as deficit spending, to support economic growth. This is financed by issuing debt.

On the monetary policy side, an ‘independent’ central bank manages the money supply in order to achieve some kind of stability between inflation and economic growth and thus, employment. This has evolved to target an annual consumer inflation rate (2% in the case of the Bank of Canada), while supporting growth in employment via economic expansion. It’s sort of a ‘not too hot, not too cold’ balancing act. Both fiscal and monetary policy should find an equilibrium that supports ‘full employment’ balanced against a reasonable rate of consumer price inflation.

Monetarism

By studying the economic history of the United States, Milton Friedman and Anna Schwartz published their theories in 1963 in a book titled: A Monetary History of the United States, 1867–1960. The most succinct description of these theories, quoted from the book, is: Inflation is always and everywhere a monetary phenomenon. What this means is instead of pulling the levers of government spending to try and achieve equilibrium between employment and inflation, central banks should focus only on the growth of the money supply, in order to achieve the goal of consumer price stability. Everything else will follow. The reasoning: it’s all about the money.

Neither of the above two theories are contradictory. In fact, Friedman accepted Keynesian theory but thought that fiscal policy was not the correct tool to encourage growth in national output and stable prices. These debates never end, but essentially the focus of one school of thought and all of its sub-branches differs in what is considered important – government spending or the growth rate of the supply of money.

Modern Monetary Theory

It seems that MMT originated from a loose collection of individuals who think that everyone has it wrong. There doesn’t appear to be a specific paper that developed the theory similar to what is outlined above. However, a book written by Stephanie Kelton, an economics professor at Stony Brook University, titled: The Deficit Myth: Modern Monetary Theory and the Birth of the People’s Economy, was published in 2020. Note: Kelton served as an advisor to the Bernie Sanders’ 2016 presidential campaign. A guess: someone told Canada’s prime minister about it.

Another vocal and financial supporter of MMT is Warren Mosler, who has a background in economics and made his fortune on Wall Street. Here is a quote from a recent interview published on YouTube.

The government has to spend first before the funds are there to pay taxes or to buy bonds. So instead of the government needing the economy’s money to be able to spend, it’s the other way around.

Source: Reinvent Money 2021.07.27 https://www.youtube.com/watch?v=-P7ZaeeKnP8

This seems like a different description of what is currently happening, rather than a policy theory. Remember, this is in the context of a developed economy that issues its own currency. It wouldn’t apply to a European Union nation, or any other country that has no control over its monetary policy – as in developing nations which rely on U.S. dollar debt.

Here are some highlights of MMT ideas:

- The government has a monopoly on money

- Money exists to pay taxes, so the demand for a nation’s currency is dependent on taxation

- Governments spend money into existence

- There is no real constraint on what a government can spend because they can print currency

- If there is too much money in the system when the economy is thriving, that could cause consumer price inflation

- Governments can control inflation by taxing more, thereby reducing the quantity of money in the economy

- Full employment should be guaranteed by the government, along with full healthcare benefits

That’s a brief summary of what we consider the important points of the theory. The following are some thoughts on what this actually means. Please keep in mind, Inukshuk does not employ a resident economist. Further, none of the above mentioned are dummies. And some had and have some street smarts. Also, it is difficult to determine how this is nothing other than a description and support of what central banks are doing – buying their government’s bonds to finance spending.

Mystery Money Theatre (apologies to Count Floyd, SCTV)

First off, the branding of ‘Modern’ is somewhat misleading. Many of the ideas of MMT are not new and use Keynesian and Monetarist frameworks, while sharing the ideas of Adam Smith. Also, history shows governments have a long-standing tradition of debasing a nation’s currency in order to spend more than they have. A well documented example is the Roman Empire that issued the denarius starting around 211 B.C. This was supposed to be a fixed amount of fine silver. It lasted as a means of exchange for more than 400 years, but in the end was a shell of its former self, as the silver was slowly replaced by cheaper metals.

Fun facts: It’s interesting how current language evolves from ancient times and how these origins are forgotten. Some might remember a cool name for money when they were younger: dineros. See above. Another is clams (= money) and having to ‘shell out’ when you had to pay someone cash. The origins of those expressions are Wampum, the currency of native north-eastern North Americans, which were made of beads fashioned from clam shells and tied together into intricate patterns.

This leads to the first two points of MMT mentioned above. The current system of money in the United States was launched in 1971, when the gold standard was cancelled. Simply put: no one could go to the gold window of the Federal Reserve and demand physical gold for paper dollars. This is not that long ago in historical terms. The ideas of MMT, while old, are basing this analysis on some very recent experience. Money was not always centralized by government. But, if the only currency defined as money by a government is what they print, there is certainly going to be a demand because the IRS won’t accept Wampum, just dollars. In this case, MMT is not incorrect.

Further, MMT is simply describing the fact that a sovereign can issue as much debt as they want and never default, because they are the monopolists on printing the paper that can pay debt holders. But regardless of whether consumer price inflation is generated by excess deficit spending and/or easy money policies that increase the supply of money, eventually you end up in the same spot. And that spot, historically, is a lack of trust in the currency the government is printing. It’s different this time is not a good argument.

To address the second last point regarding taxation as a means to control the money supply, any of the above frameworks require a system of government control to pull and tweak policy levers, whether it is fiscal or monetary, to create desired outcomes. In MMT terms, embedded in the policy mechanism is the idea that government bureaucrats will know when to implement tax increases and how long it will take to impact price inflation. There is still much confusion around how long monetary policy changes take to impact the economy. This has been debated far longer than MMT has existed.

The last point is a matter of political philosophy. It may be that those are your most cherished policy goals, and they seem admirable. Yet the consequences of attempting to reach them may be unpredictable, or potentially harmful to the very people the policy attempts to help. Inukshuk is based on the idea that no one can predict anything very well. The track-record of governments’ ability to measure in the immediate, or plan and predict for the future, is historically, miserable.

Confusion Reigns

Money is a very difficult concept, as we’ve highlighted in prior notes. In our bit of research, the first thing that caused some analytical confusion was that Paul Krugman, economist-turned-columnist, is a harsh critic of MMT. This is the bright mind, with a massive audience, who wrote in 1998: By 2005 or so, it will become clear that the Internet’s impact on the economy has been no greater than the fax machine’s.

Krugman is the poster-boy for neo-Keynesian economics, and in 2008 won the Sveriges Riksbank Prize in Economic Sciences in Memory of Alfred Nobel, which is commonly called the Nobel Prize in Economics, but is not really a Nobel Prize. Anyhoo, as is often the case: even a broken clock tells the correct time twice a day. Or MMT is actually an inside joke and Krugman has been trolled.

Conclusion

This was an attempt to make economics fun – if you have read to this point, congratulations. Here is your reward. These two are from the late, great Norm Macdonald, one of the finest practitioners of comedy in history.

Portfolio management advice

Overestimating the importance of your accomplishments

We hope you had fun and maybe learned a bit. Thanks for reading.

Also, please join us for an upcoming broadcast from a professional storyteller…

STORYTELLING

Storytelling is the oldest and most powerful form of human communication.

We sapiens invented stories as a way to capture and remember events and also to imagine realities that do not yet exist.

We all have stories running through our heads every second we are awake and much of the time we sleep. The problem is that all of our stories are different. That’s what has given us many of the problems in the world today. It is only when we agree on a story and work to its end that we can be successful as people and a race.

Business Storytelling

We are running a special virtual ‘Storytelling for Leaders’ webinar on October 27 at 12:00pm EST, with Doug Keeley, CEO & Chief Storyteller of Stories Rule.

In this high energy 60-minute interactive session, Doug will show you how and why stories work, show you how to craft and tell your stories, and give you templates for Storytelling, Listening, and Triggering in your organization.

Doug is one of the world’s leading business storytellers whose clients include Starbucks, Microsoft, TDBank, Co-Operators Insurance, Royal Canin, and many other leading organizations.

Click here to register.

HEALTH IS WEALTH

KETO – To Do or Not to Do, That is the Question

Many of my clients have inquired about various diets over the years. For the most part, all I can do is educate them about some of the pros and cons.

The keto diet has received lots of attention lately, so I wanted to share some insights for those who are considering taking it on.

The keto diet is extreme, and not known as a “balanced diet.” A true keto plan typically amounts to as much as 90% of daily calories coming from fat. Note that keto is different than a high-protein, low carb diet.

The keto diet was primarily used to help reduce the frequency of seizures in children. As far as weight loss, only short-term results have been observed, and the results are mixed. (Source: Dietician, Kathy McManus).

Ketosis is a process that takes place when your body does not consume enough carbohydrates to burn as energy. In response, your liver produces ketone bodies from stored fat. Burning fat seems like an ideal way to lose weight, but having your liver make ketone bodies can be tricky and potentially unhealthy.

Getting to a ketosis state can take a few days and requires you to deprive yourself of carbohydrates (20-50 grams net carbs/day). Eating too much protein can also interfere with ketosis.

On a keto plan, you will skip out on many fruits, legumes, starchy vegetables and whole grains. These restrictions can lead to deficiencies in essential nutrients. The diet is also high in saturated fat and is associated with an increase in “bad” low density lipoprotein (LDL) cholesterol, both of which are linked to heart disease. Additionally, over the long-term, there is also a risk of liver and kidney problems, as well as constipation.

To clarify, I’m not opposed to keto. But in my experience working with clients, I’ve noticed it is a very misunderstood diet, and not sustainable for most of us.

Will you lose weight? Yes, as with ANY diet, when you are in a caloric deficit, eating fewer calories than you burn, pounds will be shed.

My preferred message: Once you understand that nutrition and weight loss are all about energy balance, then you’ll have FREEDOM! Choose foods that help you stay satiated and feeling great on your journey to improve your overall health.

If keto is still on your radar, you should consult with your physician before giving it a shot

‘To sustain it, you must maintain it.’

Victoria Bannister, ICM Health Ambassador

At Inukshuk Capital Management, we are firm believers in the connection between Health (physical, mental and spiritual) and Wealth.

Our ICM Health Ambassador is available to our clients for complimentary consultations. Contact us for more information.

Have a question? Contact us here.

Challenging the status quo of the Canadian investment industry.