At Inukshuk Capital Management (ICM), we feel that we have a responsibility to help inform and educate our clients, especially as the industry evolves. There are many positive developments taking place regarding fee and performance disclosures that investors need to know. Unlike many in the industry, we welcome the opportunity to serve our clients with a fiduciary duty. A fiduciary duty is the highest responsibility and standard of care in the industry. We fervently believe that an investor who understands what they own, why they own it, and what it costs, is an empowered and confident investor and more likely to achieve their investing goals over time.

Actively Underperforming

Actively managed funds(1) account for a large share of global savings, which is likely due to the perception that they’re able to outperform their passive benchmarks and provide what investors seek: Alpha. Active managers charge relatively high fees for their services and while there are some stock and bond pickers who have proven they are worth the fees they charge, myriad studies have proven that over a long period of time, the vast majority of them underperform the broad market.

According to the SPIVA Canada Scorecard produced by S&P Dow Jones Indices, 91.11 percent of actively managed Canadian equity funds failed to beat the S&P/TSX Composite Index over the 10 years ended Dec. 31, 2016(2). 98.28 percent of U.S. equity funds sold in Canada underperformed the S&P 500 over the same period. And, 96.4 percent of actively managed global equity funds failed to beat the global stock market benchmark(3). These findings are cause for concern for investors who think average stock pickers and mutual funds are able to provide alpha—it is clear that most of the time, they don’t.

While it appears that investors have gained little from investing with active managers, one group that has benefited is the managers themselves. According to Boston Consulting Group, the industry as a whole is very profitable, with enviable operating margins of 37% in 2015 and $100 billion in profits globally. These gains were achieved largely from the fees charged on assets under management.

In addition to underperformance, an underappreciated phenomenon is that of “closet indexers.” These are managers who build passive stock and bond portfolios that closely mimic their benchmark indices and charge high fees for the service. These supposed stock pickers don’t make a serious effort to beat the market because that would require assuming higher risk. The business model of these “active” mutual funds is to hang on to their assets for as long as possible in order to profit from the fees.

Data is scarce on how many active funds are closet indexers, but there have been some attempts to quantify the practice. A recent study by Morningstar asserted that 15% to 20% of managers in the European Union were closet index trackers. Another study by the European Securities and Markets Authority (ESMA) concluded that up to 15% of funds marketed as “active” fall into the category.

More alarming still is that even those managers that try to beat their benchmark indices by building concentrated stock and bond portfolios are on average, unable to provide alpha. These portfolio managers have a high ‘active share’—a measure of how much a stock or bond fund diverges from its benchmark index. A high active share portfolio will have a high percentage of stock holdings that are different from its passive benchmark. A low active share portfolio will hold few or no stocks that differ from its benchmark.

Given these findings, one would think that investors would look for lower-cost alternatives, particularly since there is a booming passive fund industry that charges much lower fees. We are seeing assets migrate to passive strategies but the data shows that by a large margin, most assets continue to be held in actively managed vehicles such as mutual funds and hedge funds. Assets held in passive funds globally have increased to $6 trillion since 2007, an increase of 230%, but the active fund industry still manages a whopping $24 trillion.

The Importance of Fees

The lack of evidence that actively managed funds can consistently outperform passive funds should trouble investors. The fact that active funds charge higher fees than passive funds, only to underperform, should enrage them. A study by Dartmouth College finance professor Kenneth French calculated that under reasonable assumptions, an investor would have saved an average of 67 basis points per year between 1980 and 2006, if he or she had used a passive strategy instead of an active one. According to Thomson Reuters Lipper, an active stock-picking fund has an average expense ratio of 1.4% of assets per year, while an average passive index fund costs 0.6% of assets.

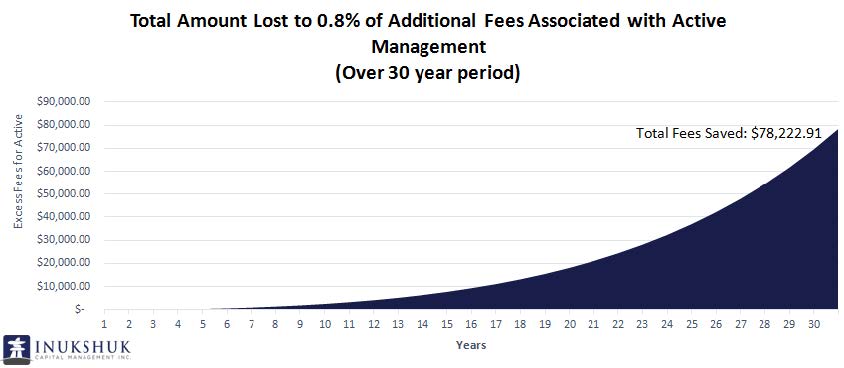

Although the cost differential of 0.8% per year between passive and active funds may seem insignificant at first, over long periods of time the law of compound interest makes it substantial. For example, a portfolio with annual contributions of $5,000 made at the beginning of the year that earns an annual return of 7.5% (the average return of the S&P 500 over the past 20 years), will grow to $555,772 in 30 years. Taking into account the 0.8% fee difference on assets under management between the cost of an average passive fund and an average active fund, an investor would be left with $78,223 less capital at the end of the 30-year period if pursuing an active approach. Keep in mind that this is an optimistic scenario that is only possible in the statistically unlikely event that an active stock picker matches the returns of their benchmark.

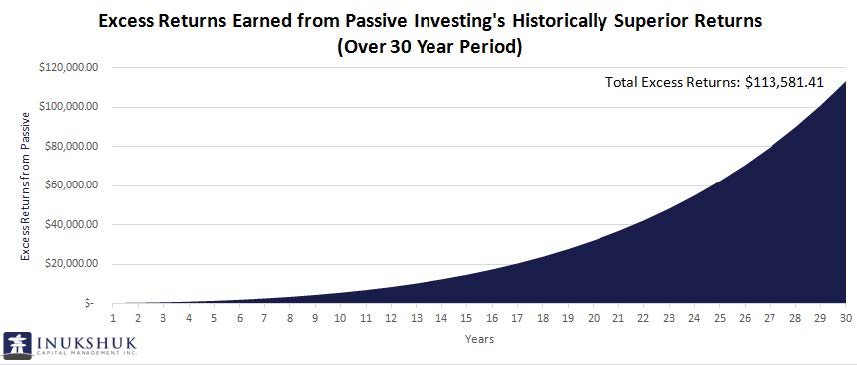

According to Morningstar’s Active/Passive Barometer, over the trailing 10-year period ending in 2016, the average asset-weighted return of large cap asset managers was 5.9% annually, while similar passive funds returned 7.2% net of fees over the same period. Passive equity funds also beat their active stock picking peers over the shorter periods of one, three and five years. Assuming these rates of return, for an investor who chose a passive strategy, a $5,000 investment made annually at the beginning of each year would turn into $524,899 in 30 years. An active manager, meanwhile, would return $411,318 in 30 years, representing a dramatic difference of $113,581.

The key finding here is that the semi-annual Morningstar’s Active/Passive Barometer has consistently proven that a major predictor of outperformance is the fee charged. As a rule, the more a fund charges, the poorer its performance. The same is true for passive funds. For instance, the active funds charging the lowest fees have returned an average 6.6% annually over the past 10 years, while those charging the highest fees posted annual gains of just 5.5%. Meanwhile, passive funds with the lowest expense ratios returned an average 7.3% annually over the past decade and the highest-cost funds gained only 6.8%.

Click here to learn about the advantages of working with a registered Portfolio Management firm.

Why Do Investors Choose Active Managers?

Given that the research shows that passive management is the better choice for the average investor, it is not clear why actively managed funds are favored over passive funds. It is possible that investors are unaware of the evidence and are persuaded by their financial advisors and industry leaders that active management is in their best interests. If this is the case, the active funds industry is misleading their clients that they provide more value than passive funds.

It is also possible that the average investor thinks he will be able to select the right manager and beat the odds, similar to people who buy lottery tickets and gamble at casinos despite knowing the chances of success are stacked against them. But investing for your future should not be left to chance.

The Alternative

For many investors, exchanged traded funds (ETFs) are an excellent alternative to actively-managed funds. ETFs are marketable securities that track an index, a commodity, bonds, or a basket of assets like an index fund. An ETF offers investors more transparency and control over their investments than with active funds and ETFs have a lower average expense ratio of 0.44%. This cost can decrease even further if an investor focuses on large, highly liquid ETFs. In addition, increasing competition between issuers such as BlackRock, Vanguard and State Street means fees will likely drop even more as their assets under management grow. Active managers cannot match ETF’s low fees and their approach is not tax-friendly due to high turnover.

But not All ETFS Are Created Equal

There are more than 2,500 ETFs listed in North America and not all are suitable for a typical investor. There are some important criteria that one should consider before buying an ETF that is intended to be held for an extended period, including:

- the management expense ratio

- tracking error

- treatment of withholding taxes

- the amount of assets under management

- liquidity

In most cases, a low-cost ETF will have a large amount of assets and have high liquidity, but a careful investor should look at all the above characteristics.

An important indicator to look at is tracking error, which shows how much the performance of an ETF deviates from its underlying index. In practice, ETFs are unable to perfectly imitate the underlying index’s performance, so it is paramount to find ones that have as low a tracking error as possible.

Also important are the ways different ETFs are taxed. For instance, U.S. and international equity may be subject to a withholding tax of between 15% and 27% on dividends if the stocks are held via a Canada-listed ETF. There are ways to minimize taxes, such as investing within a Registered Retirement Savings Plan (RRSP), TFSA or other registered accounts as well as buying Canadian equities. To reduce the impact of taxes on international and U.S. ETFs, an investor should buy a U.S.-listed or a Canadian-listed ETF that holds stocks directly.

Position Your Portfolio for Success

At Inukshuk Capital Management, our objective is to minimize costs and maximize risk-adjusted returns for our clients. We understand the challenges investors face in their pursuit of alpha and we believe there is a better way. While we are not active stock pickers, based on our rigorous research we recommend the most appropriate ETFs from the ever-expanding list of North American choices and we aim to enhance performance by actively managing the risk exposure of our client’s portfolios.

For clients who are looking for us to actively manage their risk exposure, we will strive to maximize performance by implementing our proprietary and time-proven momentum investing approach. Using our systematic, or rules-based, methods developed over the past 20 years, we dynamically adjust risk exposures based on the persistence of positive or negative trends in the markets. This process is designed to proactively limit downside risks and maximize upside potential. This feature is especially important in the current environment as the bull market may be overextended—we are seeing historically rich valuations and heightened political risks.

The degree of dynamic adjustment to a client’s asset allocation is determined only after reaching a deep understanding of our clients’ investment objectives, risk tolerances, and tax considerations. This comprehensive understanding of our client’s goals and constraints gives us the ability to choose from a wide spectrum of bespoke portfolio solutions, which range from passive to dynamic.

Our clients receive personalized investment advice from a dedicated ICM Portfolio Manager but our rules-based strategies are free of personal predictions or bias. Countless studies have shown that the performance of many portfolios suffer precisely because of human intervention—human emotions such as fear, greed and herd mentality often lead to poor investment decisions in times of volatility, panic and exuberance.

With our disciplined approach, your portfolio will have the potential to outperform by exploiting the reflexive fear and greed of those who invest without adhering to a disciplined and unemotional plan.

Combining thoughtful, disciplined investment management with low fees and active risk management, Inukshuk Capital Management is ready to help guide clients towards achieving their personal financial goals.

Click here to schedule a comprehensive and objective third-party review of your investment portfolio.

(1) Actively managed funds invest in individual stocks and bonds for the purpose of beating a passive benchmark. Inukshuk Capital Management manages both passive and active portfolios of ETFs that track well known equity and fixed income indexes.

(2) According to recent figures published by index provider S&P Dow Jones Indices

(3) ibid